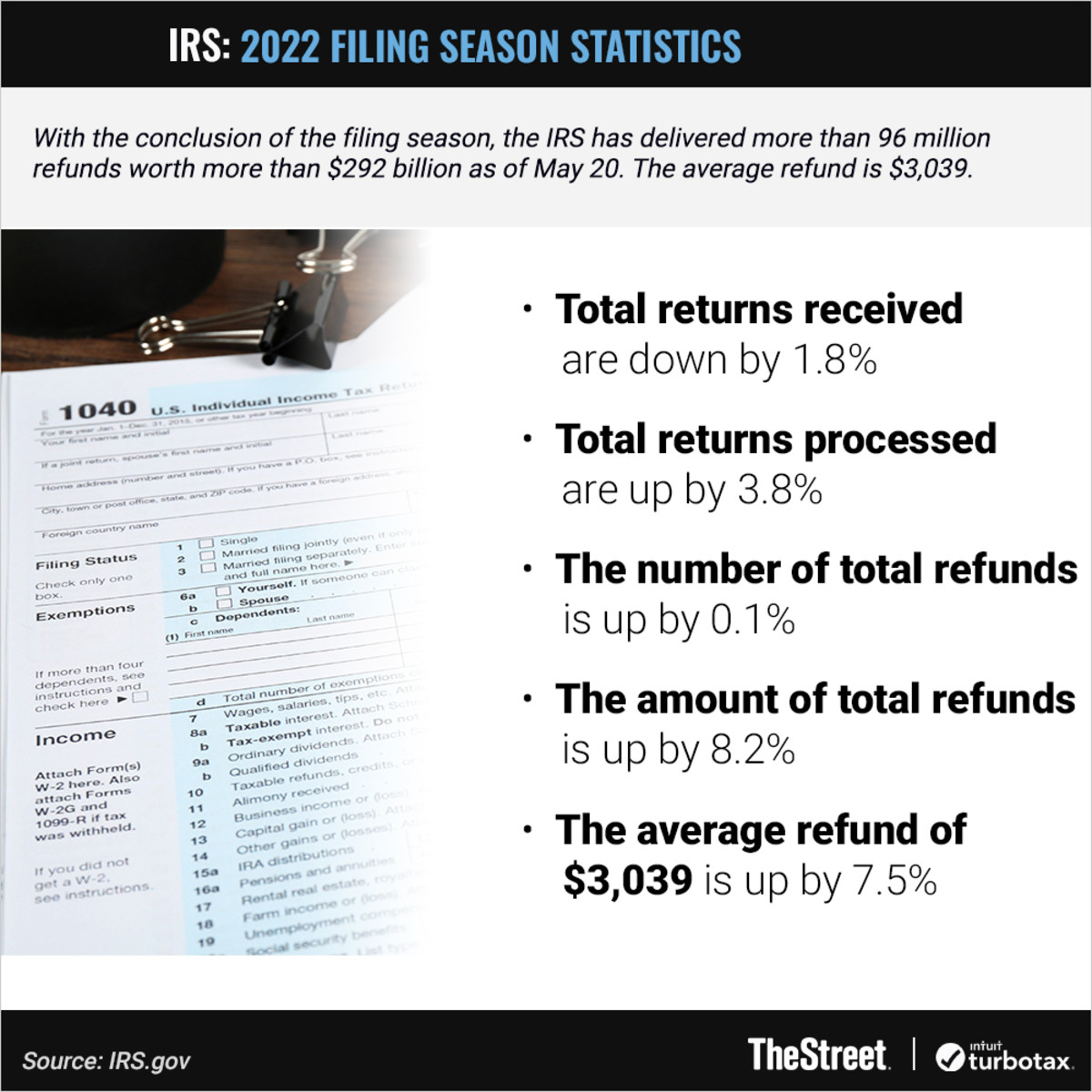

When you see headlines saying that the IRS has paid out more than 96 million tax refunds worth more than $292 billion, it can make any taxpayer pause and take notice.

According to the tax filing statistics ending on May 20, 2022:

Total Returns Received are down by 1.8%Total Returns Processed are up by 3.8%The Number of Total Refunds is up by .1%The Amount of Total Refunds is up by 8.2%The Average Refund of $3,039 is up by 7.5%”. 2022 Filing Season Statistics Graphic: 2022 Filing Season Statistics Table: 2022 Filing Season StatisticsThe thought of getting an extra $3,039 has some taxpayers asking a common tax conundrum: “Should I overpay my taxes to get a refund next year?

Retirement Daily’s Robert Powell sought out answers to that question and sat down for a video interview with Jeffrey Levine, CPA and leading tax expert from Buckingham Wealth Partners to better understand the pros and cons of overpaying and underpaying your taxes.

Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

Levine surprised us in the video above when Powell asked him “Is it better to underpay one’s taxes and owe the government money or to overpay and give the government an interest-free loan?”.

TheStreet Q&A: Jeffrey Levine: Are those my only choices? Is that it? My choice is either to dramatically underpay, so I have a penalty or overpay, so I have a massive refund. How about I just do good tax planning, and I pay about what I’m supposed to?

Scroll to Continue

Here’s the deal. A lot of people know approximately what their tax bill will be from year to year. They have a W-2 income, where they have a relatively stable business, and they take a standard deduction or they have itemized deductions, but they give about the same to charity each year. Their mortgage deduction isn’t changing dramatically from one year to the next. So for a lot of people, their tax bill, it’s fairly determinable even early in the year, right?

So for instance, right now, we’re early in 2022. You could tell a lot of people about what they will owe in 2022. Now, certainly, for others, that’s not the case. At a bare minimum, what people should try to do is to avoid the estimated tax penalty. In most cases, you want to avoid paying any more than you have to. And so to do that, there are a couple of ways.

Quotes| $292 Billion In Tax Refunds Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth Jeffrey Levine, Chief Planning Officer, Buckingham Strategic WealthOne way is you could pay 90% of this year’s tax liability throughout the year, either through estimated tax payments or withholdings or some combination of those. The challenge, of course, Bob, is that if you don’t know what this year’s tax bill looks like, how do you know how much to pay? How do you know how much 90% of the unknown amount is?

Safe Harbor Tax Estimate & ExamplesAnd so the better way for a lot of people, the safe harbor way, if you will, is to base this year’s estimated tax payments on last year’s tax bill. For most people, that just means paying 100 percent of last year’s tax bill throughout the year. If you are a high earner with more than $150,000 of income, then it’s 110 percent.

So for argument’s sake, if you had a $20,000 tax bill last year, most people should pay $5,000 per quarter this year, and that will eliminate any penalty, even if they owe a lot more at the end of the year. So even someone who wins the lottery, Bob, on May 1st of this year wins $100 million dollars. If their tax bill last year was 20,000, they only need to pay 5,000 each quarter, and they will avoid the estimated tax penalty. Now come next April, will they owe a lot? Yes, but they won’t have any estimated tax penalty.

Proactive Tax PlanningAnd I’ll finish up with one last thought, Bob. It’s that, will they owe a lot? Yes, but that just requires some planning, doing some proactive work, and not waiting until March or April when your tax return is due to look at your taxes. But doing it throughout the year, looking at your income, looking at your deductions, and doing an estimate and saying, are we paying enough in?

I would certainly say that if you have a very large refund, that’s not great tax planning because you are giving the government an interest-free loan. And the more interest rates rise, which we’re seeing now, the more costly that becomes to you. Similarly, you don’t want to underpay to the amount where you have a penalty.

Tax Planning AdviceSo the best tax planning, in my estimation, is to pay what you need to do to avoid a penalty, and then know how much more if any, you’ll need to add in in March or April when you file your taxes, so that you can have the best cash flow throughout the year, but also avoid those costly penalties.