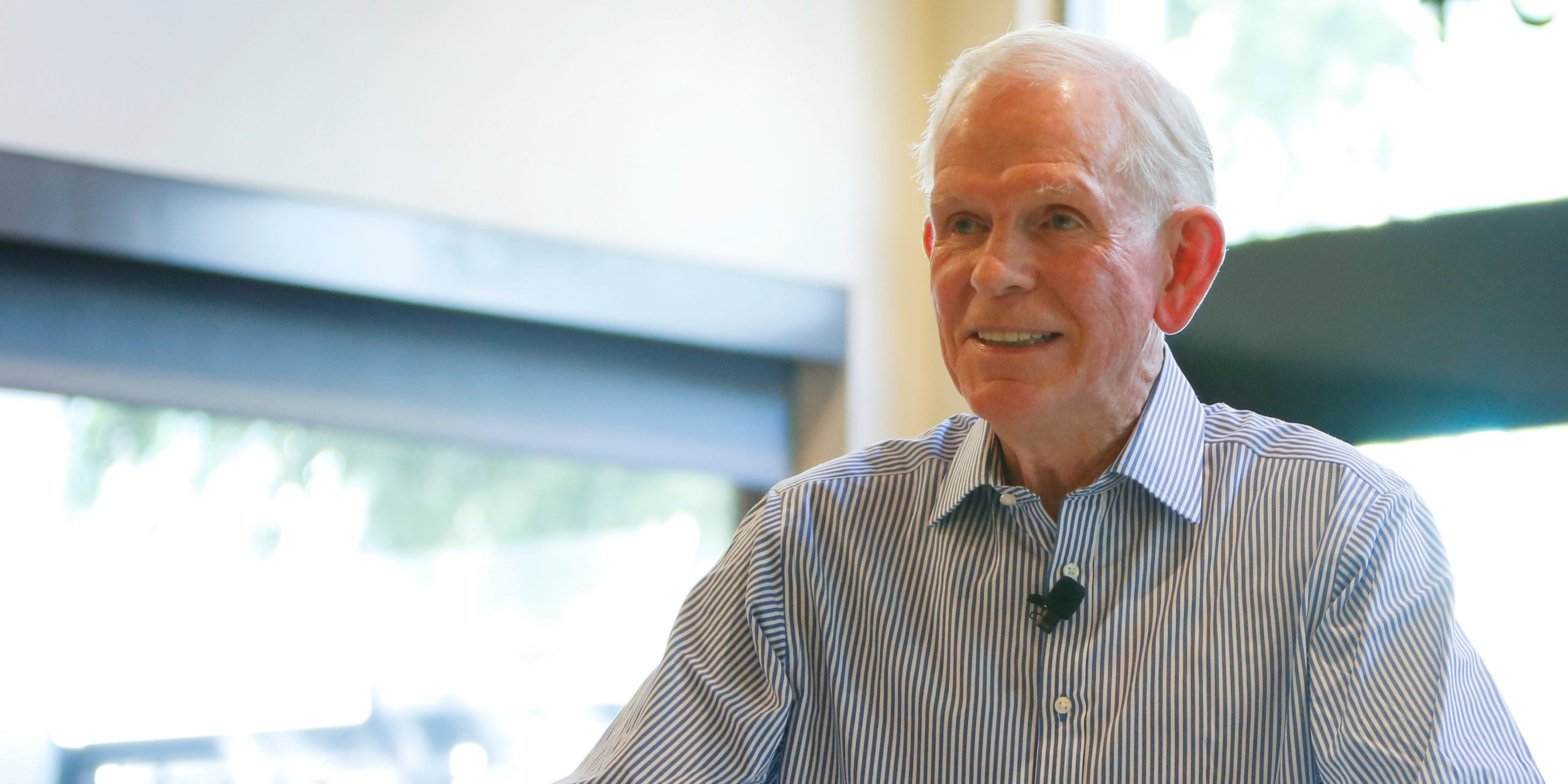

Stocks are in a bubble and could crash by over 50% if it ends badly, Jeremy Grantham says. The elite investor sees house prices falling and predicts a recession will strike next year. Here are his 16 best quotes from a new interview, including comments about bitcoin and AI. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Jeremy Grantham floated the possibility of a 50% crash in the S&P 500, predicted US house prices would drop, and rang the recession alarm during the latest episode of Bloomberg’s “Merryn Talks Money” podcast.

The GMO cofounder and market-bubble historian also slammed bitcoin as a scam, advised against buying US stocks or real estate, and shared his outlook for fossil fuels and artificial intelligence.

Here are Grantham’s 16 best quotes, lightly edited for length and clarity:1. “The market suffers from attention deficit disorder, so it always thinks every rally is the beginning of the next great bull market.”

2. “If everything works out badly, I would not be amazed if the S&P went to 2,000. That would require a couple of wheels to fall off, and wheels tend to fall off in the great bubbles’ unraveling, but it doesn’t mean they have to. The S&P would be unlikely not to get to something close to 3,000.”

3. “The simple arithmetic suggests you’ll either have a dismal return forever, or you’ll have a nice bear market and then a normal return. And the nice bear market will be hopefully less than a 50% decline, but it won’t be a huge amount less than 50% from the peak in real terms.”

4. “You increase the pressure on a very complicated system until a few things snap. That is the pattern — something breaks and nobody seems to know what it is. It’s always a surprise, but you always have a surprise, so the idea of a surprise is totally unsurprising.”

5. “My guess is we will have a recession. I don’t know whether it will be fairly mild or fairly serious, but it will probably go deep into next year.”

6. “The most vulnerable area in my opinion is the Russell 2000. It often has no collective earnings at all. It has a very high density of zombies — companies that really can only pay their interest payments by issuing more debt. They’re vulnerable on the debt front, vulnerable on the financial front, and vulnerable on a broad economic front.”

7. “An over 40-year period of driving down mortgage rates, of course you drove up house prices all over the world, pretty much. And now the rates have gone up, of course it will drive down.”

8. “House prices are worse for the ordinary household. They’re worse for the economy than stocks because they’re substantially more broadly owned. It’s really an important part of the median family’s income picture and capital picture. The motto should be, ‘Don’t mess with housing.’ The super motto should be, ‘Never have a housing bubble at the same time as you have a stock-market bubble.'”

9. “Although we didn’t get carried away with ridiculous subprime this time, the multiple of family income actually went higher than it did in 2007. So in terms of actual long-term vulnerability posed by overpricing, this housing market was more overpriced, and it was accompanied by a much more overpriced and classically bubbly stock market than 2007.”

10. “Don’t invest in real estate, don’t invest in the US. If you have to invest in the US, quality has been the mispriced asset for 100 years. They outperform in bear markets. They underperform in bull markets, because you want to own Tesla, you want to own meme stocks, you want to own what’s flying. You don’t want to own Coca-Cola, it’s just too boring.”

11. “When it comes to quality, they have less risk of every kind. They have less debt, they go bankrupt less, they have less volatility, they have a lower beta. Yet they outperform. That is a free lunch.”

12. “Bitcoin is, of course, an elaborate scam, really.”

13. “Commodities break your heart because just as they’re doing well, they have a wipeout for 18 months, and then they go roaring back to a new high.”

14. “Artificial intelligence is absolutely for real. Is it big enough, soon enough to stop the deflating? No, I don’t think it is. It’s a 10-, 20-year, multi-decadal effect going off into the distant future, and it will be potentially vast in its effects.”

15. “I’m not a great believer in economists. They’ve lost the plot for the last 70 years. They’ve forgotten their job description, which is to be useful. They drown in assumptions and closed systems, which are largely irrelevant for everything except their reputation inside their industry.”

16. “You should not be surprised if the price of oil doesn’t go over $100 maybe once or twice in the next five years. You should be amazed if the price of oil does not then have a long-term crutch, and it will run down to a level where the Saudis or somebody will be able to grind out $45 oil into the setting sun. That’s how I think the game will end.”