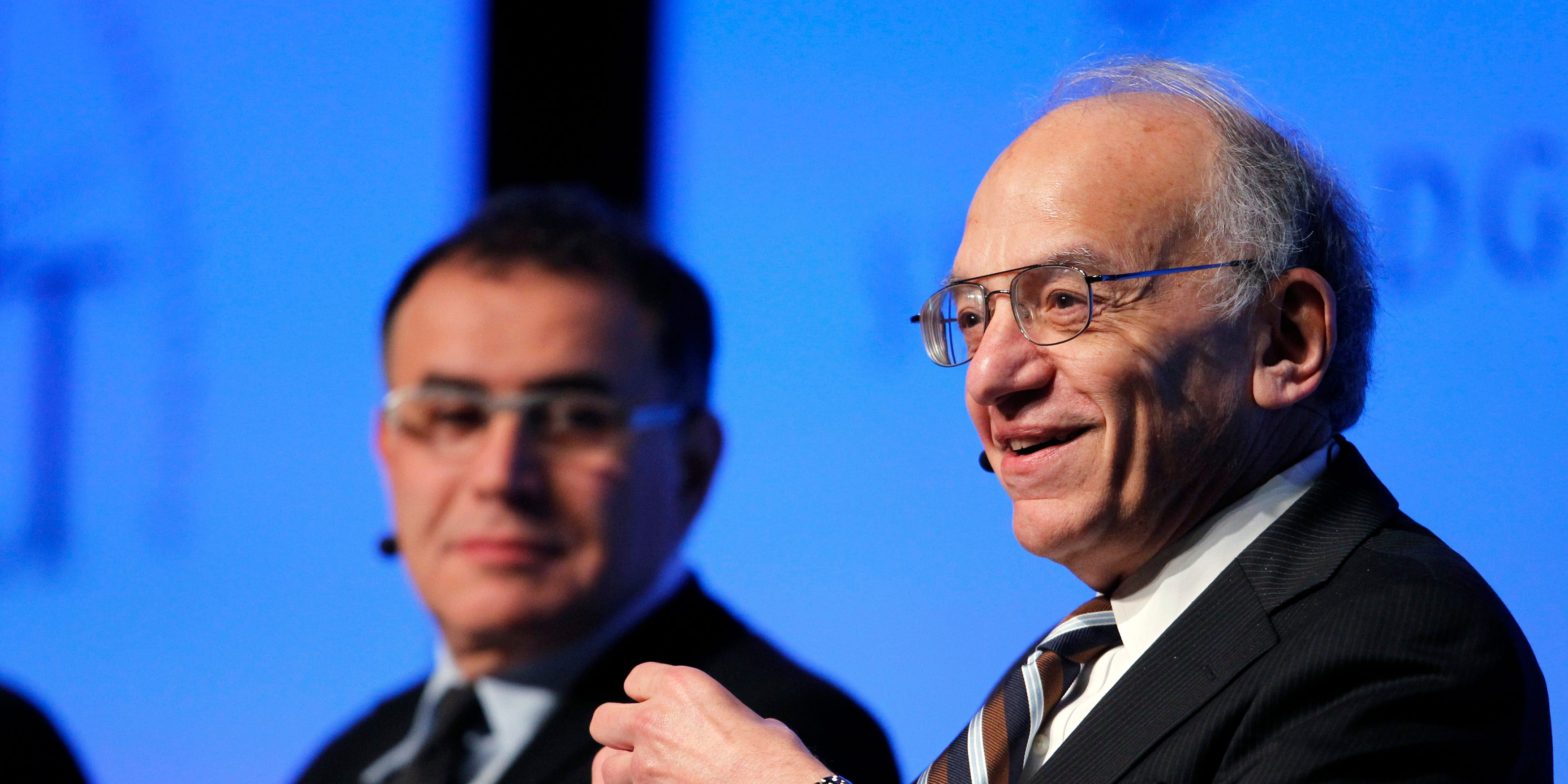

The housing market crash will push the Federal Reserve to pivot, according to Jeremy Siegel. The Wharton professor told CNBC on Monday that Fed chief Jerome Powell relies on backward-looking housing data. “I think the market says he’s gotta flip sometime,” Siegel said. “He will see the light, it’s just taking him a little longer.” Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Wharton professor Jeremy Siegel thinks the housing market downturn will push the Federal Reserve to re-evaluate future tightening.

He told CNBC on Monday that Fed Chairman Jerome Powell is too focused on backward-looking housing data to evaluate inflation and is overlooking how home prices and rents are already declining significantly.

“I think the market says he’s gotta flip sometime,” Siegel said. “He will see the light, it’s just taking him a little longer.”

He added that Powell is more hawkish now than in September, but since then only backward-looking housing indicators have shown an uptick while more forward-looking ones show a decline. “They’re looking at the wrong indicators.”

Siegel said housing accounts for 40% of the core inflation metric, noting that home price data from the likes of Zillow and Case Shiller are showing a decline.

Last week, Realtor.com reported the median list price for homes in the US fell more than 5% last month from a peak of $449,000 in June of this year. At the same time, more homes are staying listed for longer for less as sellers adjust to a softening market.

The next consumer price index report is due on Thursday.