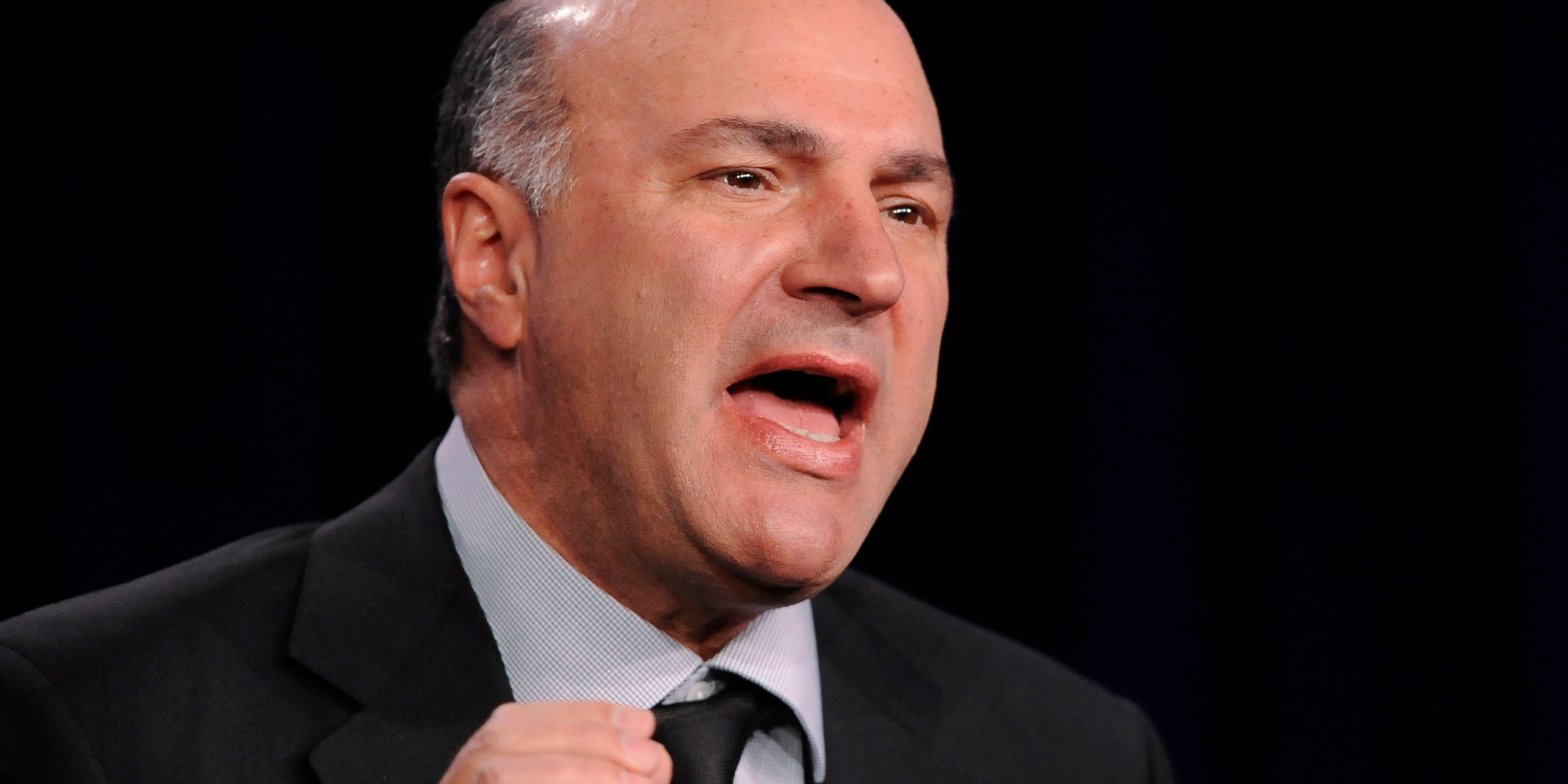

The commercial real estate sector faces a big correction, ‘Shark Tank’ star Kevin O’Leary said. He told Fox Business there’s “so much money on the sidelines waiting for this so-called ‘bloodbath.'” O’Leary said that meant the landing would be “a lot softer than you think.” Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

The commercial real estate market is facing a major shakeout for the first time in more than two decades, according to “Shark Tank” investor Kevin O’Leary.

Despite anticipating a big correction in the commercial property market, he said it wouldn’t be wiped out entirely.

“It’s a hard asset, the ownership changes because you got the idiot managers. They get wiped out, they lose all their equity, and new managers come in with distressed funds – of which there’s billions being raised now,” O’Leary told Fox Business on Thursday.

“There’s so much money on the sidelines waiting for this so-called bloodbath. It is going to be a lot softer than you think,” he added, referring to comments made by his fellow “Shark Tank” star Barbara Corcoran.

O’Leary and others have warned of stress brewing in commercial real estate due to higher borrowing costs in the wake of Federal Reserve interest rate rises, and falling demand for office space post-pandemic.

“No matter how much you talk up your real estate book around office, the world has changed. Not only are rates up, but people don’t want to work in a cubicle anymore,” O’Leary told Fox Business.

He also highlighted the potential impact on regional banks, which have up to a quarter of their portfolios in commercial real estate – a market that is now underwater, according to his estimates.

O’Leary previously said that the fall of Silicon Valley Bank in early March would be the beginning of the end for regional banks.

He told Fox that over the next five years, 4,500 “little, crappy banks” would consolidate to about 800 well-financed “super regionals.”

“It’s going to be painful as that happens, but get over it. It’s not going to shut down the American economy,” O’Leary added.