tech stocks

MSFT’s $68.7 billion deal for ATVI brings the tech giant a library of A+ titles … and another way to leverage its cloud heft.Long-suffering shareholders — not to mention canny value investors — were rewarded for their patience in Activision Blizzard (ATVI, $65.39) Tuesday when Microsoft (MSFT, $310.20) agreed to pay $68.7 billion, or $95 a share in cash, for the troubled video game publisher.

After all, ATVI, the developer of global hits such as World of Warcraft and the Call of Duty franchise, had an annus horribilis in 2021.

Allegations of sexual harassment, litigation, a torrent of bad press and calls for CEO Bobby Kotick to step down would have been trouble enough. Tough year-over-year comparisons against 2020’s pandemic-fueled growth only made matters worse.

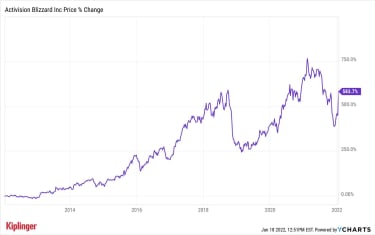

Shares in Activision Blizzard, which closed at an all-time high of $115.82 in February, lost 28% last year. That lagged the tech-heavy Nasdaq Composite by nearly 50 percentage points.

Shares naturally popped on the Microsoft news – a deal in which the software titan is paying a premium of roughly 30% to the video game maker’s Friday closing price. ATVI stock was up more than 25% as of midday Tuesday. (U.S. markets were closed Monday in observance of Martin Luther King Jr. Day.)

Some newer ATVI shareholders will close out their investment with losses, but longer-term holders will go out with a smile.

YCharts

MSFT shares were slightly lower Tuesday, but Microsoft shareholders should like this arrangement for the long run. The acquisition unites Activision’s considerable talents for content production and distribution with MSFT’s Xbox console and subscription-based gaming business.

It’s the largest deal in dollar terms in Microsoft’s history, and comes as the emergent metaverse and other industry trends are forecast to deliver outsized industry growth for years to come.

Why Microsoft Bought Activision BlizzardThe global gaming market is projected to expand to $546.0 billion in 2028 from $229.2 billion last year, or a compound annual growth rate of 13.2%, according to data from market researcher Fortune Business Insights.

Not only does the deal create the world’s third-largest video game company, but — perhaps more importantly — it gives MSFT another way to leverage its behemoth of a cloud-based services business.

Indeed, gaming’s future as a cloud-based product was one of the reasons behind Cambiar Investors’ interest in Activision Blizzard, says Chief Investment Officer Brian Barish.

Cambiar, a Denver-based active value manager with $8.1 billion in assets under management, initiated stakes in ATVI in the fourth quarter. The video game publisher accounts for 2% to 2.5% of the funds that own it; namely, Cambiar Opportunity Fund (CAMOX) and Cambiar Aggressive Value Fund (CAMAX).

Barish saw value in a stock beaten down by scandal, negative press and difficult year-over-year comparisons — especially one that was trading at just around 13 times free cash flow.

“The conclusion at the time of purchase was there was some component of ‘inevitability’ that the management suite drama would conclude in some constructive fashion, along with scarcity value for a major video game studio,” Barish says.

And make no mistake: That scarcity value is key at a time when major cloud companies such as Amazon.com (AMZN), Google parent Alphabet (GOOGL) and Microsoft all have designs on the space.

“Eventually we expect video games to become a cloud-based product (as compared to console based), and more content to throw at the customer should expedite this process,” Barish adds.

That’s the strategic rationale behind Microsoft’s deal for Activision, Barish surmises. “The migration will take a lot of time, however,” he cautions.

Bottom LineIt appears investors in ATVI can put the drama surrounding the C-Suite and the stock behind them. MSFT, meanwhile, looks to have made a bold strategic acquisition in a massive and fast-growing industry.

And as for investors in other video game studios? Does the MSFT-ATVI marriage make those assets more valuable?

“Possibly,” Barish says.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

The 12 Best Tech Stocks to Buy for 2022

tech stocks

The 12 Best Tech Stocks to Buy for 2022The best tech-sector picks for the year to come include plays on some of the most exciting emergent technologies, as well as several old-guard mega-ca…

January 3, 2022

How to Know When You Can Retire

retirement

How to Know When You Can RetireYou’ve scrimped and saved, but are you really ready to retire? Here are some helpful calculations that could help you decide whether you can actually …

January 5, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

January 14, 2022

What Is the Metaverse (And How Can I Invest?)

Technology

What Is the Metaverse (And How Can I Invest?)Metaverses have actually been around in some form for decades. Facebook and others will try to bring the technology into the world’s everyday lives.

January 7, 2022

The 12 Best Tech Stocks to Buy for 2022

tech stocks

The 12 Best Tech Stocks to Buy for 2022The best tech-sector picks for the year to come include plays on some of the most exciting emergent technologies, as well as several old-guard mega-ca…

January 3, 2022

Goldman Sachs’ GTEK: Cutting-Edge Tech

Becoming an Investor

Goldman Sachs’ GTEK: Cutting-Edge TechGoldman Sachs Future Tech Leaders Equity ETF amassed $260 million in its first three months.

December 22, 2021