The Wall Street roller coaster remains oiled up and operational as summer hits its stride, with stocks dipping down Wednesday amid a few worrisome signals.

U.S. crude oil futures gushed 2.3% higher, to $122.11 per barrel, after the Energy Information Administration said U.S. crude inventories dropped by 2 million barrels, and gasoline stocks dropped by 800,000 barrels, during the week ended June 3. That helped the energy sector finish ahead of its 10 other counterparts Wednesday, albeit with a mere 0.2% advance.

The market’s overall weakness Wednesday could be chalked up to any number of things. Goldman Sachs says it believes Q4’s year-over-year growth will slow to 1.3% this year, “driven in large part by a substantial fiscal drag and a negative impulse from tighter financial conditions.”

Signs of slowing also are cropping up in what has hitherto been a screaming housing market, with the Mortgage Bankers Association reporting that mortgage application volume dropped 6.5% week-over-week to multidecade lows.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

“Weakness in both purchase and refinance applications pushed the market index down to its lowest level in 22 years,” says Joel Kan, MBA’s associate vice president of economic and industry forecasting.

And it’s possible investors’ attention is on the upcoming consumer price index (CPI) report, due out Friday morning, which could provide guidance on the Federal Reserve’s direction.

“What’s perplexing for investors may be the lack of clarity over the upper end of rate expectations so that they could factor in a price,” says Kunal Sawhney, CEO of Australian research firm Kalkine Group. “It is presently unclear when the Fed would pause the rate hikes; unless, of course, we see definite evidence on the ground that inflation is easing. In this context, the CPI data for May … would be critical.”

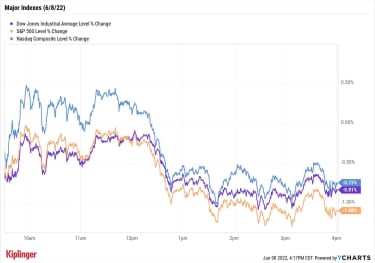

The real estate (-2.4%) and materials (-2.1%) sectors led the market lower Wednesday. The S&P 500 was the worst of the major indexes, down 1.1% to 4,115, followed by the Dow Jones Industrial Average (-0.8% to 32,910) and the Nasdaq Composite (-0.7% to 12,086).

YCharts

Other news in the stock market today:

The small-cap Russell 2000 retreated 1.5% to 1,891.Gold futures edged up 0.2% to settle at $1,856.50 an ounce.Bitcoin also took a step back, slipping 2.9% to $30,078.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Altria (MO) fell 8.4% after Morgan Stanley analyst Pamela Kaufman downgraded the consumer staples stock to Underweight from Equal Weight, the equivalents of Sell and Hold, respectively. The analyst says there are increasing headwinds facing the tobacco industry, namely the sharp rise in gas prices, slowing wage growth and consumer confidence hovering near a three-year low. MO also faces rising competition from Philip Morris’s (PM, -2.6%) acquisition of Swiss tobacco maker Swedish Match.Wedbush analyst David Chiaverini initiated coverage on Affirm Holdings (AFRM, -4.2%) with an Underperform (Sell) rating and $15 price target, nearly 36% below the buy now, pay later (BNPL) stock’s Wednesday’s close at $23.33. There are several things to like about AFRM, the analyst says, including its value proposition to both consumers and investors, as well as its solid execution to drive growth and build merchant relationships. However, “we’re concerned about Affirm’s path to GAAP profitability, increasing competition in the BNPL space, industry forecasts calling for slowing e-commerce sales (which drive Affirm’s gross merchandise volume, or GMV), and its ability to cover its cost of capital as funding costs increase,” Chiaverini adds.Thinking Income? Maybe Think Tech.Do you invest with an eye toward income? If so, think about the makeup of your equity portfolio for a minute. What’s carrying the load: real estate investment trusts (REITs), consumer staples, maybe utilities?

It’s likely that few investors are thinking “technology stocks” right now, and that’s understandable. Todd Rosenbluth, head of research for VettaFi, notes that the average yield on tech stocks in the S&P 500 Index was less than 0.8% in 2021, lagging far behind much richer yields available from the aforementioned sectors.

The flip side? They punch above their weight in dividend growth. Most of the tech dividend payers in the index are relatively new to delivering cash to shareholders – and newer payers often make bigger or more frequent hikes early on. Indeed, virtually all of the S&P 500’s tech dividend stocks either raised their payouts or initiated dividend programs in 2021.

There are, however, a few standout dividend payers in the technology space that offer excellent yields at current prices. We examine seven of these tech stocks, which also boast growing earnings and ample free cash flows that will help them afford bigger dividends over time.