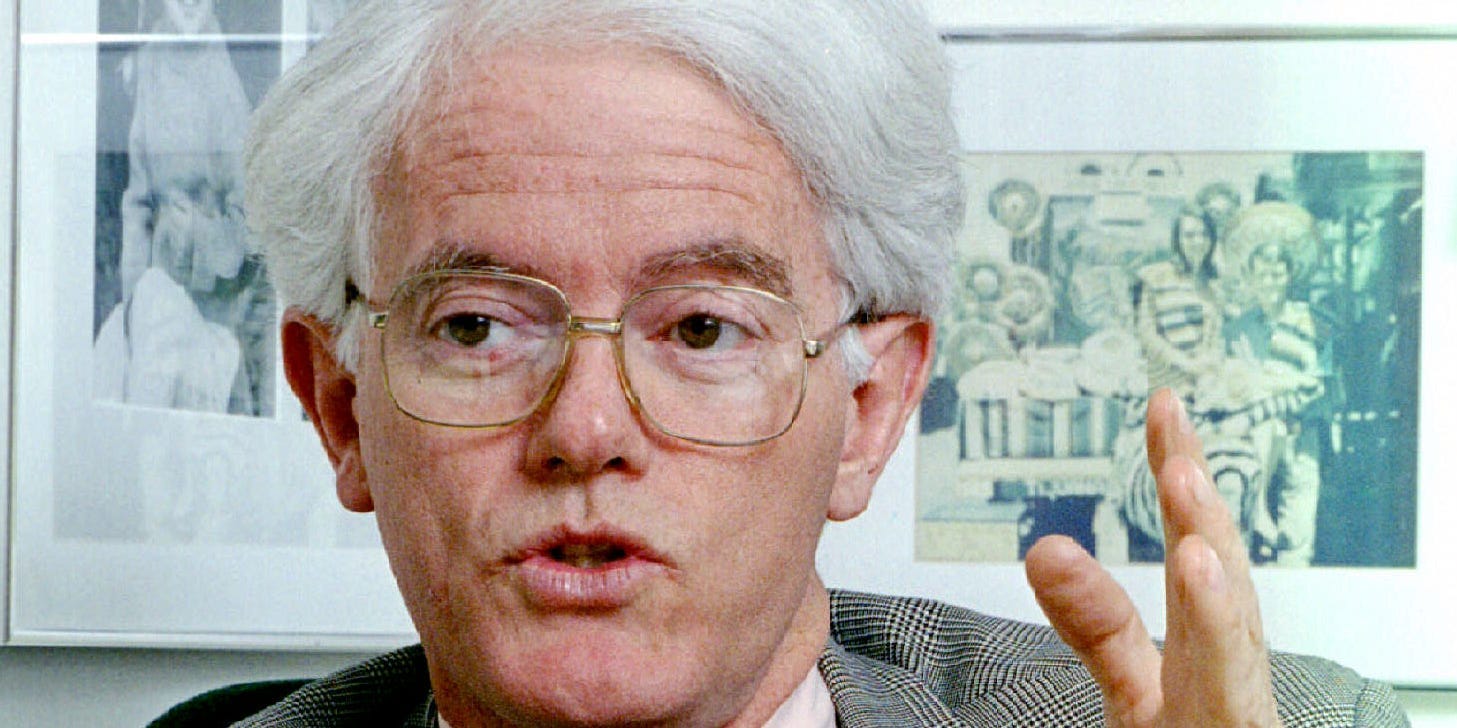

Peter Lynch warned against speculating, outlined when to buy and sell stocks, and underlined the futility of trying to time the market in a rare interview with Fidelity.

The legendary stock picker and “One Up on Wall Street” author emphasized in the interview last August that investors need to do their own research, hold their nerve during sell-offs, and be open to a wide range of opportunities.

Lynch is best known for delivering an annualized return of 29% over 13 years as the manager of Fidelity’s Magellan fund, and growing its assets under management from $18 million in 1977 to $14 billion in 1990.

Here are Lynch’s 9 best quotes, lightly edited and condensed for clarity:1. “In the stock market, the most important organ is the stomach. It’s not the brain.” (Lynch explained that investors need to know their pain tolerance, and often succeed if they simply hang on to their holdings.)

2. “You’ve got to look in the mirror every day and say, ‘What am I going to do if the market goes down 10%? What do I do if it goes down 20%? Am I going to sell? Am I going to get out?’ If that’s your answer, you should consider reducing your stock holdings today.”

3. “Stocks aren’t lottery tickets. Behind every stock is a company. If the company does well, over time the stocks do well, and vice versa. You have to look at the company — that’s what you research.”

4. “The public’s careful when they buy a house, when they buy a refrigerator, when they buy a car. They’ll work hours to save a hundred dollars on a roundtrip air ticket. Yet they’ll put $5,000 or $10,000 on some zany idea they heard on the bus. That’s gambling. That’s not investing. That’s not research. That’s just total speculation.”

5. “In baseball terms, you want to buy in the second or third inning and get out in the seventh or eighth.” (Lynch gave the example of Walmart, which only had stores in 15% of the US as a 10-year-old public company, spent the next 30 years expanding nationwide, and its stock skyrocketed 50-fold during that period.)

6. “When the business goes from semi-crummy to better to good, I’m probably out. You sell the company that was the growth story when there’s no room to grow.”

7. “Theoretically, the individual’s edge has improved in the last 20, 30 years versus the professional. The problem is people have so many biases. They won’t look at a railroad, an oil company, a steel company. They’re only going to look at companies growing 40% a year. They won’t look at turnarounds. Or companies with unions. You have to really be agnostic.”

8. “Long term, the stock market’s a very good place to be. But more people have lost money waiting for corrections and anticipating corrections than in the actual corrections. Trying to predict market highs and lows is not productive.”

9. “I think if you spent over 13 minutes a year on economics, you’ve wasted over 10 minutes. It’s not helpful. Everybody wants to predict the future, and I’ve tried to call the 1-800 psychic hotlines. It hasn’t helped. The only thing I would look at is what’s happening right now.”

Read more: Value investors have missed out on massive gains by dismissing the likes of Amazon and Alphabet as overpriced. Fund manager and writer Adam Seessel explains how to fairly value tech champions, and avoid losing out again.