Tech stocks have been crushed this year, but analyst Dan Ives says it’s not another dot-com bust. Ives says Wall Street estimates for most tech companies won’t come down very much. He tells investors what they should buy in large cap tech, cyber security, and other key areas. Wedbush technology analyst Dan Ives wants investors to know they’re not witnessing the end of a new tech stock bubble.

The problem with reassuring people that they’re not in the middle of a disaster is that it often reminds people that they’re really scared of an impending disaster. Things can be plenty bad even if a worst-case scenario isn’t developing.

So Ives emphasizes that he doesn’t think the current slump in tech and tech-adjacent stocks will have an outcome like the dot-com bubble 20 years ago, when the Nasdaq composite plunged 80% between March 2000 and October 2002. It took 13 years for the index to recover all of those losses.

The Nasdaq has dropped 24% this year, but Ives says this is a moment where another generation of winners will separate itself from the pack, and as such, it’s a buying opportunity.

“Valuations for high quality growth stocks are very compelling here in our opinion, the fear level is something we have not seen since late 2008/early 2009,” he said. “Longer term demand drivers (cloud, EV, cyber security) are not going away, and each tech bear market the last 30 years has led to the next hyper growth cycle over the coming years.”

Tech stocks that are valued based on long-term growth have already been slammed because interest rates are rising, and Ives says some investors think things will get worse for tech. They’re concerned about a recession , he says, and they expect analysts covering the companies will have to slash their profit forecasts for the companies, leading to even more selling.

But Ives says things won’t get that bad.

“In a worst case scenario Street numbers for 2023 come down by less than 10%, while in a base case scenario they are unchanged from today and in a soft landing scenario actually go up from current numbers,” he said.

He says it’s true that some stocks may never recover, and others will get taken private now that they’re so much less expensive than they were a few months ago. But some of the companies that survive, or that are just getting started, will become long-term winners.

“From the rubble come the winners; From Salesforce to Google, from Tesla to Apple, from Microsoft to Oracle,” he said. “Our best calls since 2000 were finding the opportunities in the carnage; not yelling fire in a crowded theater and saying ‘stay in cash or put money under the mattress.'”

As a tech-stock enthusiast, Ives adds that if investors get overly conservative now and go all-in on value stocks, they may regret it.

“If we stuck to a disciplined investment philosophy and ONLY invested in companies on a straight PE or FCF, we would have missed Tesla, Apple, Facebook, Microsoft, Amazon, Nvidia, Workday, Zscaler, AMD, Palo Alto, Netflix , Google, Salesforce.com and the list continues,” he said.

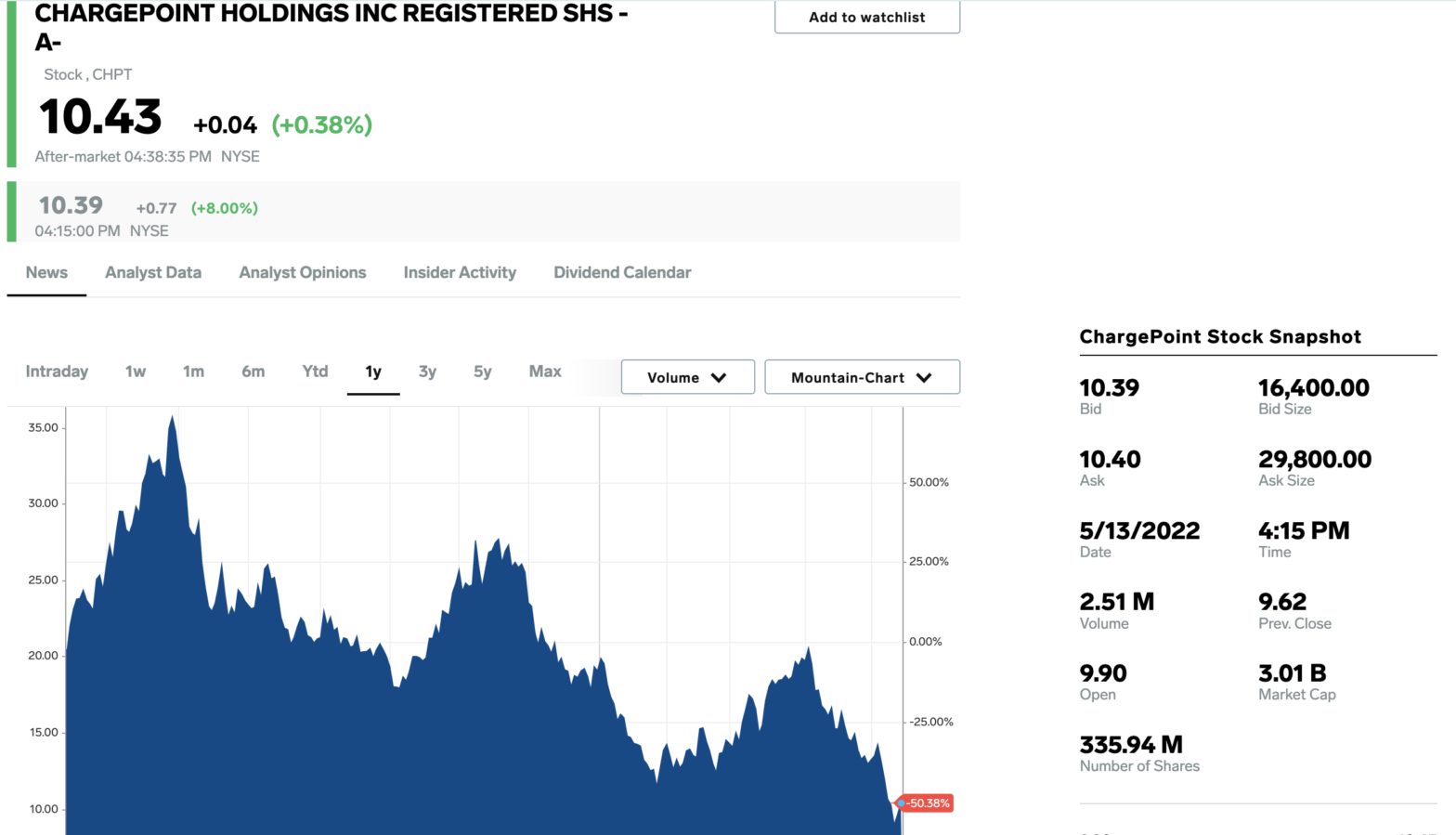

Ives sent out the following playbook, offering a handful of methods to find winners in the tech sector today. Those include the straightforward theme of large-cap top picks; his favorite stocks with cloud and cybersecurity exposure because of his confidence in that theme; cheaper “value tech” names that serve end markets where demand has stayed strong; and “consensus” electric vehicle stocks that should hold up.

The performance of the stocks is calculated based on Friday’s closing prices.