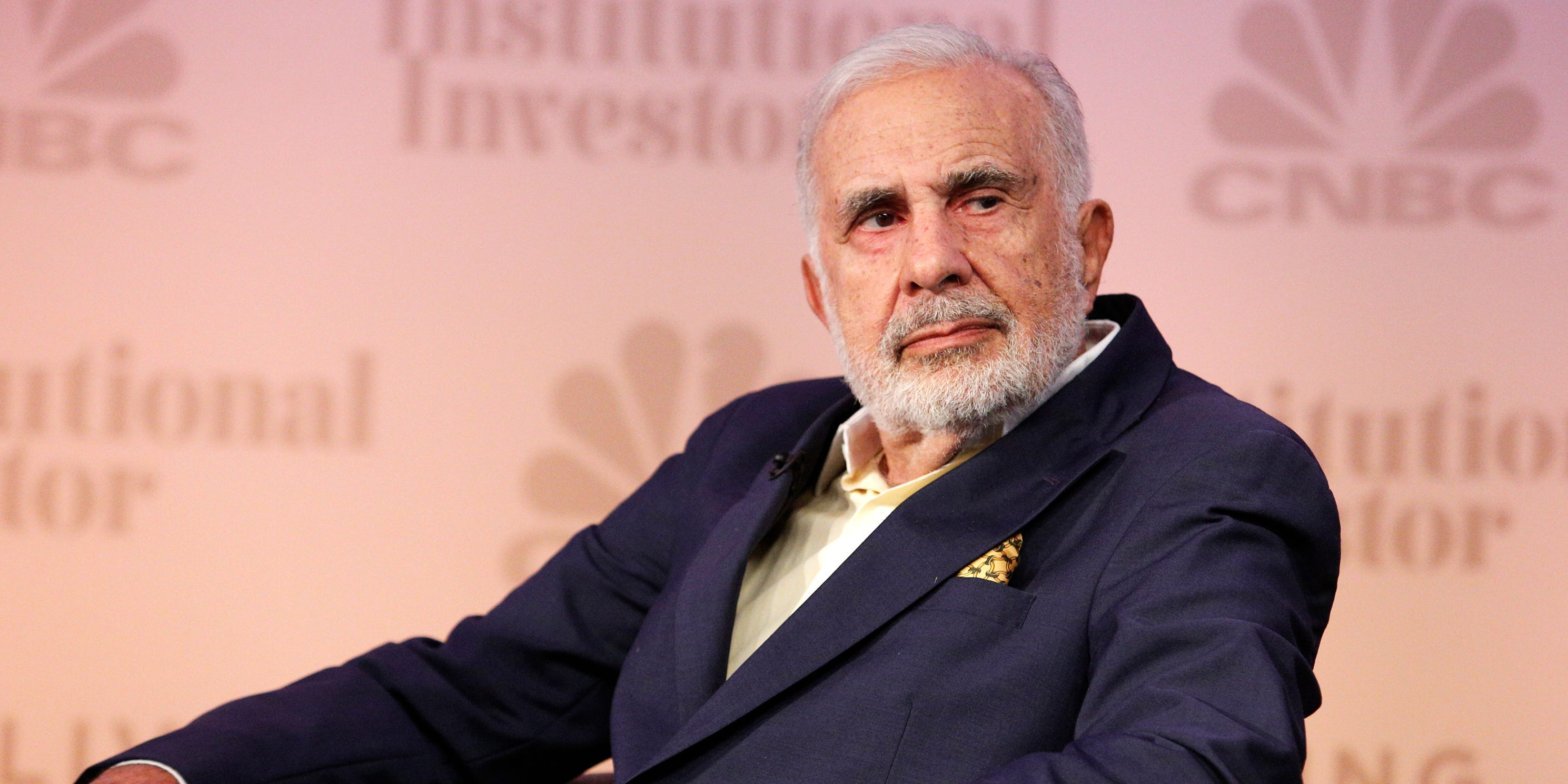

Shares in Carl Icahn’s firm Icahn Enterprises plunged 30% Friday. Those losses came after it said it would halve the amount it pays out to shareholders. The activist investor came under fire from famed short-seller Hindenburg Research earlier this year. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Embattled activist Carl Icahn’s nightmarish 2023 continued Friday as shares in his investment firm suffered a sharp sell-off.

Icahn Enterprises’ stock price tumbled 30% at the opening bell after the company said it would halve its payout to shareholders from $2 per depositary unit to $1 per depositary unit.

The billionaire investor also pledged to rethink the firm’s strategies, focusing more on activism and less on short-selling.

“We believe strongly that our current portfolio will yield additional winners and generate significant upside ahead,” Icahn wrote in a letter to investors, per Bloomberg.

Icahn added that a “misleading and self-serving Hindenburg [Research] report” was the source of much of his firm’s struggles.

The short seller attacked Icahn Enterprises on May 2, disclosing they were betting against the firm’s stock and bonds.

“Icahn has been using money taken in from new investors to pay out dividends to old investors,” Hindenburg said. “Such ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one ‘holding the bag’.”

Icahn has disputed Hindenburg’s allegations several times in the three months since, accusing the firm’s founder Nathan Anderson of running “disinformation campaigns” and pledging to “fight back” against the report.

Icahn Enterprises has plunged 53% since May 2, wiping just under $15 billion off of Icahn’s personal fortune per the Bloomberg Billionaires Index.