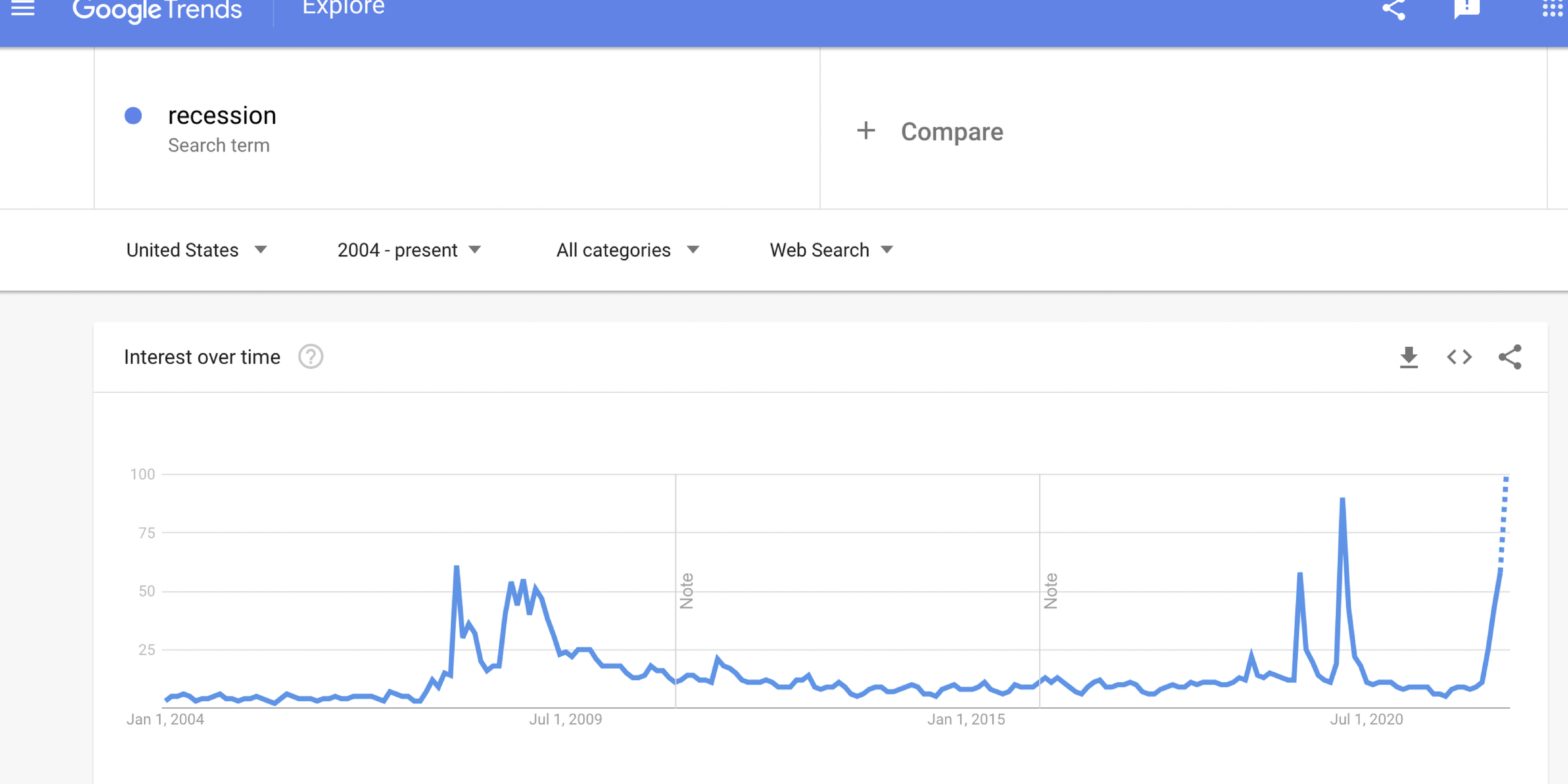

Americans are getting increasingly worried about recession as inflation continues to bite the US economy. Google search trends show more and more people in the US are looking up the word “recession.” Economists are predicting the US will tip into a recession as the Fed plays a dangerous game of catch-up. Loading Something is loading.

President Joe Biden says he’s confident a US recession isn’t inevitable, but inflation is soaring, the Federal Reserve is about to deliver a set of rate hikes at breakneck speed and ordinary Americans are getting worried.

Speaking to the Associated Press Thursday Biden said the US economy wouldn’t necessarily fall into recession, even as growth slows and inflation stays strong.

“First of all, it’s not inevitable,” he said. “Secondly, we’re in a stronger position than any nation in the world to overcome this inflation.”

Inflation has been rampant in the US, growing by 8.6% year-on-year in May, its fastest in 41 years. Fuel costs are the crux of the rise in consumer prices as Western sanctions on Russian energy widen the overall gap between global demand and supply. But the cost of basic foodstuffs and housing is rising sharply too.

The Federal Reserve took an aggressive step to squash inflation by raising the benchmark interest rate by 75 basis points this week. This was the largest single rate hike since 1994 and more are on the horizon as Fed officials suggest rates may need to rise to about 3.8% in 2023 – this would be the highest since early 2008.

A number of high-profile economists and investors have sounded the alarm on an impending recession in the US, despite the Fed’s efforts and Biden’s optimism. Economists at Wells Fargo said the steep rate hikes will raise borrowing costs across the economy and are likely to tip the US into a “mild-recession,” in mid-2023.

That view was echoed by Morgan Stanley when its chief strategist Mike Wilson, who predicted the last three stock market crashes, said the risk of a recession has been elevated with the implementation of higher rates.

Assuming the Fed delivers a soft landing, however, Wilson said chaos is still likely to play out in the stock market. He predicted the S&P 500 will slip another 10% from its current level to as low as 3,400 points with the Nasdaq 100 set for a similar slide.

The stock market where millions of ordinary people invest is on track for its worst week of losses since March 2020 as inflation and recession fears mount. Earlier this week, it officially tipped into a bear market, having lost more than 20% in value from a record high in January.

“For the moment, the mood is clear. Investors globally are questioning whether any global growth is possible amid the current monetary shackles and are giving risk assets a wide berth at the slightest excuse,” said Richard Hunter, head of markets at trading platform Interactive Investor.

Such gloom is reflected in consumer sentiment over the US economy as high gas, food, and home prices hurt Americans’ wallets. Gas prices have soared to record highs as sanctions on Russia limit supply, with the current average national gas price rocketing above $5 per gallon, according to the American Automobile Association.

Consumer confidence has fallen to an all-time low. The University of Michigan consumer sentiment index hit a record lows of 50.2 in June, as a deteriorating economy, rising costs and concern about personal finances hit home. Economic slowdown is front of mind for millions of Americans. Google Trends data showing more people in the US have been looking up the word “recession” this week than at any time since 2004.

According to Bank of America, economists have doubled down on the likelihood of a US recession. “We see roughly a 40% chance of a recession next year. Our worst fears around the Fed have been confirmed: they fell way behind the curve and are now playing a dangerous game of catch up. We look for GDP growth to slow to almost zero, inflation to settle at around 3% and the Fed to hike rates above 4%,” the bank’s economists wrote.

A screenshot of a google trends search Google