Higher interest rates are having an outsized impact on millennials who are looking to buy a home.At the same time, baby boomers have seen a net positive from elevated interest rates as their cash earns 5%.”Everyone is locked in 3% mortgage except millennials,” Bank of America said. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Our Chart of the Day is from Bank of America, which shows that millennials are getting slammed by elevated interest rates.

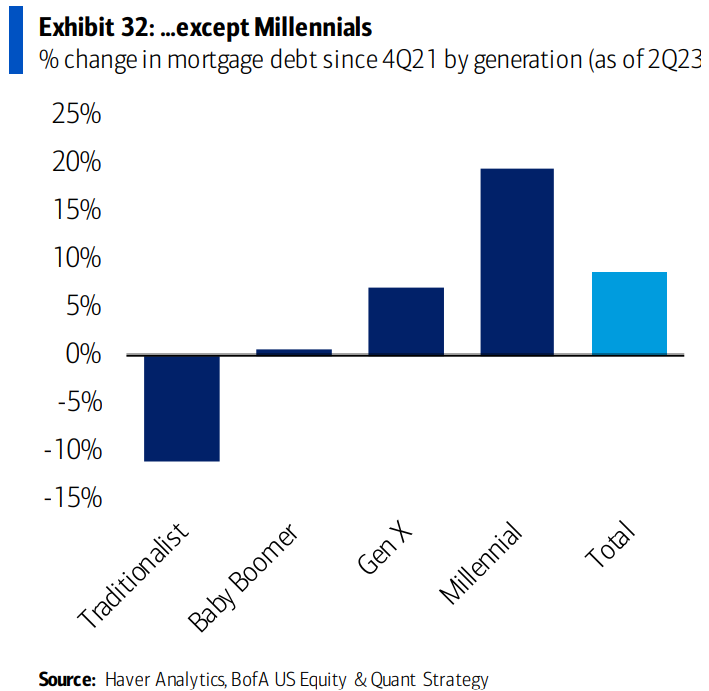

The chart shows the percentage change in mortgage debt since the fourth quarter of 2021, and breaks it out by generation. Late 2021 is significant as that was the last quarter of near-zero interest rates before the Federal Reserve began its interest rate hiking policy in March 2022.

Back then, the average 30-year fixed mortgage rate was about 3%, compared to more than 7% today. And those higher rates, combined with still-rising home prices, hve put millennials in a tough spot when it comes to buying homes.

The chart shows that millennials have seen about a 20% increase in mortgage debt since the end of 2021, compared to a less-than 10% increase for Gen X and a near-zero percent increase for baby boomers. Meanwhile, the traditionalist generation, also known as the silent generation, saw a 10% decline in mortgage debt.

“Effective mortgage rate is still below pre-COVID levels. Everyone locked in 3% mortgage except millennials,” Bank of America said in a recent note. “Millennials spend significantly more on housing, while boomers spend more on health care and entertainment.”

To be sure, boomers are past their years of needing bigger homes to raise families. But there have also been signs that they are driving more household formation in the current housing market as they age.

And baby boomers faring better than millennials during this elevated interest rate period isn’t confined to mortgages and the housing market. Boomers are also benefiting from higher interest rates because they’re able to earn 5% risk-free on their cash savings, which is a lot more than what millennials have saved up.

The bank said baby boomers and traditionalists have a combined $146 trillion in household net worth, compared to about $10 trillion for millennials.

“Since 1980, US debt to GDP rose 90%, lining baby boomers’ pockets with $77 trillion net worth and $60 trillion [of] financial assets. Today’s higher cash return of 5% translates to an annual $4 trillion,” Bank of America said.