Nvidia is still a “top pick” stock at Bank of America, even after its AI-driven year-to-date rally of 209%.The bank said Nvidia’s upcoming 2nd-quarter earnings report will be “less shock and awe” and more about execution.The biggest risk for Nvidia is its ability to scale the supply of its AI-enabling GPU chips, according to BofA. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Nvidia remains a “top sector pick” ahead of its upcoming second-quarter earnings report, even after its stunning AI-driven year-to-date stock rally of 209%.

That’s according to Bank of America’s Vivek Arya, who in a Monday note reiterated his “Buy” rating and $550 price target for Nvidia, suggesting potential upside of 22% from current levels.

While Arya still sees a rosy future for Nvidia as it helps power the growing artificial intelligence industry with its GPU accelerators, he admits that the company will have “less shock and awe” for investors after it issued a massively bullish guidance update in May. Instead, Arya expects Nvidia to transition towards a period of execution that will be defined by its ability to scale supply to meet demand.

“We expect the sentiment to be [a] bit more measured. Demand isn’t the issue, its supply and importantly the pace with which US cloud service providers are able to set up genAI compute instances,” Arya said.

Arya expects Nvidia to report second-quarter revenue of at or slightly above $11 billion, which would represent year-over-year revenue growth of 64%. Arya said he also expects Nvidia’s third-quarter revenue to accelerate up to 100% to about $12 billion.

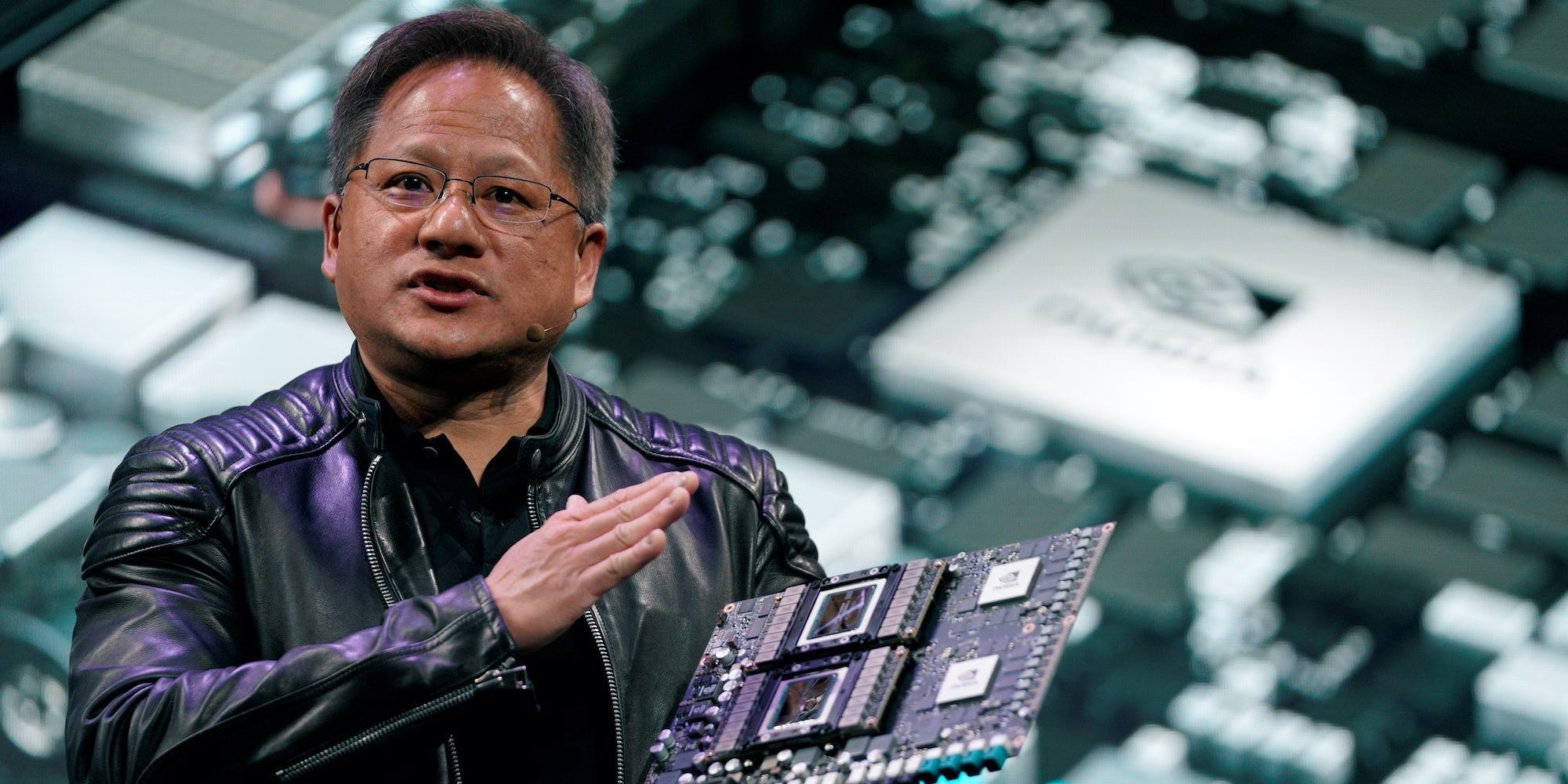

But perhaps most importantly, the near-term direction of Nvidia’s stock price hinges on guidance comments from CEO Jensen Huang, and as to whether these revenue gains are a short-term blip or have staying power.

“Investors will look for clues on sustainability of these elevated forecasts considering a lukewarm US cloud service provider capex environment,” Arya said. “Listen for management commentary around continued sales acceleration.”

The post-earnings reaction to Nvidia’s upcoming earnings report could ultimately see some “near-term stock consolidation” after its solid year-to-date rally. In other words, expect Nvidia stock to trade sideways or slightly lower after it reports earnings after the market close on August 23, according to Arya.

But Nvidia’s long-term opportunity is what Arya is focused on. The analyst estimated that Nvidia could “march towards” $20 to $25 in long-term earnings per share, which would help make its current forward price-to-earnings ratio of 39x more digestible for investors.

“We forecast AI servers to grow at a 37% compounded annual growth rate from 1.23 million in 2023 (8% to 10% of all servers) towards 4.4 million by 2027 (+25% of all servers), enabling Nvidia’s total sales to expand at a 26% CAGR to $109 billion,” Arya said.

And BofA isn’t the only Wall Street bank with a $100+ billion revenue projection for Nvidia by 2027. Mizuho said the company could generate more than $300 billion in revenue by 2027. For context, Nvidia generated revenue of about $27 billion last year.

Nvidia stock traded up just over 1% on Monday, and is down just over 6% from its 52-week high of $488.88.