Martin Pelletier: Humility is the ultimate form of risk management

Bill Ackman’s Netflix investment fail is a great example of realizing that we all make mistakes, but we can correct them and move on. Photo by REUTERS/Dado Ruvic/Illustration One of my favourite quotes is by Anthony De Mello: “The three most difficult things for a human being are not physical feats or intellectual achievements. They are, first, returning love for hate; second, including the excluded; third, admitting that you are wrong.”

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

These are important when it comes to being a decent human being, but they also have implications for investors and portfolio managers, especially the last point — admitting you are wrong.

Looking back on my past two decades in the investment industry, I can honestly say the biggest downfall of many was when they let their ego take over. Mother Nature and time are great equalizers, especially when overconfidence leads to excessive risk-taking and ignoring the power of mean reversion.

This isn’t something that happens overnight, but slowly over time. Industry changes and competitive threats, such as the shift to goals-based investing, portfolio diversification and low fees, are ignored simply because one has a top-quartile track record of beating some pre-selected benchmark or index over the past decade.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

History has shown that when things go wrong in this segment of the market, they can go terribly wrong

There is a reason why assets under management have a strong correlation to one’s performance: fund managers sell themselves on it and investors buy based on it despite the old warning that past performance does not indicate future performance.

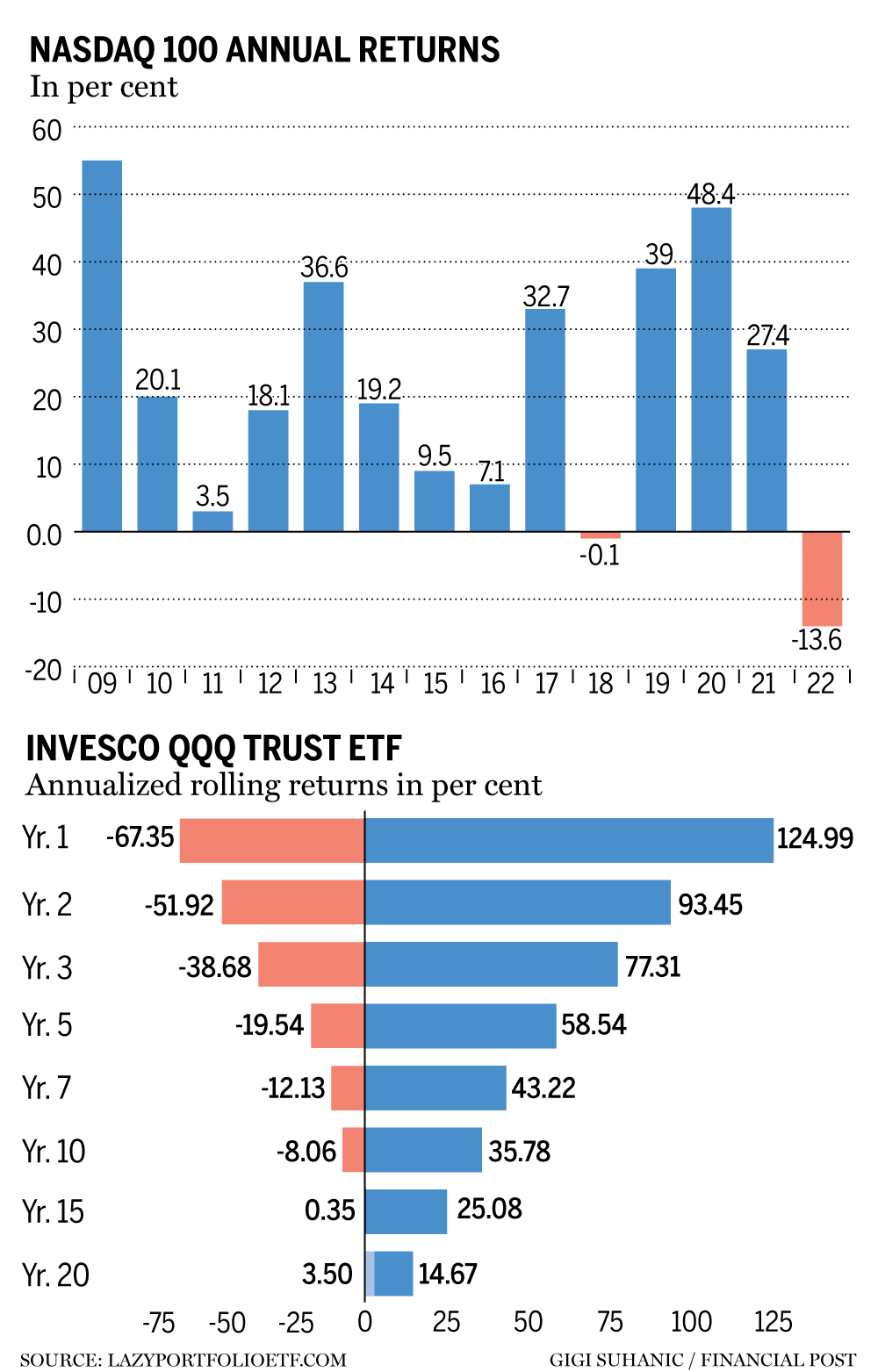

But we can’t blame them. For example, those managers overweight on the quantitative-easing, tech-fuelled growth sector made out like bandits over the past 12 years, with impressive returns year after year.

It isn’t always that easy though. History has shown that when things go wrong in this segment of the market, they can go terribly wrong, with losses as much as 67 per cent in one year, and a whopping 81 per cent drop from April 2000 to September 2002.

The big question is whether the selloff this year is just the start of something bigger or one to be bought up?

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

This is important, because it could have a catastrophic impact on your portfolio if you don’t get the timing right. Therefore, why not ask, how could I be wrong? What happens if inflation stays around longer than central bankers are telling us, and what happens to this sector in a rapidly rising rate environment?

This is when it is imperative to not ignore what could be a fundamental shift. Take Bill Ackman’s Pershing Square Capital Management LP, which recently blew out its position in Netflix Inc. at a loss of US$410 million just three months after buying it. They’re getting slagged for doing so, but we commend them for admitting they were wrong, taking the loss and moving on to something with stronger upside.

More On This Topic Don’t fight to keep your old investor habits going when they aren’t working anymore A handful of spring cleaning tips for your investment portfolio Retail investors are ignoring something bond investors are telling markets This advertisement has not loaded yet, but your article continues below.

Article content “One of our learnings from past mistakes is to act promptly when we discover new information about an investment that is inconsistent with our original thesis. That is why we did so here,” Pershing Square said in a letter to shareholders

There is a lesson in this. For those wondering if they should sell something or hold on, ask yourself if you would buy it at current levels and if the answer is no, sell the position. Ackman’s Netflix investment fail is a great example of realizing that we all make mistakes, but we can correct them and move on. By the way, even with that sizeable loss, Pershing Square’s funds are down only two per cent so far this year.

Compare this approach to other managers who stubbornly defend their positioning, such as oil is going to US$12 a barrel, or their tech holdings will offer compound annual returns of 50 per cent going forward — something that will surely be needed given a 40 per cent loss this year.

This advertisement has not loaded yet, but your article continues below.

Article content Looking for a manager to invest in or with? Take a diversified approach and choose those who consistently ask themselves how they could be wrong and can give specific examples within their portfolios. Humility is the ultimate form of risk management, which shows its merit during uncertain times.

Martin Pelletier, CFA, is a senior portfolio manager at Wellington-Altus Private Counsel Inc, operating as TriVest Wealth Counsel, a private client and institutional investment firm specializing in discretionary risk-managed portfolios, investment audit/oversight and advanced tax, estate and wealth planning.

_____________________________________________________________

For more stories like this one, sign up for the FP Investor newsletter.

______________________________________________________________

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300