dividend stocks

Similar to their American counterparts, the S&P Europe 350 Dividend Aristocrats offer investors dividend hikes and blue-chip stability.U.S. equity markets aren’t the only place where you can find income-producing royalty. Indeed, a quick look across the pond yields dozens, in the form of the European Dividend Aristocrats.

Admittedly, Europe’s dividend stocks have posted subpar returns compared to their U.S. counterparts over the past decade. However, that could change this year, says Goldman Sachs strategist Guillaume Jaisson, who points to an unusually large yield gap between European stocks and bonds. At present, yields on eurozone bonds are miniscule; the choice between dividend-paying stocks and bonds seems an easy one.

In addition, Jaisson notes that higher-yielding dividend stocks are less sensitive to interest-rate hikes, and that their stable income payments look more attractive in both high-inflation and high-volatility environments, in which capital gains look less like a lock.

The European Dividend Aristocrats in specific look enticing given the difference between dividend growth here and abroad. Jaisson says the Stoxx Europe 600 Index is expected to deliver 10% dividend growth this year, well beyond the 7% forecast for the S&P 500. (And beyond 2022, says CME Group, S&P 500 dividend growth is predicted at 1% excluding inflation.)

Another financial strategist recommending European dividend stocks is Morningstar senior equity analyst Michael Field. At present, the selection of high-yielding European dividend stocks is much larger than previous years, Field says. As a result, investors can build a high-yielding portfolio of European stocks without overly relying on traditional income sectors like financial and utilities.

“The European Central Bank is unlikely to be as aggressive in raising interest rates as the Federal Reserve, giving companies on the continent some headroom,” Field adds.

Field warns that rising interest rates will likely penalize high-debt companies, however. So he recommends investors stick with high-quality European names that offer defensible moats and sustainable cash flow.

You can find many of these traits among the European Dividend Aristocrats – a small subset of the S&P Europe 350 Index.

The European Dividend AristocratsLike their U.S. counterparts, European Dividend Aristocrats are recognized for steady and growing dividends. Consistently rising dividends are not the norm in Europe so these stocks are a rare breed indeed.

Unlike the S&P 500 Dividend Aristocrats, which must deliver a minimum of 25 consecutive years of dividend growth, European Dividend Aristocrats need only show 10 years of stable or increasing dividends.

Sign up for Kiplinger’s FREE Closing Bell e-letter: Our daily look at the stock market’s most important headlines, and what moves investors should make.

Another important difference is the frequency of payout. U.S. dividend stocks tend to pay dividends quarterly, whereas European payers tend to distribute income semiannually.

In other respects, the two groups of Aristocrats are similar. Companies that earn this elite status tend to be market leaders with multibillion-dollar valuations, consistent profits and mature business models.

The current crop of European Dividend Aristocrats offers several names that stand out for their rich yields and modest valuations. We’ll look at a few highlights, then produce the full list.

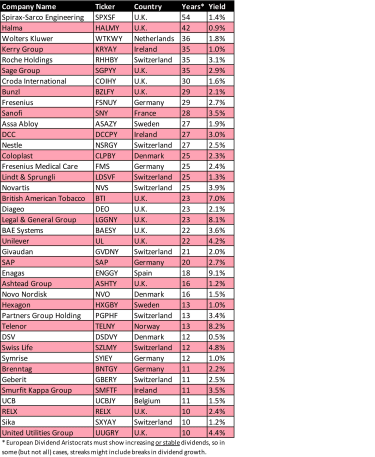

U.K. defense contractor BAE Systems (BAESY, $36.63) benefits from current geopolitical tensions that are fueling interest in its next-generation Tempest fighter jets among European customers. Already well-known for its Typhoon fighter planes and work on the F-35 fighters, BAE System has hiked dividends 5% annually over the past three years. BAESY shares yield 3.6%, or more than two times the yield of the U.S. industrial sector. A forward price-to-earnings multiple of 14 represents a 15% discount to peers.French drug maker Sanofi (SNY, $52.03) enjoys a wide moat thanks to its blockbuster drug Dupixent and is strengthening its best-in-class drug pipeline via acquisitions. Recent deals include Amunix, which adds 20 new drug candidates to the oncology pipeline, and Origimm, which is developing the healthcare industry’s first vaccine candidate against acne vulgaris – a condition affecting millions of teenagers and adults. Sanofi grew dividends 4% in 2021 and 3% annually over the past five years. SNY yields 3.5%, which is roughly twice that of the healthcare sector, and its 12.3 forward P/E is almost 35% below the sector average.U.K. pension specialist Legal & General (LGGNY, $15.21) has tapped into Europe’s aging population to generate 11% annual EPS and dividend growth over the past decade. The company is one of Europe’s largest asset managers, thanks to its mature life insurance, pension and annuities segments, and is making big investments in housing and infrastructure that should pay off handsomely in the future. LGGNY shares yield an eye-popping 8.1% and are priced at a lowly 7 times earnings estimates – a roughly 35% discount to financial peers. London-based consumer goods giant Unilever (UL, $46.17) boasts a powerful brand portfolio and the advantages of significant scale and sustainable cash flow. Its brands – which include Dove soap, Knorr sauces and seasonings, Lipton tea and Hellmann’s mayonnaise – are household names. Unilever grew dividends by 5% last year and at a 7% annual clip over the past five years. Yield is generous at 4.2%, and UL shares trade at 18 times profit estimates – a slight discount to the consumer staples sector but a 10% discount to its own historical valuation.There are a total of 40 names on the 2022 list of European Dividend Aristocrats. Member stocks and their recent dividend yield are provided in the table below:

S&P Dow Jones Indices, corporate websites

10 Substantial Stock Splits to Put on Your Radar

stocks

10 Substantial Stock Splits to Put on Your RadarStock splits can provide a short-term boost for investors. Here are 10 of the most notable names splitting their shares this year.

May 13, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Should Retirees Stay Invested and Ride Out These Volatile Times?

retirement

Should Retirees Stay Invested and Ride Out These Volatile Times?If the markets’ ups and downs have you feeling sick, it’s time to take stock of your whole financial picture. Here are five pieces of that puzzle to h…

May 13, 2022

65 Best Dividend Stocks You Can Count On in 2022

dividend stocks

65 Best Dividend Stocks You Can Count On in 2022Yield isn’t everything when it comes to finding the best dividend stocks. Income investors know there’s no substitute for regular dividend increases o…

May 10, 2022

12 of Wall Street’s Newest Dividend Stocks

dividend stocks

12 of Wall Street’s Newest Dividend StocksData shows dividend growers and initiators tend to outperform the broader market. Here are 12 new dividend stocks to consider.

May 6, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

May 6, 2022

37 Ways to Earn Up to 9% Yields on Your Money

Becoming an Investor

37 Ways to Earn Up to 9% Yields on Your MoneyOur field guide to income investments of varying dividend yields and interest rates identifies opportunities ranging from ordinary to downright exotic…

April 28, 2022