Phil Rosen

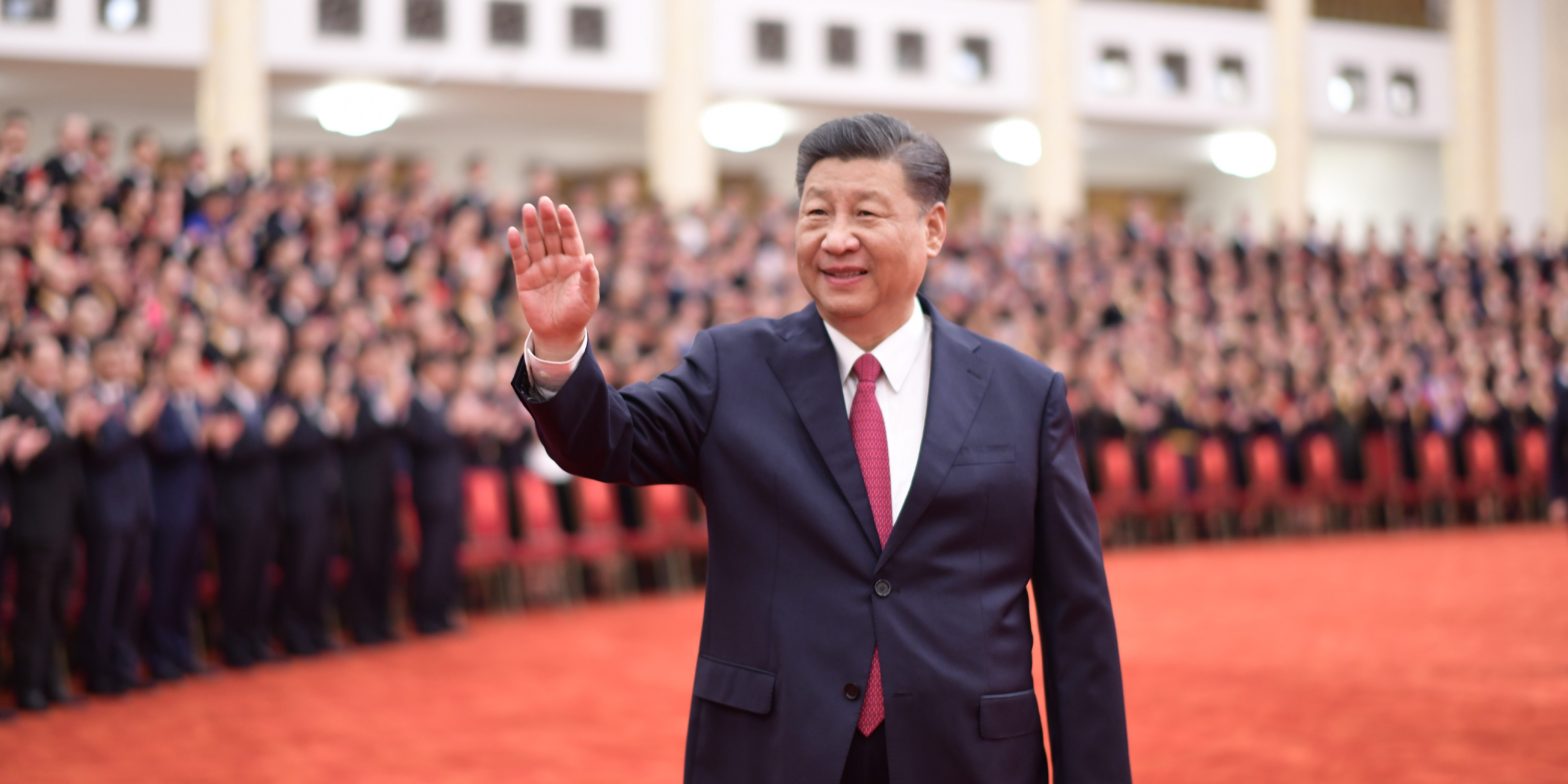

Chinese President Xi Jinping, also general secretary of the Communist Party of China CPC Central Committee and chairman of the Central Military Commission, waves while meeting with awardees of the titles of outstanding Party members, exemplary Party workers, and advanced community-level Party organizations from across the country before the ceremony to present the July 1 Medal, the Party’s highest honor, to outstanding Party members at the Great Hall of the People in Beijing, capital of China, June 29, 2021. The award ceremony of the July 1 Medal was held Tuesday morning at the Great Hall of the People in Beijing. Xie Huanchi/Xinhua via Getty Images The People’s Bank of China is building a yuan reserve with five other nations in collaboration with the Bank for International Settlements.

China is teaming up with Indonesia, Malaysia, Hong Kong, Singapore, and Chile to each contribute 15 billion yuan — about $2.2 billion — to a Renminbi Liquidity Arrangement, China’s central bank said in a Saturday statement. “When in need of liquidity, participating central banks would not only be able to draw down on their contributions, but would also gain access to additional funding through a collateralised liquidity window,” the bank said.

Per the report, the funds will be stored with the Bank for International Settlements.

The announcement follows Russia and China’s endeavor to develop a new reserve currency with other BRICS countries, President Vladimir Putin announced last week.

The basket of currencies would present a US-dominated IMF alternative, and include contributions from Brazil, Russia, India, China, and South Africa.

“The matter of creating the international reserve currency based on the basket of currencies of our countries is under review,” Putin told the BRICS Business Forum on Wednesday, according to a TASS report. “We are ready to openly work with all fair partners.”

Meanwhile, last month, China’s foreign exchange reserves — the world’s largest — grew for the first time in 2022, state data shows. The nation’s reserves rose by $80.6 billion to reach $3.13 trillion.

At the same time, the US dollar has hit a 20-year high in recent weeks.

And, in March, reports emerged of a Saudi oil deal priced in the yuan. An economist told Insider that a deal done without dollars could signal unease in relying too heavily on the US currency.

“While any deal would be symbolic, the Chinese are not alone in the search for a non-dollar reserve currency,” Aleksandar Tomic told Insider previously. “Other countries’ need for dollars exposes them to the US financial sector, and consequently gives the US political leverage.”

Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Markets China Yuan Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.