Investors betting the Bank of Canada will cut rates in coming months to counter fallout U.S. bank collapses

Author of the article:

Bloomberg News

Esteban Duarte and Erik Hertzberg

Published Mar 13, 2023 • Last updated 1 day ago • 2 minute read

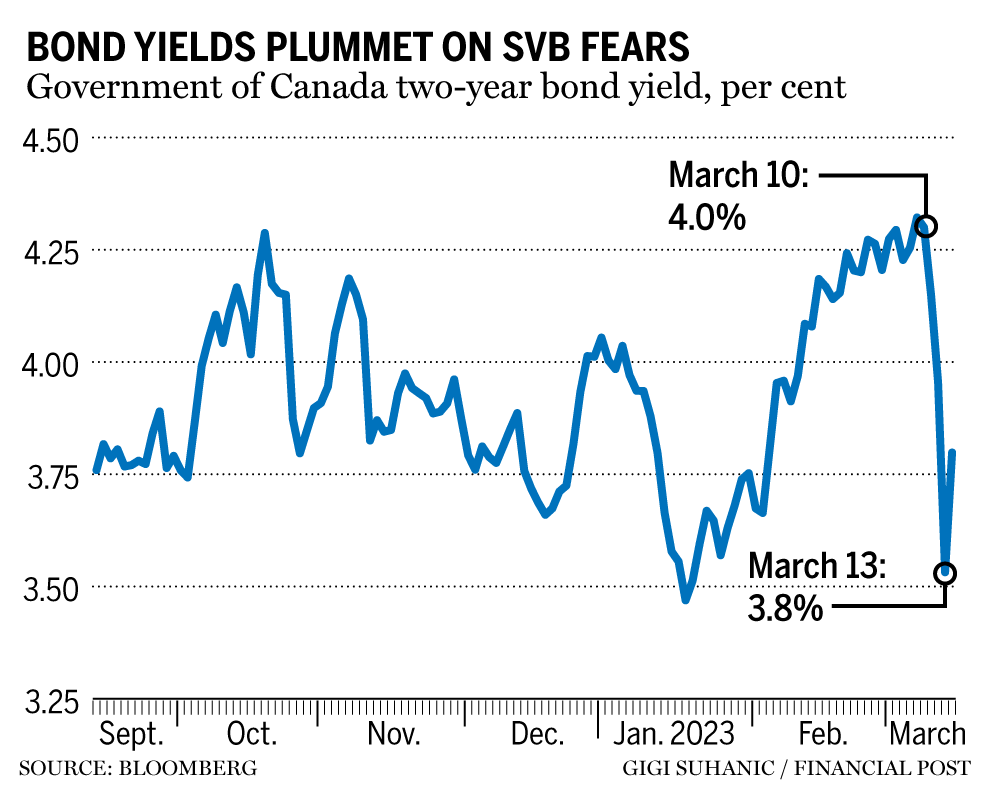

Bank of Canada governor Tiff Macklem. Photo by Blair Gable/Reuters The yield on short-term Canada bonds is falling at the fastest rate in decades, as investors bet the Bank of Canada will cut rates in coming months to counter fallout from the collapse of United States regional banks.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on Enjoy insights and behind-the-scenes analysis from our award-winning journalists Support local journalists and the next generation of journalists Daily puzzles including the New York Times Crossword SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on Enjoy insights and behind-the-scenes analysis from our award-winning journalists Support local journalists and the next generation of journalists Daily puzzles including the New York Times Crossword REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account Share your thoughts and join the conversation in the comments Enjoy additional articles per month Get email updates from your favourite authors Canada’s two-year benchmark yield tumbled 42 basis points Monday to 3.532 per cent, bringing its total decline since Wednesday to about 77 basis points. The last time the benchmark dropped that much over three trading sessions was in May 1995, according to data compiled by Bloomberg.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Traders in overnight interest swaps are now pricing in rate cuts from the Bank of Canada by June. Last week, traders were expecting the next move to be a hike.

It was a day of investors seeking safe havens as the collapse of regional U.S. lenders Silicon Valley Bank and Signature Bank rattled investor confidence in the U.S. banking system. Gold jumped and U.S. Treasury yields also saw a historic decline. Economists at Nomura Securities predicted the United States Federal Reserve will reverse course and cut its benchmark interest rate by a quarter percentage-point at next week’s policy meeting.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

“We are in behavioural finance-land now and it’s safe to assume that investors will likely stay careful and fly to safety until we have a complete picture of the situation,” said Sebastien Mc Mahon, chief strategist and senior economist at Industrial Alliance Investment Management Inc.

It’s “quite unlikely” that the Canadian yield curve will diverge significantly from the U.S., Mc Mahon said.

“We believe financial stability concerns spilling over from the U.S. is material enough to rethink the market reaction function in Canada,” Canadian Imperial Bank of Commerce fixed-income strategists Ian Pollick and Sarah Ying said Monday in a report to investors.

Recommended from Editorial Canadian startups face funding ‘pressure cooker’ after SVB collapse The story behind the Silicon Valley Bank collapse: John Ruffolo Fallout from SVB collapse could complicate life for Canada’s banks “The danger now is that we see market overreaction to bad data into the months ahead as the market looks to be more sensitive to rallies — something we have yet to see this cycle.”

Bloomberg.com