stocks

Tesla’s CEO tweeted Friday that his $44 billion buyout of Twitter was “temporarily on hold.” The purported reason: bot traffic.Anyone who expected turbulence amid Elon Musk’s quest to acquire Twitter (TWTR) got precisely what they anticipated Friday morning, when the Tesla (TSLA) CEO tweeted that the Twitter deal was “temporarily on hold.”

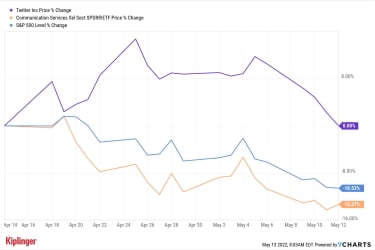

TWTR shares plunged roughly 10% early Friday following Musk’s tweet, which linked to a May 2 Reuters story about Twitter’s recent statement that “the average of false or spam accounts during the first quarter of 2022 represented fewer than 5% of our [monetizable daily active users] during the quarter.”

Musk later tweeted that he is “still committed to acquisition,” which helped cut into the losses somewhat, though another seed of doubt was already sown.

“[Musk] is clearly intent in querying the company’s estimate that spam accounts make up less than 5% of active daily users – a key metric given that establishing an accurate number of real tweeters is considered to be key to future revenue streams via advertising or paid for subscriptions on the site,” says Susannah Streeter, senior investment and markets analyst for U.K. firm Hargreaves Lansdown.

But she also raises the possibility of an ulterior motive.

“There will also be questions raised over whether fake accounts are the real reason behind this delaying tactic, given that promoting free speech rather than focusing on wealth creation appeared to be his primary motivation for the takeover,” Streeter says. “The $44 billion price tag [of the Twitter deal] is huge, and it may be a strategy to row back on the amount he is prepared to pay to acquire the platform.”

That price tag might seem like even more of a stretch now than when Musk first got involved with Twitter.

“I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced,” Musk said in April when he declared his bid for the social media platform.

Since then, the S&P 500 and the communication services sector have both declined by double digits, with many high-priced technology and tech-esque shares plunging precipitously.

Twitter, to be fair, is roughly flat since then. But this latest hurdle puts his once seemingly imminent Twitter deal even further in doubt among investors and analysts alike.

YCharts

The market has yet to price TWTR shares at the $54.20 level Musk offered in April. Not even after Musk revealed earlier this month that backers such as Andreessen Horowitz, Sequoia Capital and Oracle (ORCL) founder Larry Ellison were lined up to help provide more than $7 billion in financing.

As of Thursday’s close, TWTR shares were trading 15% below Musk’s bidding price. In Friday’s premarket trade, that number was nearly 30%.

Wall Street’s pros appear mildly skeptical the Twitter deal closing, too. According to S&P Global Market Intelligence, the 27 analysts who currently cover Twitter have an average price target of $51.50 and collectively consider the stock a Hold.