The New Development Bank is having trouble finding dollar funds to repay debts, the Wall Street Journal said. It was established by the BRICS bloc of nations to offer alternatives to dollar lending. But its own finances were deeply reliant on Wall Street, which backed away after the Ukraine war. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

A development bank established by the BRICS bloc of nations to reduce reliance on US dollar loans is having trouble finding dollars to repay its own debts, sources told the Wall Street Journal.

Based in Shanghai, the New Development Bank has largely ceased issuing new loans, the report said.

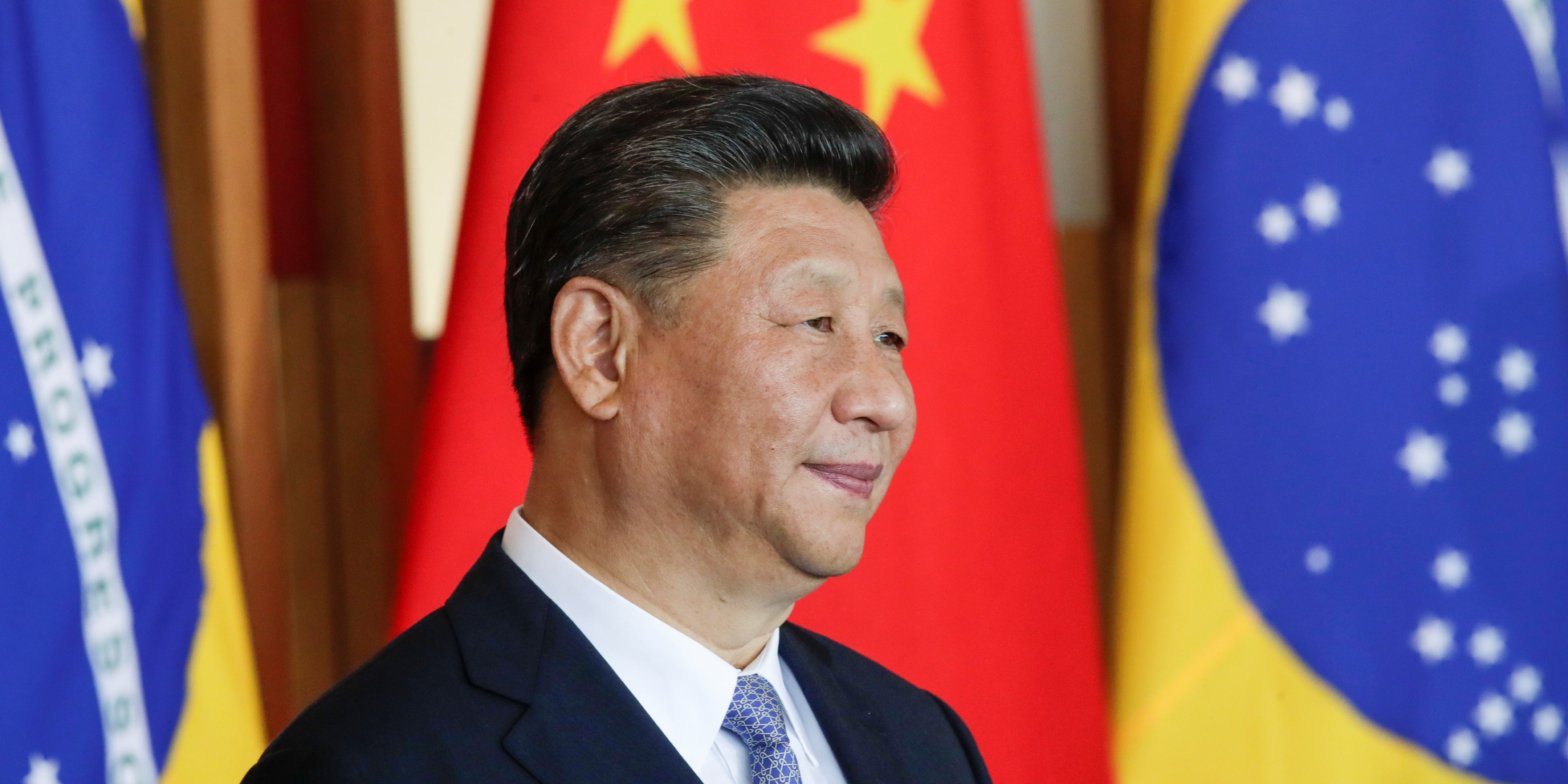

The institution came about eight years ago through the collective effort of the BRICS: Brazil, Russia, India, China, and South Africa.

It was meant to establish an alternative to US-dominated, dollar-based financial institutions like the International Monetary Fund and dovetailed with Beijing’s efforts to erode the greenback’s status. Its lending was aggressive, and committed loans climbed from $1 billion in 2017 to $30 billion in 2022.

But to provide capital to developing economies, the New Development Bank had to borrow from Wall Street as well as Chinese lenders. So despite its mission to de-dollarize lending, about two-thirds of its own borrowings were dollar-denominated, the Journal said.

But after Russia’s invasion of Ukraine last year, Wall Street backers were less willing to lend to a bank that was nearly 20% owned by Moscow.

At the same time, the appointment of Dilma Rousseff as the bank’s new chief stirred controversy, given that she was previously impeached as Brazil’s president. Next in line for the bank’s presidency will be a Russian appointee.

Without its usual dollar support, the institution is servicing prior debt through more expensive borrowings. According to the Journal, the bank’s first bond since the Ukraine war started was five times as expensive as prior loans. Taken out in April, it cost $1.25 billion.

The bank is also in talks with Argentina, Saudi Arabia and Honduras to become members and potentially provide more capital.

Still, the bank’s challenge in attaining dollars earned it a Fitch Ratings credit downgrade last July. Meanwhile, the New Development Bank was told that interest on any new loans could quadruple, and the premium the bank charges its members to borrow has doubled, shrinking loan disbursements to a trickle, sources told the Journal.

And given China’s own economic downturn, it’s unlikely that the lender can expect much financial support from Beijing.

The lender told WSJ that there’s “a considerable interest in bonds issued” through the bank, while its loan origination and liquidity remain strong. The New Development Bank did not respond immediately to Insider’s request for comment.