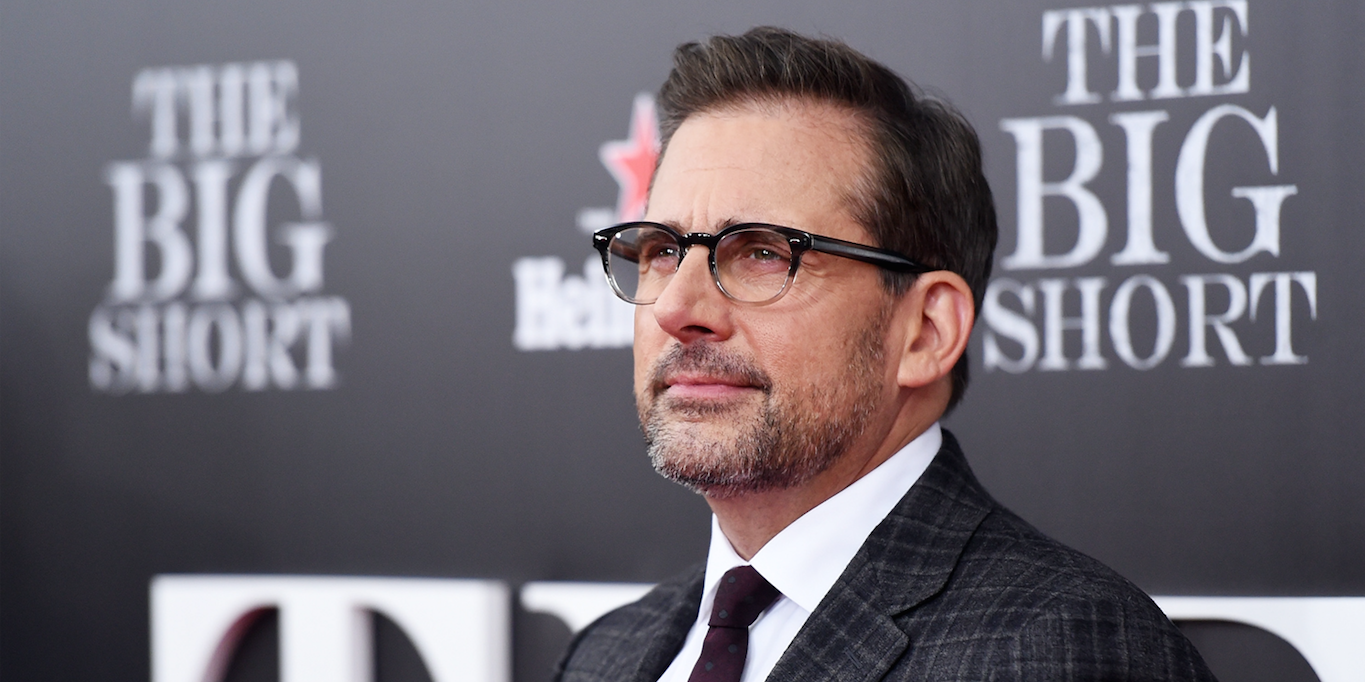

There’s no indication of a recession, “Big Short” investor Steve Eisman told CNBC. Due to that, many investors are playing market catch-up, helping fuel further gains. “So as long as there’s no evidence of recession, I think the market will probably continue to melt up — people are chasing.” Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Though Steve Eisman sees the Federal Reserve’s hiking cycle as a potential catalyst for an economic downturn, he told CNBC that nothing points to a recession yet.

And that suggests the market will continue to rally.

“So far, there’s no evidence of a recession. So as long as there’s no evidence of recession, I think the market will probably continue to melt up — people are chasing,” the Neuberger Berman portfolio manager said.

Best known for the 2008 housing crash prediction portrayed in “The Big Short,” Eisman said that his firm continues to be fully invested, with no plans to withdraw as long as the economy keeps chugging along.

However, while investor expectations point to one more Fed rate hike on Wednesday and then a pause, he noted the possibility of more tightening, even suggesting the chance of three more hikes.

But even if the Fed hikes rates again, Chairman Jerome Powell could send mixed messages during his post-announcement press briefing, Eisman said.

“The only caveat I would say is, after the Fed raises rates, Powell will speak, and if history is any guide, Powell will be dovish even when he wants to be hawkish. That just tends to be his personality,” he said.

In recent weeks, a number of economic commentators have chimed in about the likelihood of a soft landing, driven by an inflationary slowdown and continued labor market strength.

Another reason the much-anticipated recession hasn’t emerged yet is that corporate net interest payments have actually fallen amid the central bank’s hawkishness.

Strong economic performance has also been paired by equity market strength, as investors shrug off the tightening cycle to rally around Big Tech firms that benefit from new developments in artificial intelligence.

To Eisman, these stocks will continue to gain as long as interest doesn’t climb too far up, as investors seem indifferent to the market’s high price points.

Though he doesn’t see AI-linked stocks as overhyped, Eisman did suggest a possible correction at some point, along with market broadening further down the road.

“The bigger issue for me is that, at this point, ChatGPT only benefits a handful of very, very large companies,” he said. “And what’s going to be interesting over the next year or so is to see if it really broadens out to some middle-type companies.”