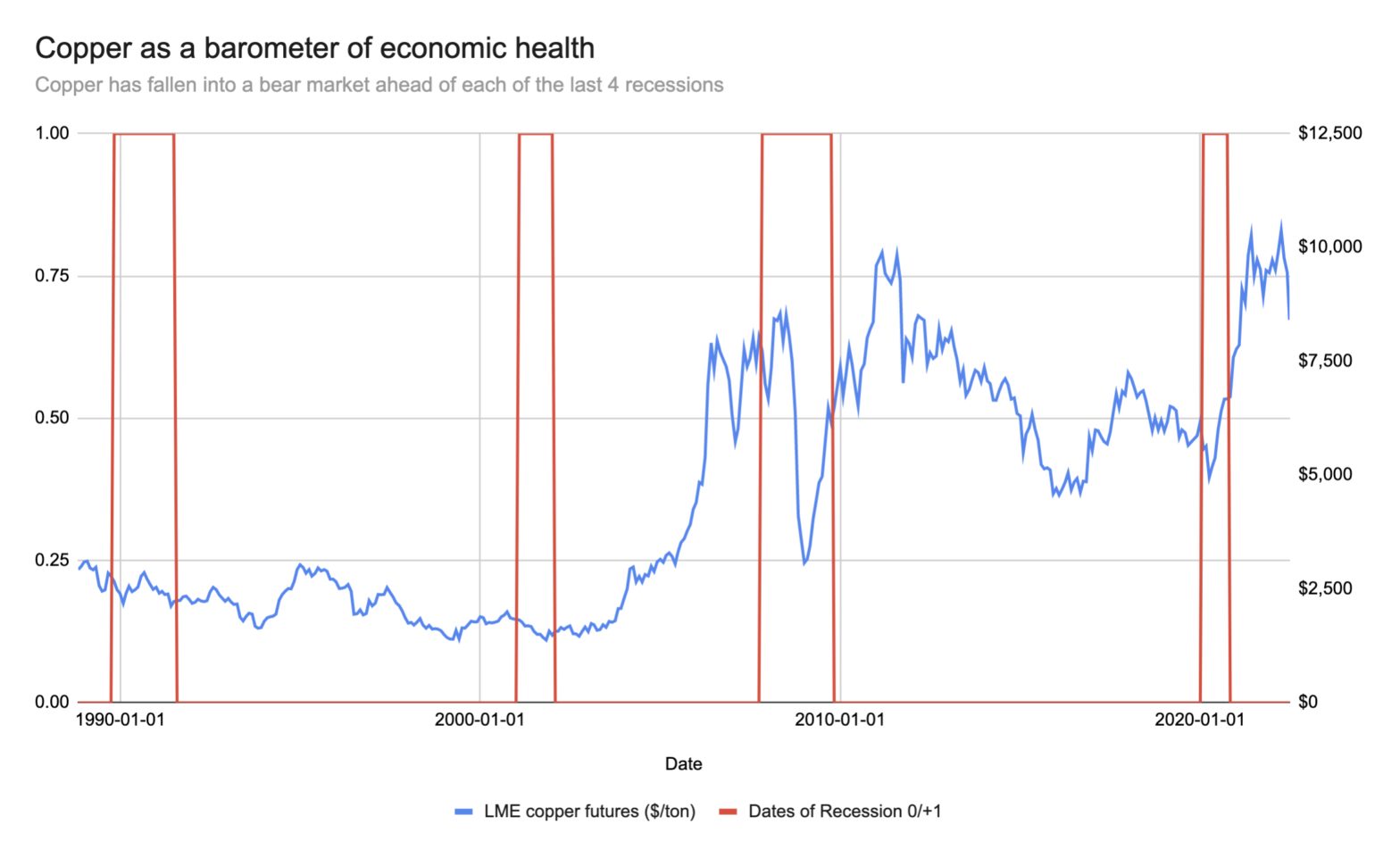

Copper has entered a bear market, which may indicate a stronger chance that recession is coming. The metal, which is an economic barometer, fell 24% from its peak in May 2021 on Friday. The risk of a recession is gathering pace as interest rate hikes and inflation choke global growth. Loading Something is loading.

Copper has just tipped into a bear market and it’s happened before each recession in the last 30 years, which could indicate another economic downturn may be underway.

It’s used in everything from electrics and electronics to construction, meaning it’s intertwined with the underlying global economy. The benchmark London Metal Exchange copper price has now fallen 24% from its peak above $10,700 a tonne in May 2021 Friday to trade at $8,255 a ton. A fall of more than 20% from a previous peak is the technical definition of a bear market.

Recessionary fears have picked up speed, fueled by rapidly rising interest rates and red-hot inflation, with some of the world’s biggest banks including Goldman Sachs, Morgan Stanley, and Citi increasing their expectations of a recession hitting the US economy, as the cost of food, fuel and housing continue to squeeze the consumer.

Copper is on track for a 19% decline in the three months from March to June, making this its worst quarterly performance since the first quarter of 2020, which witnessed the depths of the coronavirus crisis.

“These moves suggest that the market’s sensitivity to recession risks has stepped up,” Jane Foley, Rabobank senior FX strategist said.

Nomura, a leading Japanese investment bank, also predicted the US economy would tip into a recession this year.

The Fed lifted the benchmark interest rate three times faster than usual by 0.75 percentage points earlier this month as the US struggles in its war with inflation. It was responding to data from the US Consumer Price Index that showed inflation rose by 8.6% through May driven by a surge in energy prices.

Most recently, Federal Reserve Chair Jerome Powell fanned the flames on the chance of recession saying it is not an intended outcome but is certainly a possibility. At the same time, he declined to rule out a 100 basis point interest rate hike while expressing his “unconditional” commitment to fighting inflation.

Stocks have tumbled into bear-market territory, as have cryptocurrencies, as investors have ditched assets that stand to lose from an environment of higher rates and inflation.

Meanwhile, “Dr Copper” — which earned its nickname from what some believe is its tendency to gauge the health of the economy — is suggesting those fears could become more of a reality given that it’s fallen into a bear market in the run-up to each of the last four recessions dating back to 1990, as the chart below shows.

For example, the dotcome bubble burst in the early weeks of 2001, triggering a recession that would last through the remainder of that year. But copper had already peaked in September 2000 and had already lost roughly 20% when the stock market started to tumble and economic growth slowed.

“The market has become concerned about a slowing in global growth, driven by fears surrounding Chinese output and the headwinds to growth in Europe,” Rabobank’s Foley added.

Bank of America strategists said it was worth noting how copper behaved in the last aggressive rate-hike cycle of 1979/80, which also ended in recession.

“Copper did not decline wile rates were rising, but the metal ultimately came under pressure when the economy contracted. Hence, increased recession risks do matter,” they said.

Read more: Buy these 13 cheap stocks that will outperform in a recession-fuelled bear market, according to Morningstar

A chart showing copper prices plunging ahead of the last four recessions. Insider