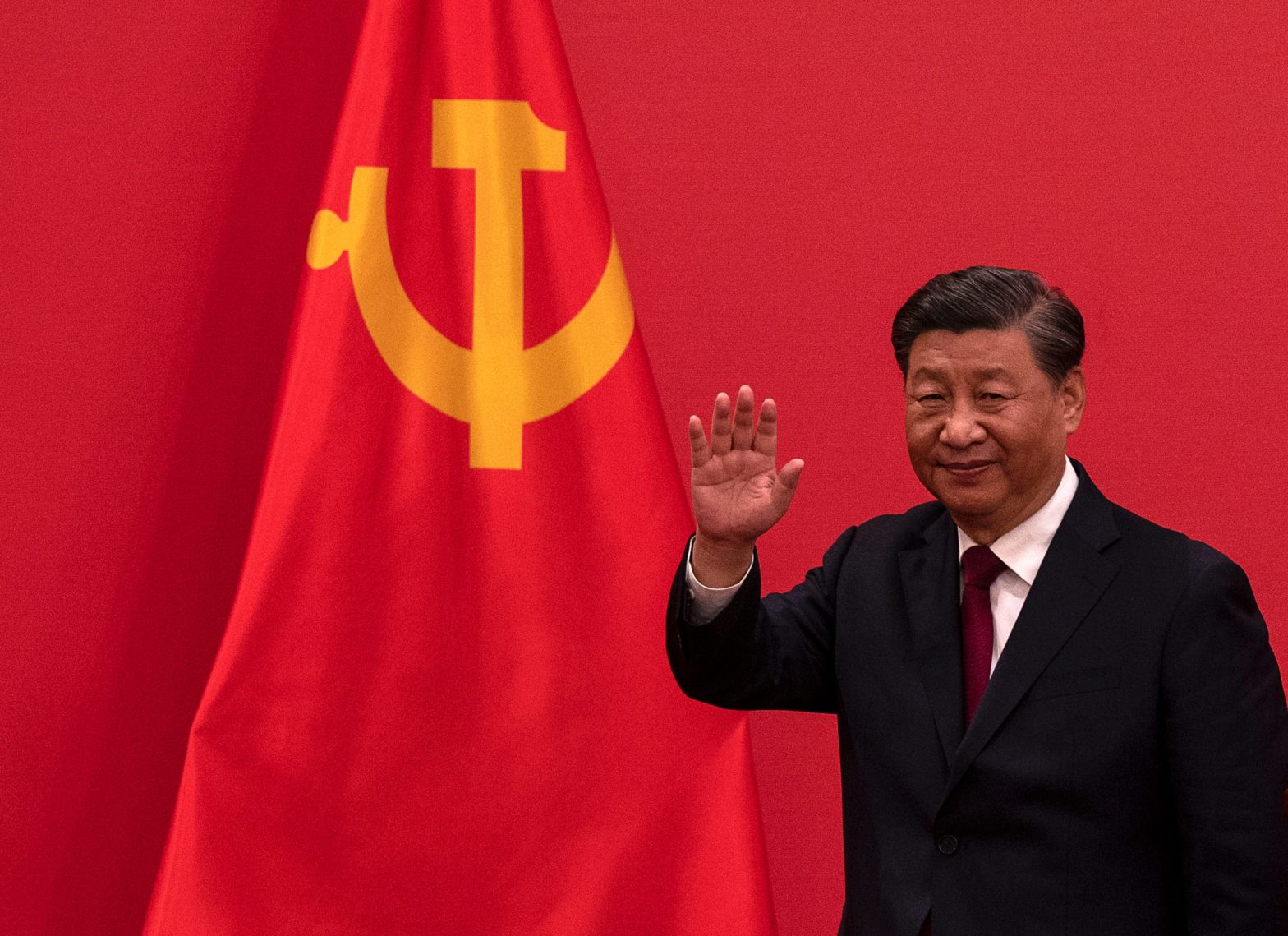

The Chinese government is buying shares in Alibaba, Tencent and other tech companies, according to the Financial Times. The stakes usually involve a 1% holding and are known as “special management shares.” This gives China’s Communist Party special rights over certain business decisions, the report said. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

The Chinese government is buying shares in Alibaba, Tencent and other tech companies to be more deeply involved in their businesses, sources told the Financial Times.

The stakes usually involve a 1% holding in a key segment and are known as “special management shares,” which give Beijing rights over certain decisions at the companies.

That allows the Communist Party to gain greater influence over the tech sector, especially in the content it provides to Chinese people, the report said.

In the case of e-commerce giant Alibaba, China’s internet regulator took a stake last week, when an arm under the state investment fund set up by the Cyberspace Administration of China bought a 1% share of Alibaba’s Guangzhou Lujiao Information Technology subsidiary.

The purchase was meant to tighten control over content at Alibaba’s streaming video unit Youku and web browser UCWeb, sources told the FT. The subsidiary also named a new board member who appears to be an official with the regulator.

Meanwhile, details of the Chinese government’s plan to buy shares in internet giant Tencent are still under discussion, the report said.

But Tencent reportedly wants a government agency from its home province of Shenzhen to buy the stake rather than the Beijing-based fund that bought shares of the Alibaba unit.

The same fund also purchased a 1% stake in a unit of TikTok parent ByteDance, called Beijing ByteDance Technology, gaining the right to name one of its directors. Communist Party official Wu Shugang, who oversaw online commentary at China’s internet regulator, joined the board.

Wu has a say over business strategy and investments, any merger plans, and profit allocations as well as control over content at ByteDance’s media platforms in China, according to the FT.

The purchases of so-called golden shares are a stark contrast to some of the heavy-handed punishments, usually fines, issued by the Chinese government that were previously a trademark of the tight grip Beijing kept on its tech sector.

The recent market rout in China due to stringent Covid-19 lockdowns as well as a loss of foreign investors pushed the Chinese government to re-evaluate its approach toward tech.