Jeremy Grantham’s GMO reduced its mega-cap tech holdings last quarter, according to its 13F filing.The trades came as Grantham sounded the alarm about an imminent crash in the stock market.These were the seven big trades by Grantham’s GMO asset management firm last quarter. Loading Something is loading.

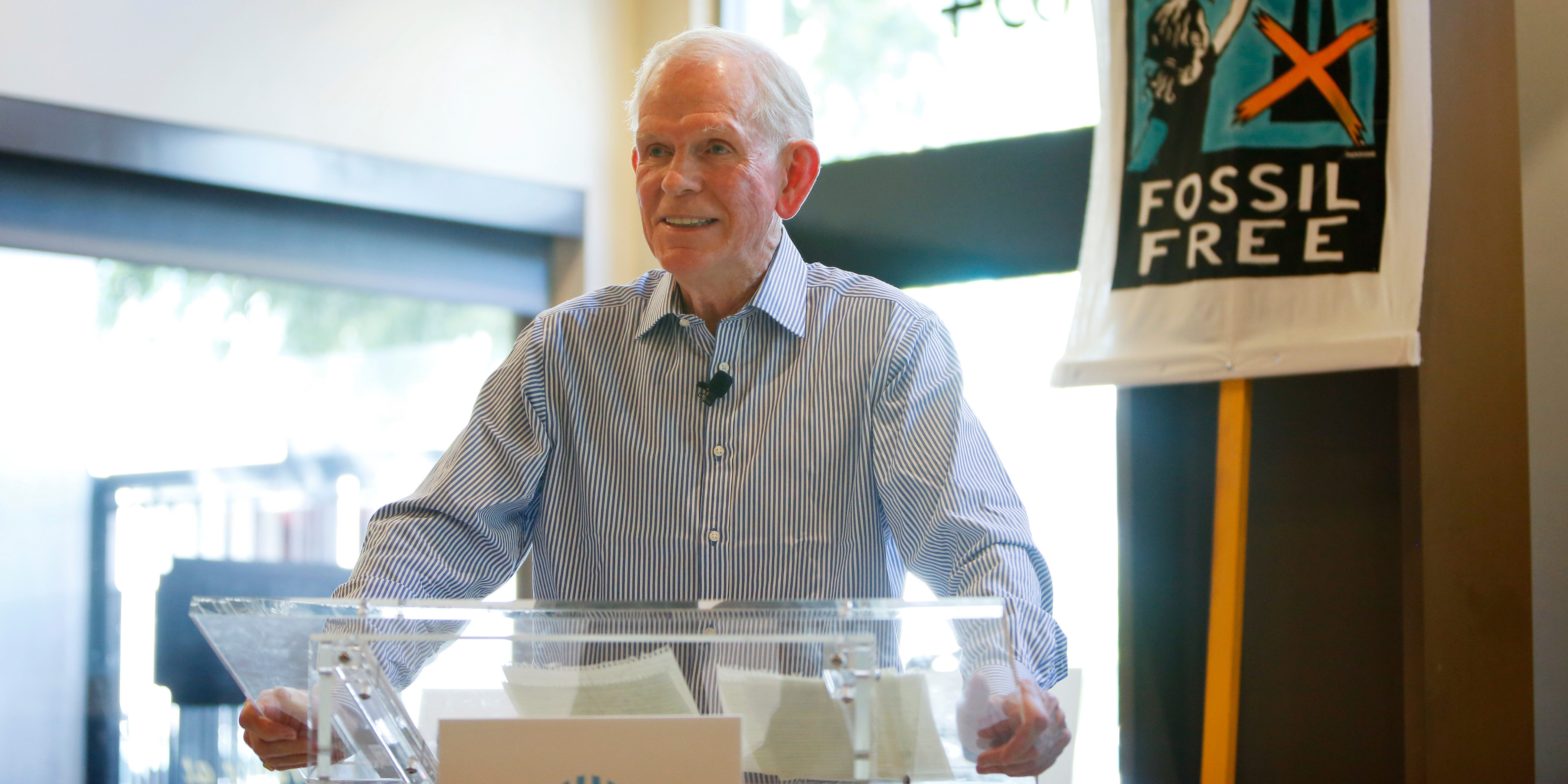

As Jeremy Grantham continues to warn about the imminent threat of a stock market crash, the asset management firm he co-founded is making trades that partly reflect that view.

According to its latest 13F filed with the US Securities and Exchange Commission earlier this week, GMO, which had just over $62 billion in assets under management at the end of 2020, trimmed its stake in mega-cap tech stocks last quarter while it bought more traditional value stocks like AT&T.

“Today in the US we are in the fourth super bubble of the last hundred years,” Grantham said in an interview last month, adding that the other big bubbles were in the stock market in 1929 and 2000, and in the housing market in 2008.

But Grantham’s resoundingly bearish view on the US stock market doesn’t automatically translate to a portfolio that is positioned defensively if a crash actually does occur. That’s mostly because GMO offers several different mutual funds that have a specific mandate to follow, and owning stocks is often part of that mandate.

The asset management firm counts Microsoft as its top holding, followed by Apple, United Health, and Coca-Cola.

Most recently, GMO warned investors against committing four big mistakes when making investment decisions, and argued that emerging markets will generate positive returns over the foreseeable future while US stocks struggle.

“We have concentrated our exposure to non-U.S. Value stocks globally,” Grantham said last month. Based on the filing, that seems to pan out. GMO reduced its exposure to Alphabet, Microsoft, and Apple, while it added to international stocks like Taiwan Semiconductor and Vipshop Holdings.

These were the 7 big trades made by Grantham’s GMO last quarter, according to according to 13F data compiled by WhaleWisdom.

1. Reduced Alphabet (GOOG)

Market Value: $88.2 million

Change in Shares: -75,834 (-71%)

Estimated Average Price Paid: $772.44

Igor Golovniov/SOPA Images/LightRocket via Getty Images

2. Reduced Pfizer (PFE)

Market Value: $21.1 million

Change in Shares: -457,535 (-56%)

Estimated Average Price Paid: $37.72

Carlo Allegri/Reuters

3. Reduced Meta Platforms (FB)

Market Value: $402.4 million

Change in Shares: -143,110 (-10%)

Estimated Average Price Paid: $180.79

Facebook Meta sign Justin Sullivan/Getty Images

4. Added to Taiwan Semiconductor (TSM)

Market Value: $177.6 million

Change in Shares: +1.1 million (+257%)

Estimated Average Price Paid: $106.64

A logo of Taiwan Semiconductor Manufacturing Co (TSMC) is seen at its headquarters in Hsinchu Reuters

5. Added to Discovery (DISCA)

Market Value: $34.0 million

Change in Shares: +1.4 million (+2,082%)

Estimated Average Price Paid: $23.62

Brian Ach/AP 6. Added to AT&T (T)

Market Value: $43.6 million

Change in Shares: +809,950 (+84%)

Estimated Average Price Paid: $26.95

People walk past the AT&T store in New York’s Times Square, June 17, 2015. Brendan McDermid/Reuters 7. Added to Vipshop Holdings (VIPS)

Market Value: $40.2 million

Change in Shares: +4.6 million (+2,662%)

Estimated Average Price Paid: $8.50

Toby Melville/Reuters