Investors can add significant alpha by going long defensives and underweighting/shorting cyclicals

A monitor with stock market information on the floor of the New York Stock Exchange. Photo by Michael Nagle/Bloomberg files By David Rosenberg and Brendan Livingstone

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

We have had three things going on with respect to the bond market in the past year: accelerating expectations of a United States Federal Reserve rate hike, rising inflation expectations and declining real rates. Historically, this has been a problematic mix for equities, with returns well below average over the next 12 months.

As such, we believe investors should adjust down their return expectations accordingly, and focus on defensives (over cyclicals), which have been shown to be big outperformers during similar environments in the past.

It is quite rare to see a convergence of increasing rate-hike expectations, higher inflation expectations and declining real rates. Since 1998 (when our dataset begins), this has transpired less than four per cent of the time. There are only a few distinct periods when this has occurred: late-2001/early-2002, late-2004/early-2005 and mid-2008. Two of the three took place during recessions, which highlights that, despite a very small sample size, this has been somewhat of an ominous signal for investors.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

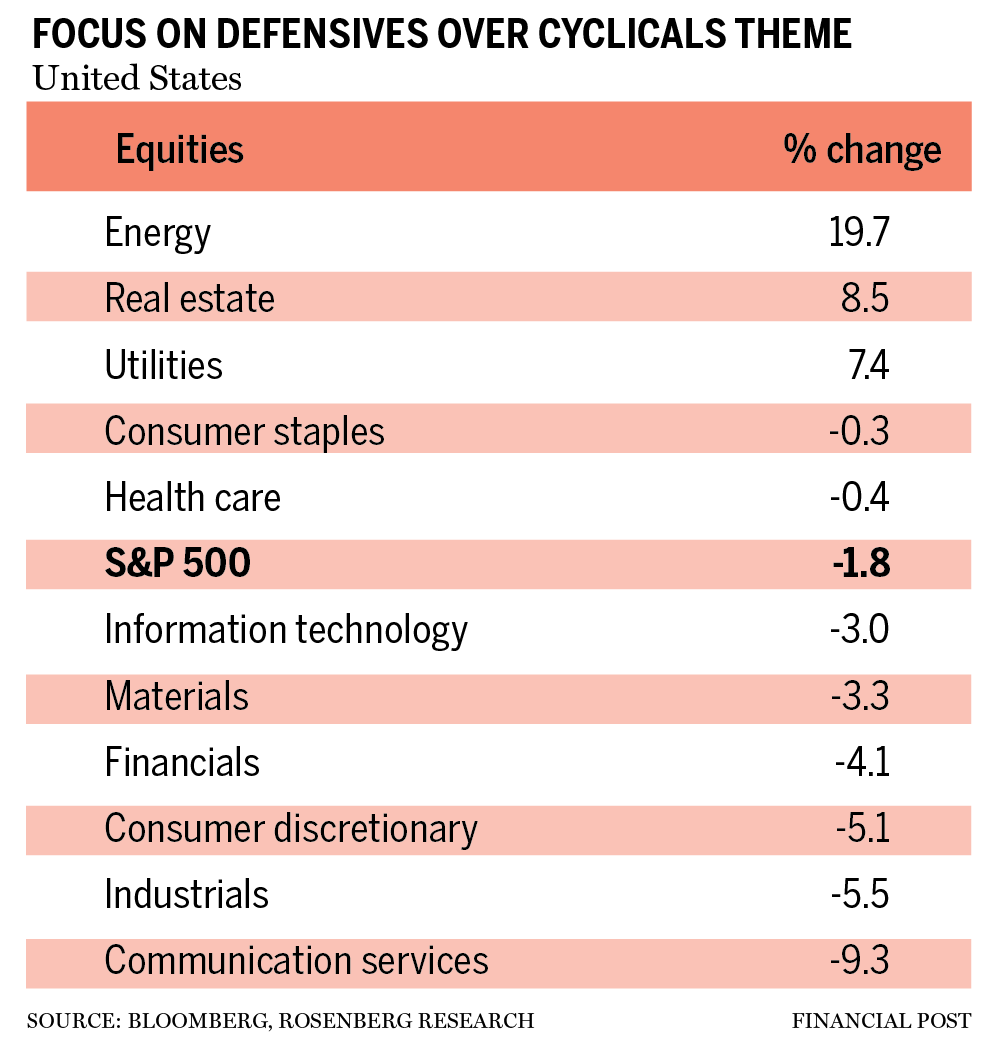

With this in mind, we looked at stock-market returns — including sectors — in the year following similar conditions in the past. As mentioned, the stock market as a whole performs very poorly, with the S&P 500 falling 1.8 per cent, on average, over the next 12 months. For reference, this compares to an average 12-month return of 7.6 per cent, representing nearly 10 percentage points of underperformance.

But perhaps more interesting is the sector performance, where there is a very clear defensives-over-cyclicals theme. Indeed, look at the top performers: outside of energy (19.7 per cent), every other sector that has done better than the S&P 500 is defensive in nature (real estate, utilities, consumer staples and health care). The average performance of defensive sectors has amounted to 3.8 per cent, representing a meaningful improvement over the -1.8-per-cent return profile for the broader market.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

By way of comparison, the laggards almost all have a cyclical tilt. This includes industrials (-5.5 per cent), consumer discretionary (-5.1 per cent), financials (-4.1 per cent) and materials (-3.3 per cent), which generally have the highest correlations with economic activity.

Note that the average performance of these cyclical sectors is -4.5 per cent over the ensuing 12 months. Thus, even in the midst of a very weak overall stock-market performance (-1.8 per cent), there is a good opportunity here for investors. Notably, going long on a basket of defensives (real estate, utilities, consumer staples and health care) and shorting a basket of cyclicals (industrials, consumer discretionary, financials and materials) has returned more than eight per cent while minimizing beta exposure. This is part and parcel of a shift towards active management and away from passive investing, which is a key theme of ours for 2022.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

More On This Topic David Rosenberg: Why Evergrande’s debt crisis is important for investors here David Rosenberg: Why we are not at the start of a new bull market David Rosenberg on the sectors that will struggle in slowing U.S. markets It is rare to see Fed rate hike expectations rise alongside higher inflation break-evens and declining real rates. From our standpoint, this reflects increased perceptions of a stagflationary backdrop as inflation break-evens are responding to rising commodity prices (despite the recent pullback), whereas lower real yields point to weaker global growth.

Critically, the economy has entered a recession two of the three times we have seen a similar development in the past. This should be a warning for the Fed that the risk of a policy mistake is elevated. Unsurprisingly, the stock market has struggled during these periods historically, although investors can add significant alpha by going long defensives and underweighting/shorting cyclicals.

David Rosenberg is founder of independent research firm Rosenberg Research & Associates Inc. Brendan Livingstone is a senior strategist there. You can sign up for a free, one-month trial on Rosenberg’s website.

_____________________________________________________________

For more stories like this one, sign up for the FP Investor newsletter.

______________________________________________________________

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300