Theron Mohamed

Jeremy Grantham. REUTERS/Nicholas Roberts The Russia-Ukraine conflict has shaken markets and disrupted global commerce. Ray Dalio, Jeremy Grantham, Carl Icahn, and others have discussed its likely consequences. Here’s what 10 of the world’s best investors have said about the crisis. Loading Something is loading.

Russia’s invasion of Ukraine continues to rattle financial markets and disrupt the global economy. Several top-flight investors have weighed in on the crisis, warning it could worsen inflation, plunge the US economy into recession , and even transform the world order.

The likes of Ray Dalio, Jeremy Grantham, Carl Icahn, and Cathie Wood have discussed the potential impacts of the crisis. Others, such as Warren Buffett and Charlie Munger, commented during Russia’s last invasion of Ukraine, and explained how they invest during periods of upheaval.

Here’s what 10 elite investors have said about Russia and Ukraine: Jeremy Grantham

Morningstar/YouTube Jeremy Grantham warned Russia’s invasion of Ukraine has complicated the global economic picture and muddled the outlook for financial markets.

“The risk profile for everybody has gone up, because you can’t rule out the Russians being a bit crazy and irrational,” the GMO cofounder and market historian said in a ThinkAdvisor interview. “Putin is a borderline psychotic.”

Grantham suggested the conflict could hurt global growth and trade, accelerate inflation, and increase uncertainty for investors. He also cautioned in a research note that sharp rises in the price of oil have always been followed by recessions in the past. Moreover, surging food prices could endanger global stability, he said.

After diagnosing a “superbubble” in asset prices and predicting a historic crash last year, the investor put his forecast on hold.

“There’s never been a war thrown in the middle of a major bubble like this,” he told ThinkAdvisor. “So I reserve the right to take a while longer to think it through and work out the implications.”

“When a war of this magnitude occurs — with ramifications that could extend beyond that — all bets are off,” Grantham added.

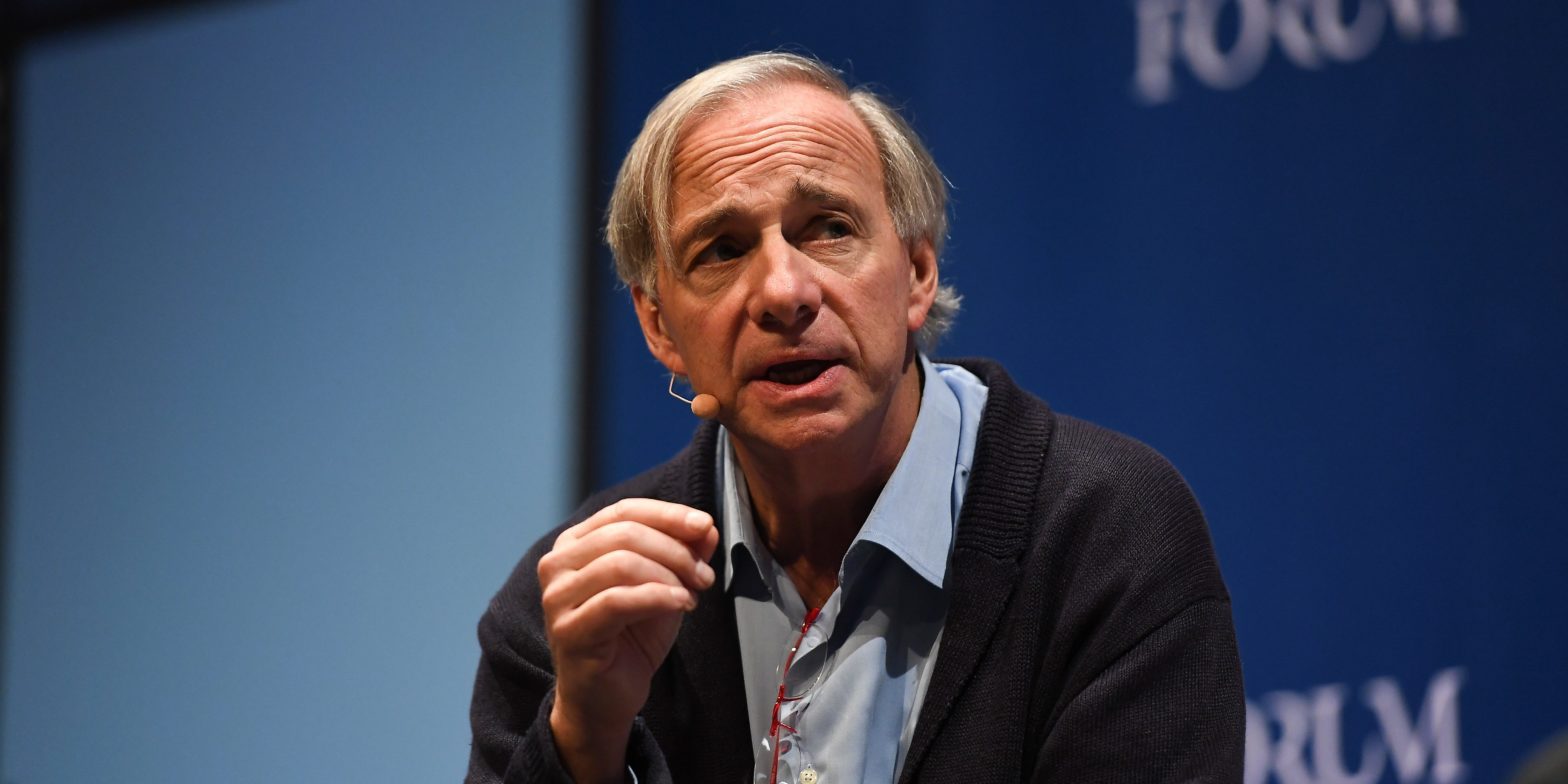

Ray Dalio

Ray Dalio. Eoin Noonan/Web Summit via Getty Images “I believe that the Russian-Ukrainian war is just the first battle in a long war for control of the world order,” Ray Dalio tweeted.

“It is very important because it will tell us how powerful the sides are in a number of ways and how the sides are lining up,” the billionaire boss of Bridgewater Associates, and the author of “Principles for Dealing with the Changing World Order,” added.

David Rubenstein

Fred Prouser/Reuters David Rubenstein highlighted the Russia-Ukraine conflict as a top concern for him, warning it could undercut the economic recovery from the COVID-19 pandemic.

“Many people are going to look at whether the US economy is now going to be needing some stimulus,” the Carlyle Group cofounder said in a recent episode of the “Invest Like The Best” podcast.

“It was growing back after COVID, but now it’s going to be stalling a little bit because of Russia,” he added.

Rubenstein also suggested Russians and Ukrainians might find comfort in holding some cryptocurrencies that are outside their governments’ control, and can be accessed without using a bank.

Kevin O’Leary

“Shark Tank”https://markets.businessinsider.com/ABC Kevin O’Leary underscored the horror of the situation in Ukraine, but dismissed its impact on US stocks.

“What impact is that going to have on S&P earnings in 2022? Practically nothing,” he said in a Project Wealth Academy interview. “Ukraine is just not a factor in US GDP,” he continued, pointing to its relatively small economy based on a single commodity — oil.

The “Shark Tank” investor, whose nickname is Mr. Wonderful, noted that US banks have minimal exposure to Russia. He described the country as a “rogue nation led by an unusual individual who I think has made a grave mistake.”

“If you look at the history of despots like Putin, it ends badly for them,” he added.

Warren Buffett

Warren Buffett REUTERS/Marc Cardwell Warren Buffett hasn’t commented publicly on Russia’s current invasion of Ukraine. “It doesn’t do me any good, and it doesn’t do the world any good, for me to talk about it,” he told veteran journalist Charlie Rose in a recent interview.

However, the famed investor and Berkshire Hathaway CEO warned there could be unpredictable consequences from Russia’s annexation of Crimea during a CNBC interview in 2014, and wished the conflict would end.

“Something has been put in motion, and it would be nice to see it come to rest,” he said at the time.

Buffett emphasized in another CNBC interview in 2014 that it was far better to hold stocks than cash during wars, given currencies tend to weaken in periods of conflict.

“The last thing you’d want to do is hold money during a war,” he said.

Buffett noted during Berkshire’s shareholder meeting in 2006 that he generally avoids investing in Russia. He explained that a company he was involved with faced threats of violence and asset seizure when it tried to extract the oil from wells it had drilled in Siberia.

Charlie Munger

AP Photo/Nati Harnik “I don’t invest in Russia,” Charlie Munger said during Daily Journal’s annual meeting in February, explaining that he wasn’t comfortable doing business in the country.

The 98-year-old investor, who is Warren Buffett’s business partner and Berkshire’s vice-chairman, compared Russian President Vladimir Putin to German dictator Adolf Hitler in a CNBC interview in 2014.

“Well, of course you worry a little when you see a pattern that reminds you of Hitler,” he said about Russia’s invasion of Crimea.

Carl Icahn

Hedge fund titan Carl Icahn Chip East/Reuters Carl Icahn cautioned in a CNBC interview that the Russia-Ukraine conflict could fuel further price increases, worsening the current inflation threat.

“You have this war going on now which adds another problem to your inflationary picture,” the billionaire investor and Icahn Enterprises boss said.

Icahn was likely referring to the upward pressure on energy and food prices caused by the war, and the disruption it has caused to the global economic recovery.

Leon Cooperman

Jeff Zelevansky/Reuters “I think the Ukraine situation is serious,” Leon Cooperman said in a CNBC interview. “I can’t handicap it.”

“We’ve got a madman running Russia,” the billionaire investor continued. “I think Putin is a dead man, he knows it, and the question really is does he go quietly, or does he try to take the rest of the world with him when he goes.”

Marc Lasry

Marc Lasry, an American billionaire businessman and co-founder and chief executive officer of Avenue Capital Group speaks during a Reuters investment summit in New York City, U.S., November 4, 2019. Lucas Jackson/Reuters Marc Lasry warned the Russia-Ukraine situation presented a fresh headache for investors.

“When there’s a lot more issues, that’s not great for the economy, and it’s not great for the stock market,” the billionaire boss of Avenue Capital told Fox Business. “It’s going to be difficult in the next six months.”

The distressed-debt investor added the Russia crisis was too unpredictable for him to wager any money on it, and cautioned others against trying to profit from the country’s economic woes.

“You’re taking a lot of risk by doing it,” Lasry said. “If it works, you’ll do exceptionally well, but if it doesn’t work, you’re going to lose all your money. People have to be prepared for that.”

Cathie Wood

Catherine Wood, chief executive officer and chief investment officer, Ark Invest, speaks during the Milken Institute Global Conference on October 19, 2021 in Beverly Hills, California. Patrick T. Fallon/Getty Images Cathie Wood, the head of Ark Invest, predicted the surge in energy prices sparked by the Russia-Ukraine crisis would fuel demand for alternative energy sources and forms of transportation.

“We’re going to be looking at a lot of demand destruction and substitution into innovation,” Wood said in a CNBC interview. “Electric vehicles as opposed to gas-powered vehicles would be the biggest one.”

Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Markets Stocks David Rubenstein Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.