Bank of America raised its price target for Nvidia, citing the firm’s dominant position in AI. The bank said the company has an opportunity to help accelerate the adoption of AI across many markets. Analysts said their view is echoed by some of the largest players in tech as they seek to expand in AI. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

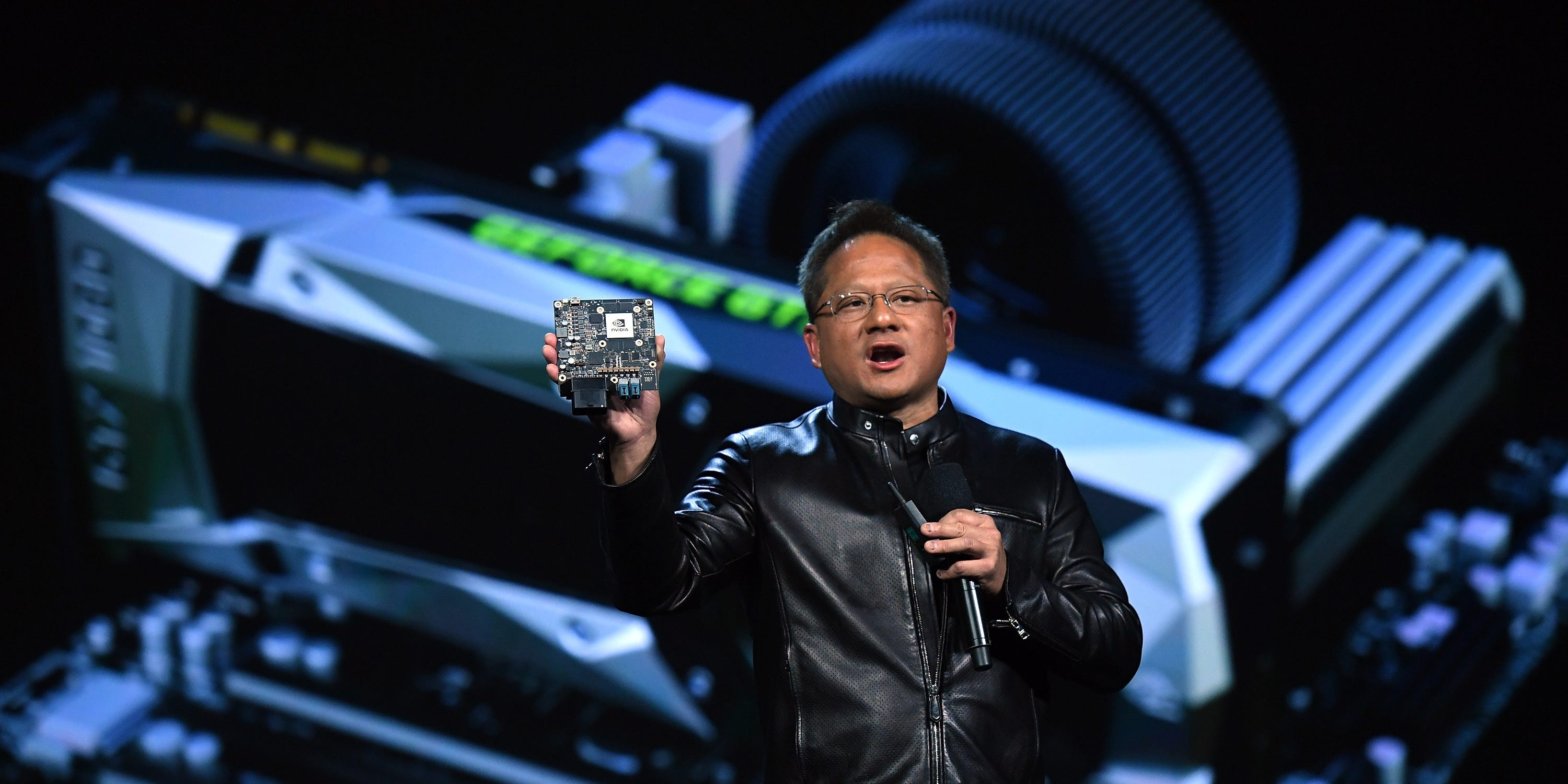

Shares of Nvidia are set to surge on the chipmaker’s dominant position in the growing field of artificial intelligence, Bank of America analysts wrote this week.

The stock has upside potential of about 14% from Wednesday’s intraday high around $271, with the bank assigning a price target of $310 per share. That view is based on factors related to the company’s growing lead in the AI and large language model (LLM) space, areas which have generated huge interest from investors so far in 2023.

“NVDA’s combination of scale and vision to invest in a full-stack, turnkey (hardware, software, systems, services, developers) model could accelerate the adoption of LLMs by enterprises in almost every end-market,” the BofA analysts said.

They added that their view is shared by some of the titans of the tech world, including Google, Microsoft, Oracle, and Amazon, which all view partnerships with Nvidia as a way of effectively rolling out AI and LLM applications. The bank said Nvidia represents a “democratizing opportunity” for the technology.

“[S]cope/ambition reinforces NVDA’s dominance in the nascent generative AI/large language model (LLM) market that could reshape the existing tech industry and usher in disruptive startups.”

Their outlook for the stock price is boosted by opportunities in the gaming sector and demand from data centers, both of which are expected to grow in the coming years.

It’s already been a wild year for AI, with companies cashing in on the viral popularity of OpenAI’s ChatGPT bot, which was launched last November. OpenAI has since integrated similar AI technology into Microsoft’s Bing search engine, after the software giant poured $10 billion into the startup earlier this year.

Companies large and small have capitalized on the interest by announcing big plans for AI integration, with everything from media firms to small software companies getting a boost in their share price from AI.