“Moneyball” star Billy Beane said Warren Buffett and Charlie Munger’s lessons apply to baseball. The ex-Oakland Athletics manager excelled at finding undervalued players and besting richer teams. Baupost CEO Seth Klarman recently described “Moneyball” as a value-investing book. Loading Something is loading.

Warren Buffett and Charlie Munger preach a “value investing” philosophy centered on identifying and buying underpriced assets. Billy Beane of “Moneyball” fame says their teachings are equally relevant in the ballpark.

“If you look at everything Warren Buffett and Charlie Munger say, if you take the word ‘investing’ out and put ‘baseball’ in, every sentence still works,” Beane said at the Tipalti Illuminate tech conference last week, according to The San Francisco Business Times.

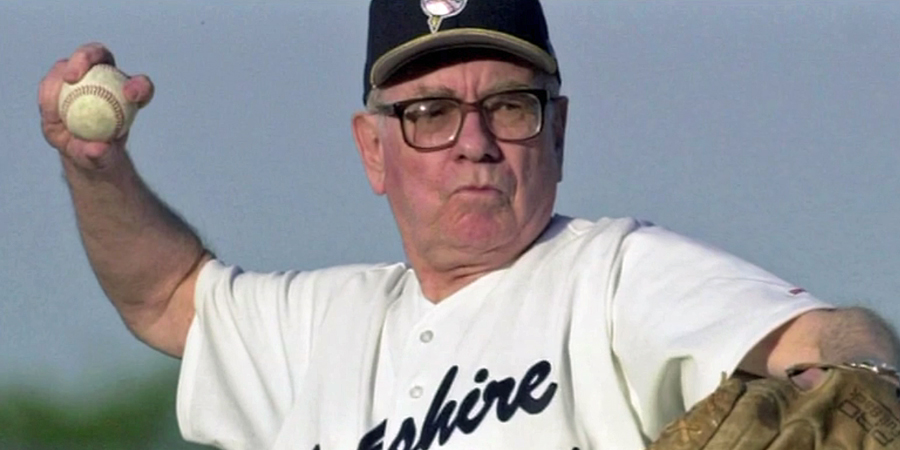

Spotting bargainsBeane, the former general manager of the Oakland Athletics, pioneered the use of statistical analysis in baseball. He and his team realized that stats such as foot speed, fastball velocity, and batting average were overvalued by other teams. Meanwhile, older, injured, or unproven players were undervalued by the market.

Those revelations allowed the Oakland A’s to bring in misfits and recruit virtually unknown players on the cheap — and then outperform its richer rivals, despite having a fraction of their payroll. Author Michael Lewis profiled Beane in “Moneyball,” and Brad Pitt played the baseball executive in the movie adaptation of the book.

As for Buffett and Munger, they’re the chairman and vice-chairman of Berkshire Hathaway — a $600 billion conglomerate that owns business such as Geico and See’s Candies, and holds multibillion-dollar stakes in public companies such as Apple and Coca-Cola.

A pair of value investorsBoth Beane and Buffett prize hard numbers, have the patience and discipline to resist overpaying, and possess the conviction and contrarian steak required to not conform or cave under pressure.

The two men excel at analyzing prospective investments to determine their future value, and aren’t afraid to back their bets with millions of dollars.

“Moneyball is really a value-investing book,” Seth Klarman told David Rubenstein in an interview for the Carlyle cofounder’s newly released book, “How to Invest: Masters on the Craft.”

“It’s about finding value in athletes, in baseball players — but those principles apply across areas,” the billionaire investor and Baupost Group CEO said.

Klarman has been heralded as “the next Warren Buffett,” including by the Berkshire chief himself.

His Baupost fund holds a stake in RedBall Acquisition Corp., a special-purpose acquisition company (SPAC) co-chaired by Beane, which reportedly tried and failed to take the Boston Red Sox public in late 2020 and early 2021.

Beane is clearly a longtime admirer and acolyte of Buffett. “The hardest thing to find is a good investment,” he tells Lewis in “Moneyball,” quoting the legendary investor.

Moreover, Buffett evolved a value-investing framework established by his college professor and former boss, Benjamin Graham. Beane got his grounding in baseball stats or “sabermetrics” from Bill James, a data whiz and sports historian.

“We’re like Warren Buffett and that guy right there is Benjamin Graham,” Beane once told Lewis, pointing to the stack of books written by James on the author’s lap.

Read more: Table tennis champion Ariel Hsing has been friends with Warren Buffett for more than a decade. She lays out 7 life lessons from the legendary investor, and reveals how being an Olympian helps her at work.