Stock Market Today

The University of Michigan’s latest consumer sentiment index didn’t help the bull case today, either.Speculation that inflation might have peaked earlier this year died abruptly with this morning’s release of the Labor Department’s latest consumer price index (CPI). And what the data showed was that prices were still rising last month.

Specifically, the CPI surged 8.6% year-over-year in May, the fastest pace since December 1981. The sharp rise in consumer inflation was broad-based, but annual increases were particularly stunning in both gas prices (+50.3%) and groceries (+11.9%). On a month-over-month basis, the consumer price index was up 1%, compared to April’s 0.3% rise in prices. Both figures were higher than what economists were expecting.

Also released this morning was the University of Michigan’s preliminary consumer sentiment index for June, which arrived at 50.2 – down 14.2% from May, the lowest value this decades-old indicator has reported. According to the report, 46% of survey respondents pointed to inflation for their negative outlook toward the economy, up 38% from last month.

“The crash in sentiment means that consumers are more and more worried about future economic conditions,” says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial. “We need to listen to what consumers say but more importantly, we need to watch what consumers do. We do expect a slowdown in consumer spending as inflation and uncertainties weigh heavily on sentiment.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

The reports were met with sharp selling on Wall Street. All 11 sectors finished in the red, with consumer discretionary (-4.0%) and technology (-3.8%) suffering the biggest drops.

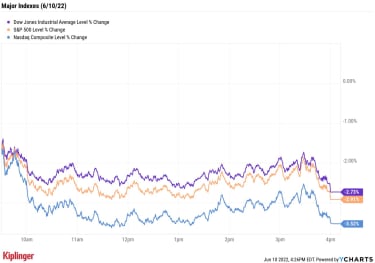

As for the major indexes, the Nasdaq Composite slid 3.5% to 11,340, the S&P 500 Index shed 2.9% to 3,900 and the Dow Jones Industrial Average skidded 2.7% to end at 31,392.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 slumped 2.7% to 1,800.U.S. crude futures shed 0.7% to settle at $120.67 per barrel.Gold futures jumped 1.2% to end at $1,875.50 an ounce.Bitcoin sank 3.4% to $28,966.18. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Netflix (NFLX, -5.1%) and Roblox (RBLX, -9.0%) posted sharp losses today after Goldman Sachs downgraded the stocks to Sell. “We downgrade NFLX to Sell as we have concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends (both in the form of gross adds and churn), margin expansion and levels of content spend and view NFLX as a show-me story with a light catalyst path in the next 6-12 months,” the analysts write in a note. And while they still view RBLX as the best-positioned name for long-term growth opportunities in the gaming/interactive universe, “we have increasing concerns around the post-pandemic environment and expect a continuation of slowing growth, tough comps, & normalization of margins in the near term.”DocuSign (DOCU) plummeted 24.5% after the e-signature firm reported earnings. In its first quarter, DOCU reported adjusted earnings per share of 38 cents on revenue of $588.7 million. Analysts, on average, were expecting earnings of 38 cents per share on $581.8 million in revenue. The company also lowered its full-year billings growth estimate to 7% to 8% from prior guidance for 15% growth at the midpoint. “DocuSign pegged the guide-down on a) macro headwinds (customers being cautious about volume expansions across all regions), b) sales execution (high sales rep turnover) c) customers that are still digesting excess capacity (pandemic distortions are still playing out in stocks) and d) a fall-off in rate-sensitive loan / mortgage e-signature volumes, impacting the financial/real estate verticals,” says UBS Global Research analyst Karl Keirstead. “We remain on the sidelines with a Neutral rating.”The Best Stocks for Sky-High InflationWe’ll get a glimpse on how the Federal Reserve will respond to today’s red-hot inflation update next week, with the central bank slated to unveil its latest policy decision Wednesday afternoon.

“From a Fed perspective, the chase continues, and more aggressive Fed measures will likely be needed to catch up to runaway inflation,” says Charlie Ripley, senior investment strategist for Allianz Investment Management.

“Whether this translates to more aggressive hikes this summer, or a continuation of 50 basis point [a basis point is one-one hundredth of a percentage point] hikes this fall is the option for the Fed, but the overall reality for the Fed is that inflation is not under control, and they have their work cut out for them in the coming months,” Ripley adds.

We’ve mentioned several times in this space how investors can protect portfolios against inflation. For example, gaining exposure to firms with pricing power or scooping up Wall Street’s best dividend stocks are two ways to help mitigate the effects of red-hot inflation on their portfolio.

Investors can also drill down on sectors that are typically considered more “inflation-proof” than others – namely, healthcare, consumer staples, utilities and real estate. Here, we’ve selected some of the top stocks from each of these sectors to create a mini-portfolio that can stand up against higher prices. Take a look.