Coinbase’s Brian Armstrong flagged rumors that the SEC may want to ban crypto staking for retail investors. Staking is a popular way for customers to earn yield in exchange for locking up their crypto assets. The SEC has repeatedly stated that most digital tokens could be regulated as securities. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

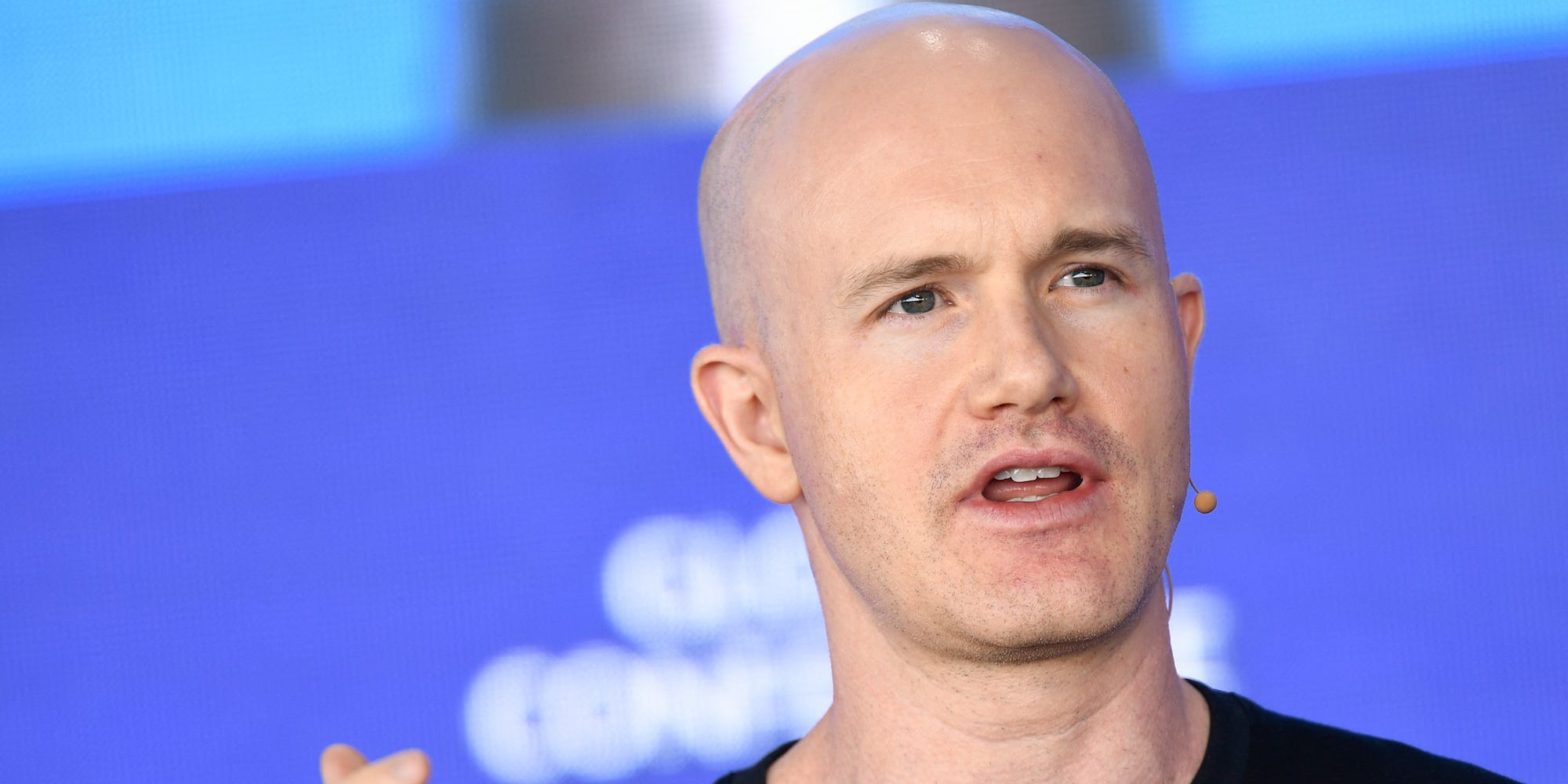

Coinbase CEO Brian Armstrong will not be happy with the US Securities and Exchange Commission if the regulator bans a crypto income-generating technique known as staking for retail investors.

In a string of tweets on Wednesday, Armstrong wrote he was “hearing rumors” that the agency would like to “get rid of staking.”

For the unititated, staking gives a crypto holder financial rewards for locking up their assets and confirming transactions on a blockchain’s network. This occurs on proof-of-stake blockchains like Ethereum and Solana.

“Staking is a really important innovation in crypto. It allows users to participate directly in running open crypto networks,” Armstrong tweeted. “Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints.”

Although the yield-generating technique may be obscure to some, there’s a huge amount of money currently staked. In the fourth quarter of 2022, there was a combined $42 billion worth of staked assets.

—Brian Armstrong (@brian_armstrong) February 8, 2023The Coinbase exec added: “I hope that’s not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.”

The SEC declined to comment. However, chairman Gary Gensler has repeatedly stated that most digital tokens could fall under securities rules. Armstrong argues that staking is not a security.

“Regulation by enforcement doesn’t work,” Armstrong added. “It encourages companies to operate offshore, which is what happened with FTX.”