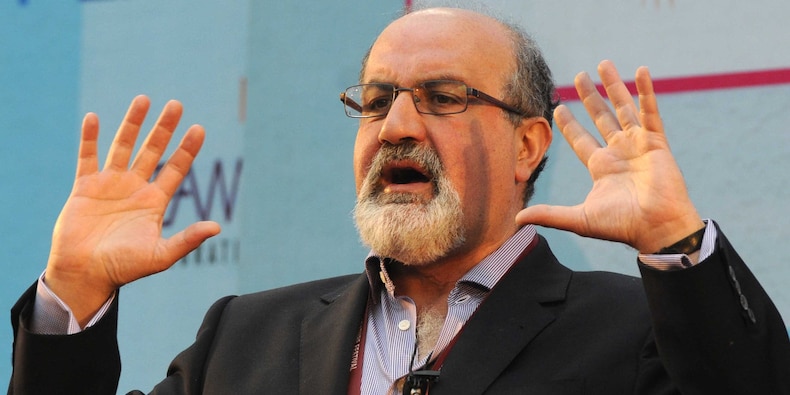

Nassim Taleb.Mohd Zakir/Hindustan Times via Getty Images

Nassim Taleb has compared bitcoin to a disease and called it worthless in recent months. “The Black Swan” author said the cryptocurrency is in a fragile, speculative bubble. Bitcoin isn’t a currency, store of value, inflation hedge, or haven for investors, Taleb said. Nassim Nicholas Taleb has fired off a bunch of incendiary tweets about bitcoin over the past six months. The author of “The Black Swan” and “Antifragile” has compared the most-valuable cryptocurrency to an infectious disease, dismissed it as worthless, and argued it doesn’t serve as a hedge against anything.

Last summer, Taleb asserted in an analysis dubbed the “Bitcoin Black Paper” that bitcoin isn’t a currency, store of value, inflation hedge, or a haven from government tyranny or catastrophe. He has used Twitter to amplify his view that bitcoin is a fragile bubble built on speculation instead of genuine value.

Here are Taleb’s eight best tweets about bitcoin, lightly edited for length and clarity:1. “Bitcoin is a contagious disease. It will spread and its price will rally until saturation, when every sucker stupid enough to buy the story is invested. Bitcoin is not competing against ‘fiat’ currency. It is competing against the thousands of other sucker products that are born every year.” (January 17, 2022)

2. “Almost nothing in financial history has been more fragile than bitcoin.” (July 3, 2021)

3. “Bitcoin has been a magnet for imbeciles.” — blasting critics who accused him of being too rigid in his views about bitcoin, even though he shifted from being excited about its potential to deciding it was worthless in 2020. (July 30, 2021)

4. “It may interest some for speculative purposes, but anyone who claims that bitcoin is a hedge against anything, financial or otherwise, is a certified fraud.” (September 20, 2021)

5. “Bitcoin is no hedge for adversity, inflation, or deflation. Bitcoin is no currency. Bitcoin is nothing.” (December 4, 2021)

6. “BTC is an awkward, clunky, and already obsolete product of low interest rates. It should collapse with inflation.” (December 28, 2021)

7. “If you still think that bitcoin is a hedge against world events, or represents ‘diversification,’ you must stay out of finance. Take up some other hobby such as stamp collecting, bird watching, or something less harmful to yourself and others.” (November 26, 2021)

8. “I am not ‘bearish’ on bitcoin. It is a tulip bubble (without the aesthetics and disguised as a ‘currency’), hence it is as irrational to buy it as it is to SHORT it, perhaps even more. Gabish?” (October 21, 2021)

Read more: A 30-year market vet shares 5 indicators that show stocks are in dangerous territory as the Fed tightens and economic growth gets set to slow — all while valuations sit at historic highs