stocks

Amazon Prime Day offered loads of good deals to subscribers, but the best value of all is still available to investors.Amazon.com (AMZN, $113.23) Prime Day has come and gone, but investors can still pick up AMZN stock at a deep, deep discount.

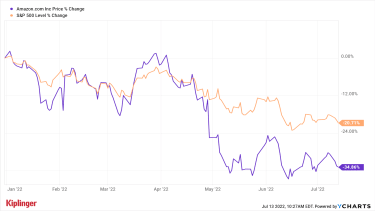

Shares are off by 32% for the year-to-date, lagging the broader market by about 13 percentage points. Rising fears of recession and its potential impact on retail spending are partly responsible for the selloff. The market’s rotation out of pricey growth stocks and into more value-oriented names is likewise doing AMZN no favors. See the chart below:

AMZN stock Amazon Prime Day

True, Amazon is hardly alone when it comes to mega-cap names getting slaughtered in 2022. Where the stock does distinguish itself is in its deeply discounted valuation, and the mass of Wall Street analysts banging the table for it as a screaming bargain buy.

AMZN’s Elite Consensus RecommendationIt’s well known that Sell calls are rare on the Street. For different reasons entirely, it’s almost equally unusual for analysts (as a group, anyway) to bestow uninhibited praise on a name. Indeed, only 25 stocks in the S&P 500 carry a consensus recommendation of Strong Buy.

AMZN happens to be one of them. Of the 53 analysts issuing opinions on the stock tracked by S&P Global Market Intelligence, 37 rate it at Strong Buy, 13 say Buy, one has it at Hold, one says Sell and one says Strong Sell.

If there is a single point of agreement among the many, many AMZN bulls, it’s that shares have been beaten down past the point of reason.

Here’s perhaps the best example of that disconnect: At current levels, Amazon’s cloud-computing business alone is worth more than the value the market is assigning to the entire company.

Just look at Amazon’s enterprise value, or its theoretical takeout price that accounts for both cash and debt. It stands at $1.09 trillion. Meanwhile, Amazon Web Services – the company’s fast-growing cloud-computing business – has an estimated enterprise value by itself of $1.2 trillion to $2 trillion, analysts say.

In other words, if you buy AMZN stock at current levels, you’re getting the retail business essentially for free. True, AWS and Amazon’s advertising services business are the company’s shining stars, generating outsized growth rates. But retail still accounts for more than half of the company’s total sales.

More traditional valuation metrics tell much the same story with AMZN stock. Shares change hands at 42 times analysts’ 2023 earnings per share estimate, according to data from YCharts. And yet AMZN has traded at an average forward P/E of 147 over the past five years.

Paying 42-times expected earnings might not sound like a bargain on the face of it. But then few companies are forecast to generate average annual EPS growth of more than 40% over the next three to five years. Amazon is. Combine those two estimates, and AMZN offers far better value than the S&P 500.

Analysts Say AMZN Is Primed for OutperformanceBe forewarned that as compellingly priced as AMZN stock might be, valuation is pretty unhelpful as a timing tool. Investors committing fresh capital to the stock should be prepared to be patient.

That said, the Street’s collective bullishness suggests AMZN investors won’t have to wait too long to enjoy some truly outsized returns. With an average target price of $175.12, analysts give AMZN stock implied upside of a whopping 55% in the next 12 months or so.

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

July 15, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

65 Best Dividend Stocks You Can Count On in 2022

dividend stocks

65 Best Dividend Stocks You Can Count On in 2022Yield isn’t everything when it comes to finding the best dividend stocks. Income investors know there’s no substitute for regular dividend increases o…

July 14, 2022

Stock Market Today (7/15/22): Dow Jumps 658 Points After Stellar Retail Sales Report

Stock Market Today

Stock Market Today (7/15/22): Dow Jumps 658 Points After Stellar Retail Sales ReportRetail sales were up 1% in June, while consumer sentiment edged higher in July.

July 15, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

July 15, 2022

Stock Market Today (7/14/22): Stocks End Mixed After Bleak Bank Earnings, Inflation Data

Stock Market Today

Stock Market Today (7/14/22): Stocks End Mixed After Bleak Bank Earnings, Inflation DataBoth JPMorgan Chase and Morgan Stanley saw sharp declines in profit in Q2.

July 14, 2022

10 Best Green Energy Stocks for the Rest of 2022

stocks

10 Best Green Energy Stocks for the Rest of 2022The future for green energy is bright, and these 10 top-rated stocks are poised to profit on the growing trend toward sustainability.

July 14, 2022