Warren Buffett’s Berkshire Hathaway (BRK.B, $326.60) is having a great year in a down market, and on Monday, it quietly hit a milestone. The company’s far-lesser-traded Class A shares were priced at $500,000 on the nose intraday for the first time in their history.

That’s right. For a fleeting moment, a piece of Buffett’s holding company cost a cool half-million per share.

BRK.A, which crossed $5,000 way back in 1989, attained such a shocking dollar amount because Buffett has never split the stock. That’s intentional. The high price of admission to the Class A shares helps attract long-term investors and discourages speculation, is Buffett’s thinking, and he told shareholders as much in 1984.

Of course, most investors still have access to Warren Buffett’s investing acumen via the more accessible Berkshire Hathaway Class B shares, which currently trade around $325 to $330 each. The Class B shares, created in 1996, remain at reasonable levels thanks to the 50-to-1 split required to facilitate Berkshire’s acquisition of railroad operator Burlington Northern Santa Fe in 2010.

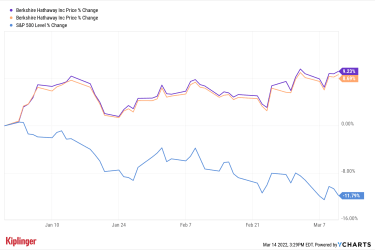

Happily, investors in both shares are enjoying considerable outperformance amid an otherwise painful start to 2022. BRK.A was up 8.7% for the year-to-date through March 11. BRK.B added 9.2% over that span.

The S&P 500? It’s off nearly 12%.

YCharts

Berkshire Shares Are Long-Term Winners, TooThe fact Class A shares have never split explains their half-million-dollar price tag, but that shouldn’t diminish Buffett’s role in getting them to their lofty level. Folks don’t call him the greatest long-term investor of all time for nothing.

For one thing, Berkshire Hathaway is the 12th best stock of the past 30 years, according to Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University. Under Buffett’s stewardship, BRK.A and BRK.B created $504.1 billion in wealth for shareholders, or 11.7% annualized, between January 1990 and December 2020.

Sign up for Kiplinger’s FREE Closing Bell e-letter: Our daily look at the stock market’s most important headlines, and what moves investors should make.

Longer term, Buffett’s performance is pretty much untouchable. Berkshire’s return more than doubled that of the S&P 500 since 1965, notes Argus Research – or a compound annual growth rate of 20.1% vs. 10.5% for the index.

Putting it perhaps most evocatively is Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. He notes that if you had invested $10,000 in Berkshire Hathaway in 1968 and left it untouched for 50 years, your nut would have grown to $85 million.

Buffett’s unparalleled investment returns and his refusal to split the Class A shares make them by far and away the most expensive stock in the world, per data from S&P Global Market Intelligence. For context, Swiss chocolate maker Lindt & Sprüngli AG (LDSVF) comes in a distant second, with a home exchange price of about 110,000 Swiss francs (or $108,000).

Here are some other ways to put BRK.A’s $500,000 stock price in perspective. A single Berkshire’s Class A share is …

1.23 times the median sales price of a house in the U.S. (~$408,100). 2.5 times the average annual wage of an American CEO (~$198,000). 130,208 McDonald’s hamburger Happy Meals.To be sure, there’s nothing special about BRK.A breaking $500,000 a share – not even psychologically. Only 615,160 shares are available for trading, average daily volume is 1,940 shares, and, uh, they cost around $500,000 a pop. It’s not like retail investors are going to chase these prices higher on surging volume.

But it’s a fun milestone to note and a tribute to the power of buy-and-hold (and hold and hold and hold) investing. And then some.