Shutterstock

Maven Media Brands, LLC and respective content providers to this website may receive compensation for some links to products and services on this website.

Tax season is in full swing. If you’re the type of person who likes to tackle your tax returns yourself, the 2021 tax year brings several unique challenges. From reconciling stimulus payments and Child Tax Credits to understanding tax law changes, you’ll be faced with new elements to contend with as you file your taxes by the April 18, 2022 deadline.

Plus, this year more than ever the IRS is highly recommending that taxpayers eFile their returns in order to simplify processing and potentially, get their tax refund faster. Additionally, the IRS issued an announcement reminding taxpayers that even if you are waiting for the processing of 2020 returns, you can still file for 2021 – and you should do so as soon as possible to prevent delays on receiving your refund.

To be best prepared to face the tax season, you’ll want to make sure you have the right tax software to help you navigate it all. But with so many choices out there, which tax software should you trust? We evaluated two of the top contenders in the field: TurboTax by Intuit and TaxAct, which is a lesser-known name that boasts a 20-year legacy. Let’s take a look at some of the features, benefits, and costs associated with both programs.

Intuit TurboTaxIntuit TurboTax offers four levels of service for consumers at multiple price points, including their freemium service designed for people with simple returns who just need a little bit of guidance. The company also provides TurboTax Live, which adds live online help from a tax preparer who can answer your questions and review your return before it’s submitted to the IRS. Finally, the company’s Full Service offering is the same as working with a professional tax preparer in your community – except you don’t have to leave your home.

If you’re confident about filing your taxes on your own, have just a W-2 form to process, and understand all the deductions and credits you’re eligible to receive, the free version of TurboTax can help you eFile both state and federal returns easily.

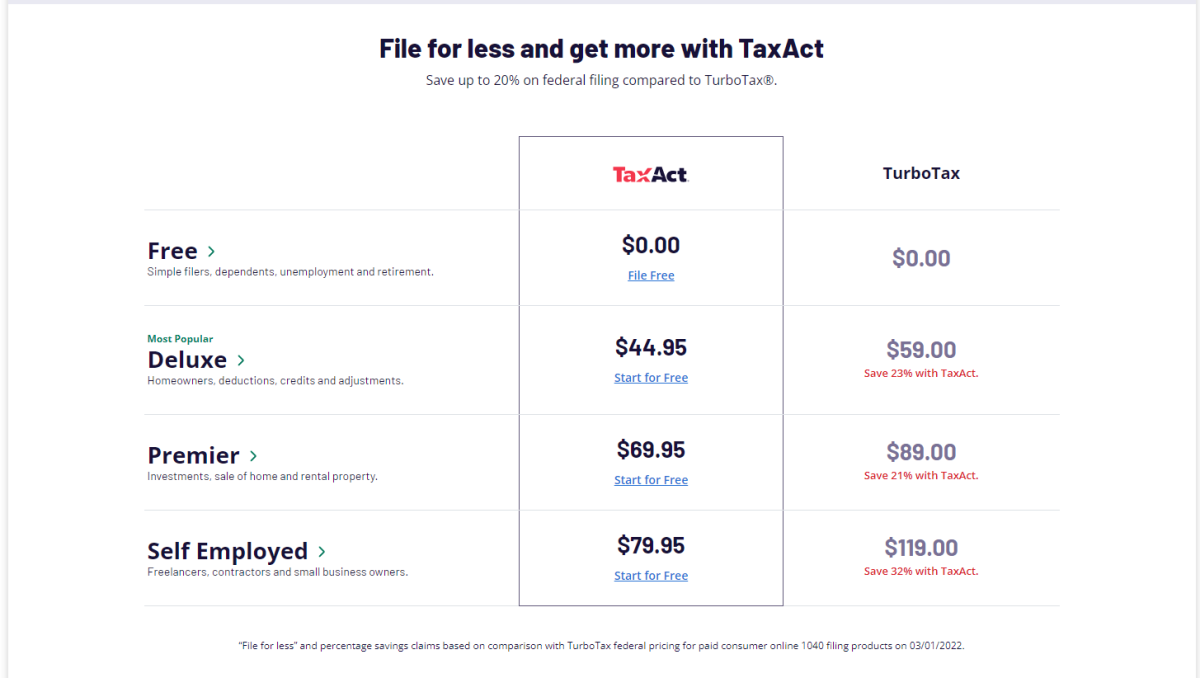

The Deluxe edition costs $59 for federal filing, with an additional cost for state tax filing. This would be for individuals with more than a W-2 form, but still a relatively simple return. The Premier edition at $89 plus state filing, is designed for those with investments or rental property. The Self Employed Edition ($119 + state) helps 1099 contractors maximize their deductions and report business income and expenses.Easy to use and intuitive, TurboTax is a go-to for many Americans filing taxes. The company guarantees accurate calculations and maximum tax savings (or a maximum refund). If another tax preparer or tax software provider can reduce your tax bill further or get you a larger refund, TurboTax will refund the purchase price of the TurboTax software package used. If you used the Free edition for tax prep, TurboTax would give you a $30 payment.

TaxActTaxAct is also an authorized IRS eFile provider that can handle state and federal tax returns with a freemium offering and three additional packages. The Deluxe Edition costs $44.95 and can help taxpayers navigate through financial aspects such as State and Local Tax (SALT) deductions, childcare expenses, and student loan payments.

The Premier version, which costs $69.95, is designed for anyone with capital gains to claim, investments, or rental properties. The Self Employed version, at $79.95, offers a tremendous bargain over TurboTax, with filing for 1099 contractors and small business owners for just $79.95. Like TurboTax, TaxAct also offers an Xpert Full Service package, but does not disclose pricing. TaxAct also guarantees accuracy, although the company website doesn’t mention any guarantees of the lowest tax bill or maximum refund.The company also charges extra for services like eFile Concierge, which notifies you if there’s a change to the status of your return. However, taxpayers can easily check the status of their return for free through the IRS.gov website.

How the Tax Software Packages CompareIt’s easy to see that TaxAct is the cheaper option – or is it? First, it’s important to note that the freemium version of TurboTax includes one state tax return for free, while TaxAct charges an extra $19.95 per state.

TaxAct, however, provides free assistance on your taxes until March 31, where TurboTax Free users have to pay for expert help by upgrading to TurboTax Live.

For self-employed individuals, TurboTax integrates with QuickBooks, as well as Square, Lyft, and Uber so you can be sure you’re tracking all your income and expenses accurately with no transposition or other data entry errors.

On the other hand, if you’re looking to save money, don’t need as much guidance or prompting from your tax software, or want to take advantage of free online help through March 31, TaxAct is worth considering.

Both tax software companies allow you to start filing your returns for free. You don’t have to pay until you eFile the return. So, it might make sense to set up an account with each company and navigate through the first few screens to see which interface you prefer before making your selection.