A dig into the data shows sales held their own last year against long-term trends setting up this year for a likely recovery

A ‘for sale’ sign is displayed outside a home in Toronto. Photo by Carlos Osorio/Reuters files Most pundits believe the long-term outlook for housing is positive, but any kind of consensus on the short-term future of housing markets is lacking, with some believing that prices will continue to fall this year while others see a turnaround once interest rates stabilize.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

These contrasting views make one wonder how reviewing the same statistics and trends can lead to such diverging forecasts. In parsing the housing market, though, motivations matter.

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

For example, suppose the data is being reviewed by those told-you-so pundits who have been predicting an imminent market crash for decades. Their market pronouncements will tend to sound bleaker despite their crash forecasts being wrong year after year. On the other hand, those whose welfare may be tied to a quick market recovery will spot a silver lining in every dark cloud. For them, the glass is never half empty.

Our review of the December 2022 data from the Canadian Real Estate Association (CREA) reveals trends that contrast with the oft-repeated gloom-and-doom headlines.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

For starters, average residential prices were up 2.4 per cent in 2022 relative to 2021. Average prices were up by double digits in Quebec, New Brunswick, Nova Scotia, and Prince Edward Island, and they also increased 6.8 and 7.5 per cent in Ontario and British Columbia, respectively.

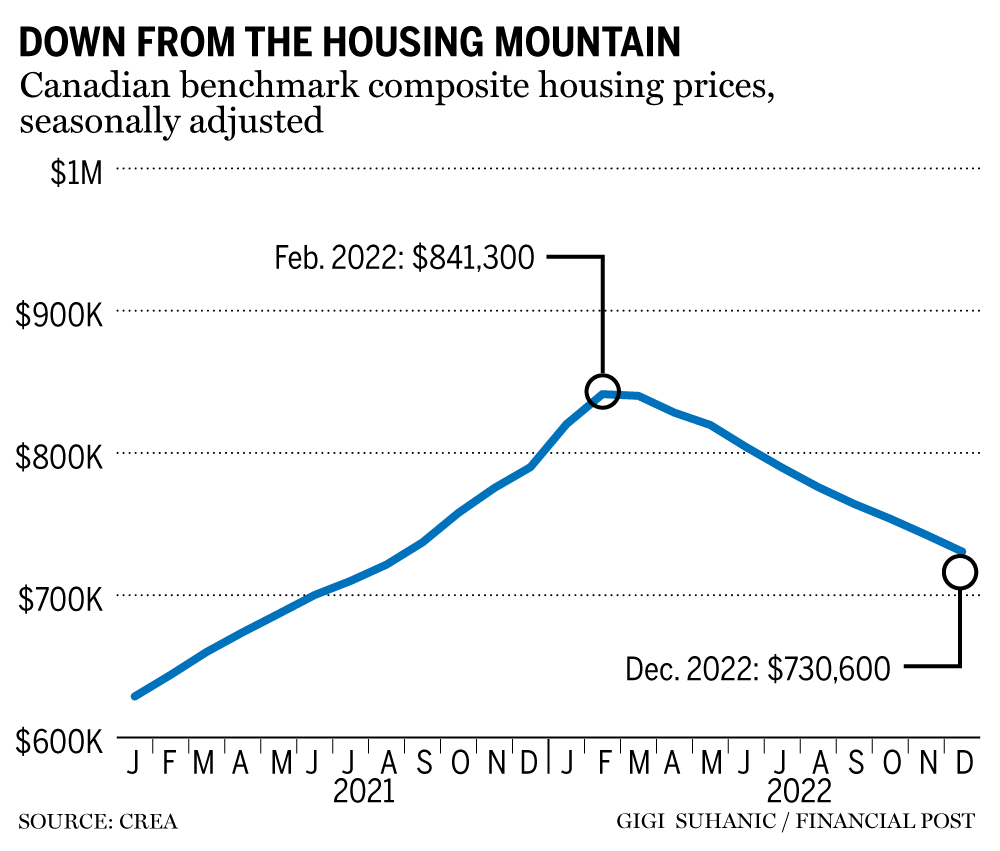

What drove average housing prices higher was the boom in the first quarter of 2022. Since then, however, prices have considerably declined. Month-over-month comparisons show significant price declines, while even more pronounced declines were observed relative to the peak prices in February and March 2022.

CREA also has a quality and size-adjusted home price index (HPI) benchmark, a preferred indicator of housing price dynamics since it compares apples to apples. This seasonally adjusted benchmark price in December was 1.6 per cent lower than in November, 9.1 per cent lower than six months earlier and 7.5 per cent lower than in December 2021.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

But a longer-term comparison shows the benchmarked price in December was up 33 per cent over three years and 29.7 per cent over five years. The five-year gains were higher for less populous towns in Ontario and the Maritimes. Calgary is one big city that has been marching to a similar tune, with the benchmark price on the rise.

Consequently, how one measures pricing dynamics matters. Yes, housing prices have been declining since the first quarter of 2022, but the average price in 2022 was higher than the year before, so the decline has not been catastrophic.

Sales volumes, meanwhile, significantly declined in the more populous provinces in 2022 relative to the year before. Overall, about 168,000 fewer sales were recorded in Canada in 2022, a drop of 25 per cent from 2021. Ontario and British Columbia, the two most expensive provinces for housing, recorded more significant declines in sales, while Alberta, again, stood out, with sales dropping by a little less than two per cent.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

One may be tempted to conclude from the dismal sales figures that housing demand has taken a severe blow from the rising cost of borrowing and, indeed, mortgage rates are partially responsible for the decline.

But one important but often ignored factor is that more than 200,000 additional sales unexpectedly transpired in 2020 and 2021. Some of these transactions would have happened in 2022 or 2023, but were advanced to take advantage of ultra-low mortgage rates.

Setting aside the cheap-credit-driven buying frenzy, sales volume in 2022 were in line with the long-term pre-pandemic trend. Hence, we expect more home transactions in 2023 than last year.

Recommended from Editorial Peter Hall: Housing’s hard stop spells trouble ahead for the economy Housing starts pace declined in December, ending year flat versus 2021 Canada’s home prices to fall almost 6% this year, CREA forecasts This advertisement has not loaded yet, but your article continues below.

Article content Where will markets head in 2023? A lot depends on the direction interest rates take. Already, news of layoffs has started to emerge in the United States, with Microsoft Corp. laying off 10,000 employees from its global workforce. Banking executives in Canada are warning that tens of thousands of borrowers are at risk because of rising mortgage costs.

If borrowing costs continue to rise, housing sales and prices will likely struggle, reporting even more declines but of a smaller magnitude than before. But if mortgage rates stabilize by mid-year, it is not unlikely that housing prices will reverse course.

Canadian housing markets have rationally reacted to the overall changes in the macroeconomy. The declines in sales and prices were the logical and measured response to a host of shocks to the economic system. Minus an unexpected large future shock, 2023 is likely to report a housing market recovery in Canada.

Murtaza Haider is a professor of real estate management and director of the Urban Analytics Institute at Toronto Metropolitan University. Stephen Moranis is a real estate industry veteran. They can be reached at the Haider-Moranis Bulletin website, www.hmbulletin.com.