Investors are overlooking the risk to stocks from a sharp rise in real bond yields, Bill Gross says. The “Bond King” is skeptical the Fed will achieve 2% inflation and cut interest rates anytime soon. Gross warned the US economy relies on asset prices rising, putting it at risk if they don’t. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

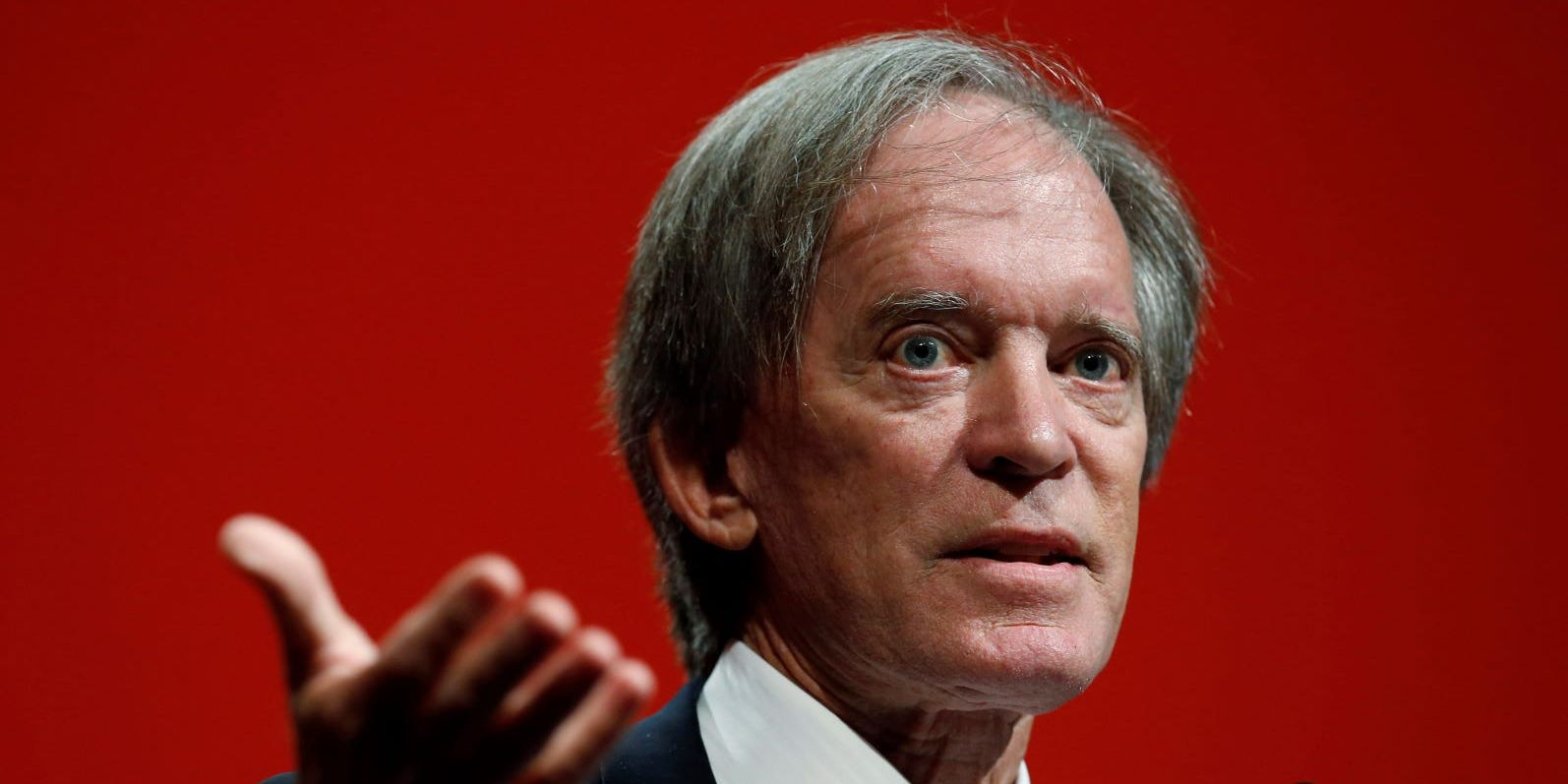

Investors are shrugging off a key risk to the stock market, and putting too much faith in the Federal Reserve, Bill Gross says.

Yields from 5-year Treasuries have surged from about 2.1% to 4.4% over the past 18 months, while inflation has slowed from 7% to below 4% over the same period. The “incredible” surge in real yields has lessened the relative appeal of stocks, as investors can now earn a solid, risk-free return from bonds even after accounting for inflation, Gross said.

“When we start talking about stocks, it’s definitely a negative influence in terms of valuations and PEs, but the market doesn’t seem to recognize it,” the billionaire investor said during a live taping of Bloomberg’s “Odd Lots” podcast this week. Gross was referring to price-earnings multiples, or the multiple at which a company’s stock trades to its earnings per share to price in its future prospects.

Inflation surged as high as 9.1% last summer, spurring the Fed to hike interest rates from nearly zero to north of 5% today. The central bank’s efforts have helped slow price growth to below 4% in recent months, but inflation remains above its 2% target.

Gross, known as the “Bond King” because he cofounded PIMCO and ran the fixed-income giant’s flagship fund, poured cold water on hopes the Fed might soon crush inflation and reverse its rate hikes. Higher rates encourage saving over spending and raise borrowing costs, which can curb consumer spending, erode corporate profits, pull down asset prices, and even drag an economy into recession.

The veteran investor dismissed the idea that the Fed can use interest rates to produce 2% inflation as a “dream,” and called it a “stretch” to believe that rates will come down as the bank nears its target.

“I don’t think so, unless recession comes with a capital ‘R,’ and it doesn’t seem to be doing that,” he said about the potential for rate cuts in the near future.

Gross weighed in on the US economy’s surprising resilience to the Fed’s rate hikes, suggesting it’s been buttressed by the historic amounts of government spending during the pandemic.

“We threw trillions of dollars out of a helicopter, and so the last of it is just now being spent,” he said.

Gross also flagged a fundamental risk to the US financial system.

“We have an economy that’s based on asset prices going up,” he said. “If they don’t go up, there are problems,” he continued, pointing to huge amounts of debt and aggressive stock valuations pinned on expected growth.

“It’s precarious at some point,” Gross added. “I’m not saying get out. I’m just saying that assets have to go up or else the economy will not do well.”