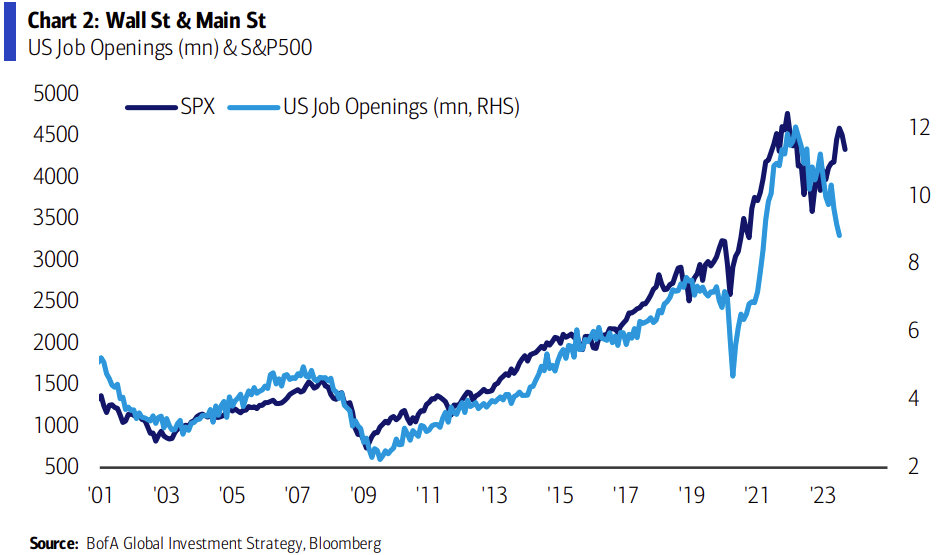

An ongoing decline in job openings is not a good sign for the stock market, according to Bank of America.Job openings have dropped 27% since their peak of 12 million in March 2022.The bank highlighted that since 2001, job openings and the S&P 500 have had a strong correlation. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Our Chart of the Day is from Bank of America, which highlights that an ongoing decline in job openings could bode poorly for the US stock market.

The chart shows that since 2001, job openings have been closely tied to the S&P 500. With job openings down 27% since their March 2022 peak of 12 million, that suggests the stock market is likely to follow.

“Strong correlation between US job openings (labor demand) and stock market,” Bank of America’s Michael Hartnett said in a Friday note.

The chart ties into Hartnett’s overall bearish view that investors should “sell the last hike.” Hartnett observed that stocks tend to perform poorly after the Federal Reserve’s last interest rate hike, which could have been in July when the Fed last raised rates by 25 basis points.

The Fed paused at its September FOMC meeting, and the market currently expects that it will keep rates steady again at the November and December meetings. The S&P 500 has declined 6% since the Fed’s last rate hike.

“[Sell the last hike] strategy tends to work when monetary policy needs to work harder to slow economy in inflationary era” like in the 1970s and 1980s, Hartnett said.

It’s worth noting that there also has been a bullish argument to the steady decline in job openings: the downtrend could help reduce wage inflation, which would help bring down the overall inflation rate and potentially lead to rate cuts from the Fed. But according to Hartnett, that’s a reason to sell stocks, not buy.