New York’s Belfer family lost money investing in FTX, according to the Financial Times. Two companies linked to the family had a combined stake in FTX Group that was valued at $34.5 million last year. The oil dynasty also fell victim to Bernie Madoff’s Ponzi scheme and lost billions in the collapse of Enron. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

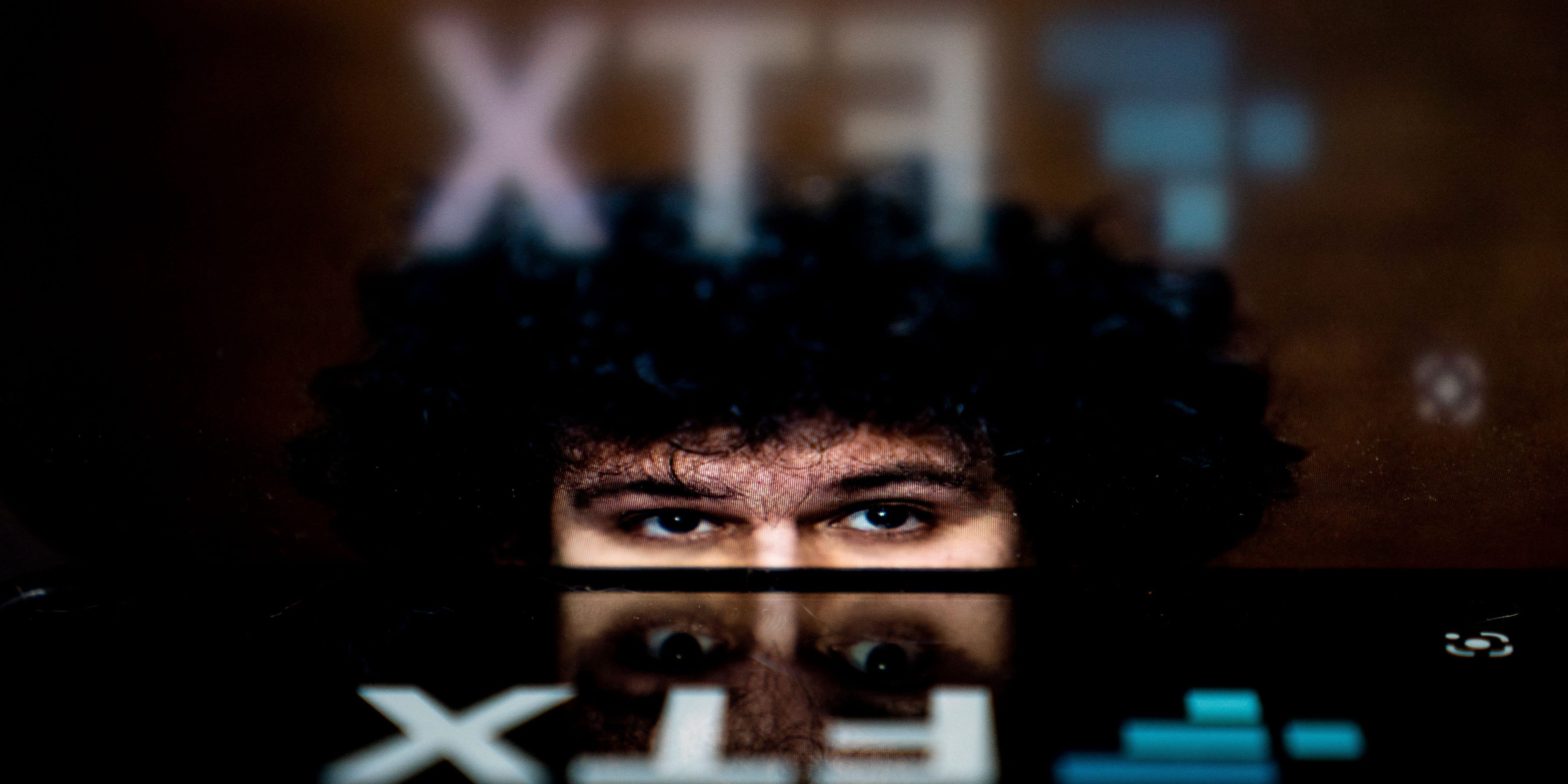

New York’s Belfer family lost tens of millions of dollars of investments in Sam Bankman-Fried’s bankrupt FTX, according to the Financial Times.

The famously philanthropic family had suffered big losses from Bernie Madoff’s Ponzi scheme in 2008 and Enron’s collapse in 2007.

Investment firms run by the Belfer family were recently listed on court documents as FTX shareholders.

Belfer Investment Partners maintained shares from FTX’s equity fundraising efforts in 2021 and 2022, and also invested in the crypto firm’s US business. Meanwhile, Lime Partners LLC also held shares in FTX and FTX US.

The two companies’ combined stake in FTX Group was valued at roughly $34.5 million during the latest fundraising round early last year, sources told the Financial Times.

Belfer Management LLC, which is the Belfer’s family office, could not be reached for comment and declined to comment to the FT.

The FTX loss is relatively small compared some of the family’s history, which includes roughly $2 billion with the collapse of Enron

The family’s fortune can be traced back to Arthur Belfer, who immigrated from Poland around World War II and began selling imported feathers before expanding to rubber and petroleum, according to the FT.

The Belfer’s oil company was bought in the 1980s by a predecessor of Enron, making the family top shareholders.

FTX filed for bankruptcy in November amid a liquidity crisis stemming from reported transfers of client funds to Alameda Research, the trading arm of Bankman-Fried’s crypto empire. Bankman-Fried has pleaded not guilty to federal fraud charges related to the fall of FTX.

Other big equity investors in FTX who are also set to see their stakes wiped out include football star Tom Brady, New England Patriots owner Robert Kraft, and fashion model Gisele Bündchen.

In addition, well-known funds run by Tiger Global, Thoma Bravo, Sequoia Capital, SkyBridge, and Third Point, among others, were FTX investors too.