investing

A Russian invasion of its neighbor might, at least in the short term, extend 2022’s volatility in the stock and commodity markets.The safety trade could be in full force now that Russian President Vladimir Putin has ordered troops into separatist regions of eastern Ukraine. But equity investors would be wise to keep calm and carry on, market strategists say.

True, risk assets such as stocks tend to retreat when geopolitical crises dominate the headlines. Meanwhile, safe havens, such as Treasuries and gold, catch a bid.

This particular crisis has rippled across commodities markets as well. Crude oil popped because Russia is a major energy supplier. Prices for a number of agricultural commodities jumped too, as Russia and Ukraine together account for about 20% of global corn exports and 25% of wheat exports.

But as dramatic as the price action across various asset classes might be, that shouldn’t change most retail investors’ basic calculus or long-term plans.

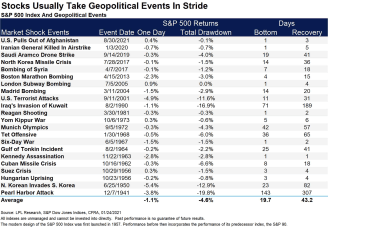

How Markets Have Historically Weathered ConflictHistory shows that stocks usually take global saber-rattling events in stride.

“As devastating as a major conflict could be between Russia and Ukraine, the truth is stocks likely will be able to withstand the geopolitical struggle,” writes Ryan Detrick, chief market strategist of LPL Financial. “In fact, looking back at other major geopolitical events throughout history reveals stocks usually take them as a nonevent.”

Just look at past market performance following similar geopolitical strife, courtesy of LPL Financial:

LPL Financial

But that’s not to say Russia’s actions in Ukraine don’t complicate matters in the shorter term.

Russia-Ukraine’s Impact on Commodities and Equity IndustriesRising energy and agricultural prices only exacerbate worries about inflation – a top-of-mind anxiety for investors and the Federal Reserve alike. The conflict in Eastern Europe could reinforce the market’s current preferences, which include an appetite for value names at the expense of growth stocks.

“[Although] Russia-Ukraine tension is a low earnings risk for U.S. corporates, an energy price shock amid an aggressive central bank pivot focused on inflation could further dampen investor sentiment and growth outlook,” says Dubravko Lakos-Bujas, JPMorgan Chase’s global head of equity research.

A number of strategists share similar concerns, especially as they relate to energy prices. But even there, the outlook is by no means black and white, says Raymond James senior economist Scott Brown.

“If the result [of the current crisis] is similar to Russia’s annexation of Crimea, there should be little impact on the U.S. economy,” Brown writes. “Higher oil prices could be a factor, but energy is a lot more neutral in its effect on the economy than in past decades.”

Brown adds that if gas prices do continue to rise, even that is not an entirely bad thing. Although higher prices at the pump would add to inflation and dampen consumer spending, they also could boost business investment by encouraging more exploration.

Sign up for Kiplinger’s FREE Closing Bell e-letter: Our daily look at the stock market’s most important headlines, and what moves investors should make.

But ballooning energy prices have clearly been good news for energy ETFs, which have surged amid the crisis. That includes stock-centric funds such as the Energy Select Sector SPDR Fund (XLE, $68.05), as well as ETFs such as the United States 12 Month Oil Fund LP (USL, $32.71) that expose investors to commodity futures.

David Rosenberg, chief economist and strategist at Rosenberg Research, is less sanguine about rising prices in the commodities pits. Oil, nickel and aluminum futures have all jumped as investors weigh the risk of supply disruptions from potential Western sanctions, he points out.

“This is clearly a potentially huge stagflationary shock for the world economy at a time when pandemic-induced bottleneck pressures were just showing signs of a thaw,” Rosenberg writes.

Also, gold and gold ETFs have flourished as the “fear trade” has re-emerged. The SPDR Gold Shares (GLD, $177.12), an ETF backed by physical gold held in a vault in London, is up about 4% since the start of 2022, versus a nearly 9% decline in the S&P 500.

“In just a couple of months, investors have done an about-face with gold,” says Edward Moya, senior market strategist at currency data provider OANDA. “Ukraine tensions remain the primary driver behind gold’s earlier rally above the $1,900 level.”

Then, of course, there are industry-specific risks.

The global auto industry, for example, is already grappling with shortages, notes Kristina Hooper, Invesco’s chief global market strategist. And stocks such as Ford (F, $18.04) and General Motors (GM, $48.60) have struggled of late in part because of the conflict’s potential to create additional supply-chain headaches.

“Russia is the world’s largest exporter of palladium,” Hooper writes, “so there is the potential for more auto supply-chain disruptions given that palladium is used in catalytic converters.”

Conversely, that could mean good things for the likes of the Aberdeen Standard Physical Palladium Shares ETF (PALL, $217.80), an ETF that, similar to GLD, is backed by physical palladium held in a London vault. PALL is the most popular such fund at about $400 million in assets.

Bottom Line”Geopolitics rattling markets is nothing new,” says Lindsey Bell, chief markets and money strategist for Ally.

“It’s typical that the immediate reaction to geopolitical events is the most dramatic,” she writes. “The good news is that the impact tends to be short-lived, only lasting anywhere from one to three months.”

Most importantly, history shows that 12 months after events such as our current crisis, the market edges higher, Bell adds.

Be that as it may, investors can expect markets to remain on edge for weeks. And so they would do well to remind themselves to stay frosty.

For retail investors, in particular, sitting tight is often the best course of action.