One of China’s largest developers averted a debt default Monday after paying two coupons during the grace period. But the property crisis is far from over – with Bloomberg data showing 34 of the top 50 developers as defaulters. The remaining 16 firms face almost $1.5 billion of combined bond payments due September, per the data. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

China’s property sector remains on a knife-edge despite one of the nation’s largest developers managing a last-gasp payment on two missed bond coupons this week.

Although Country Garden Holdings managed to repay interest totaling $22.5 million on Monday, the real-estate crisis in the Asian nation continues, with over two-thirds of its top developers having defaulted at some point over the last two and a half years.

As many as 34 of the 50 developers with the most outstanding dollar bonds have missed payments on such debt, according to data compiled by Bloomberg.

Equally worrying, the remaining 16 firms – which includes Country Garden – face a combined $1.48 billion of public bond payments coming due for either interest or principal in September.

The massive debt burden carried highlights the years-long crisis facing the nation’s real-estate sector, which has seen 53 companies collapse in the space of little over two years.

Chinese developers’ dollar-denominated bonds have been all but wiped out – losing a staggering 87% of value over the past 24 months, according to recent research. The rout obliterated $135.5 billion of value from $154.9 billion of outstanding notes, according to an analysis by Debtwire.

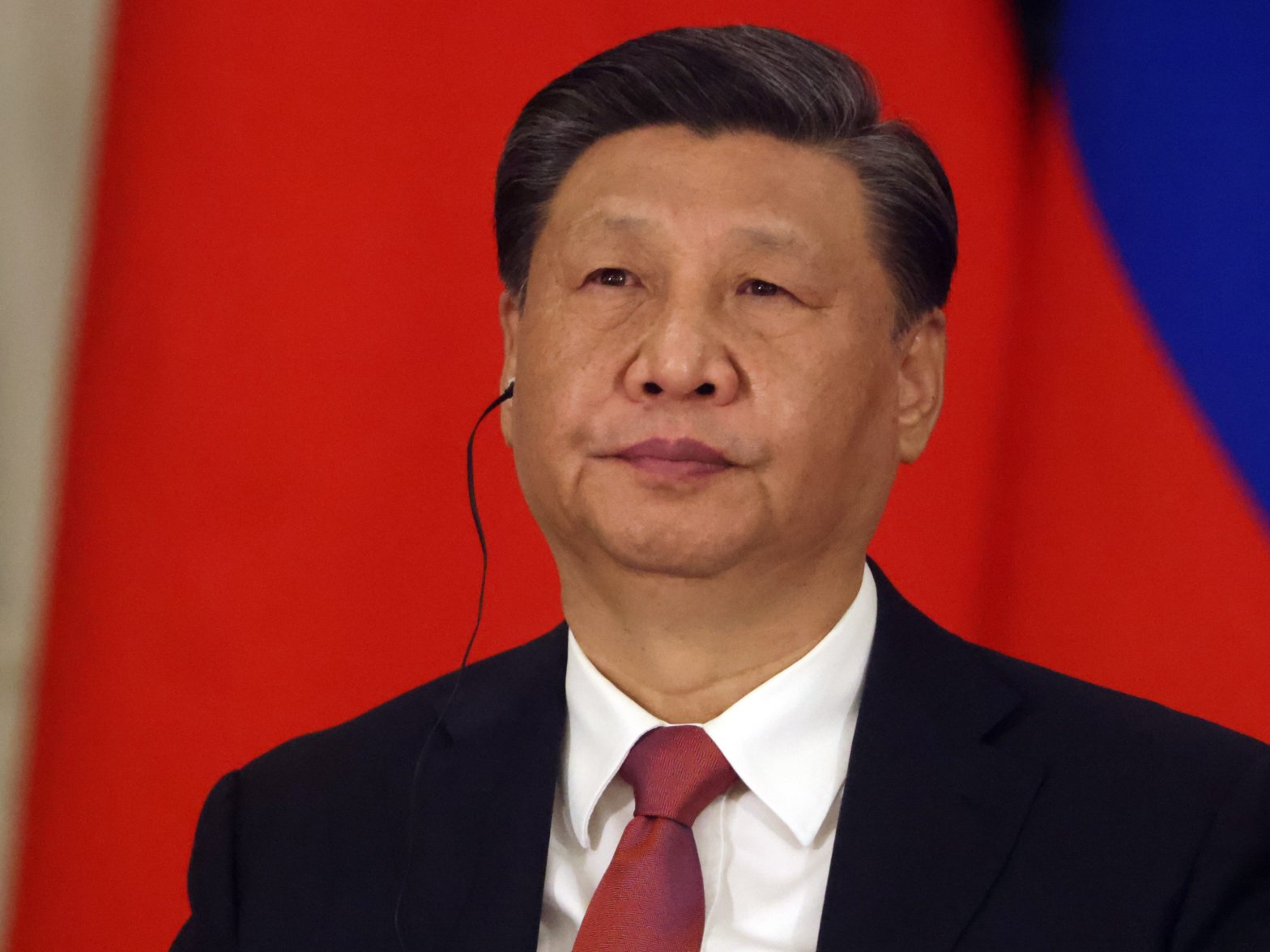

The embattled industry has been hanging on to every word of the Chinese government – whose long-awaited commitment to stimulate the slumping sector has not yet been enough to change developers’ fortunes.

China’s real estate sector is gigantic – accounting for about 30% of the country’s overall output.

Fears of a full-blown implosion has experts worried that trouble in the world’s second-largest economy could spill over around the globe.