Energy companies and one oilfield service company leapfrogged conventional growth stocks

An oil and gas pump jack near Granum, Alta. Photo by Todd Korol/Reuters files Oil and gas companies have come roaring back onto the Toronto Stock Exchange’s annual list of top stocks after a three-year absence.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

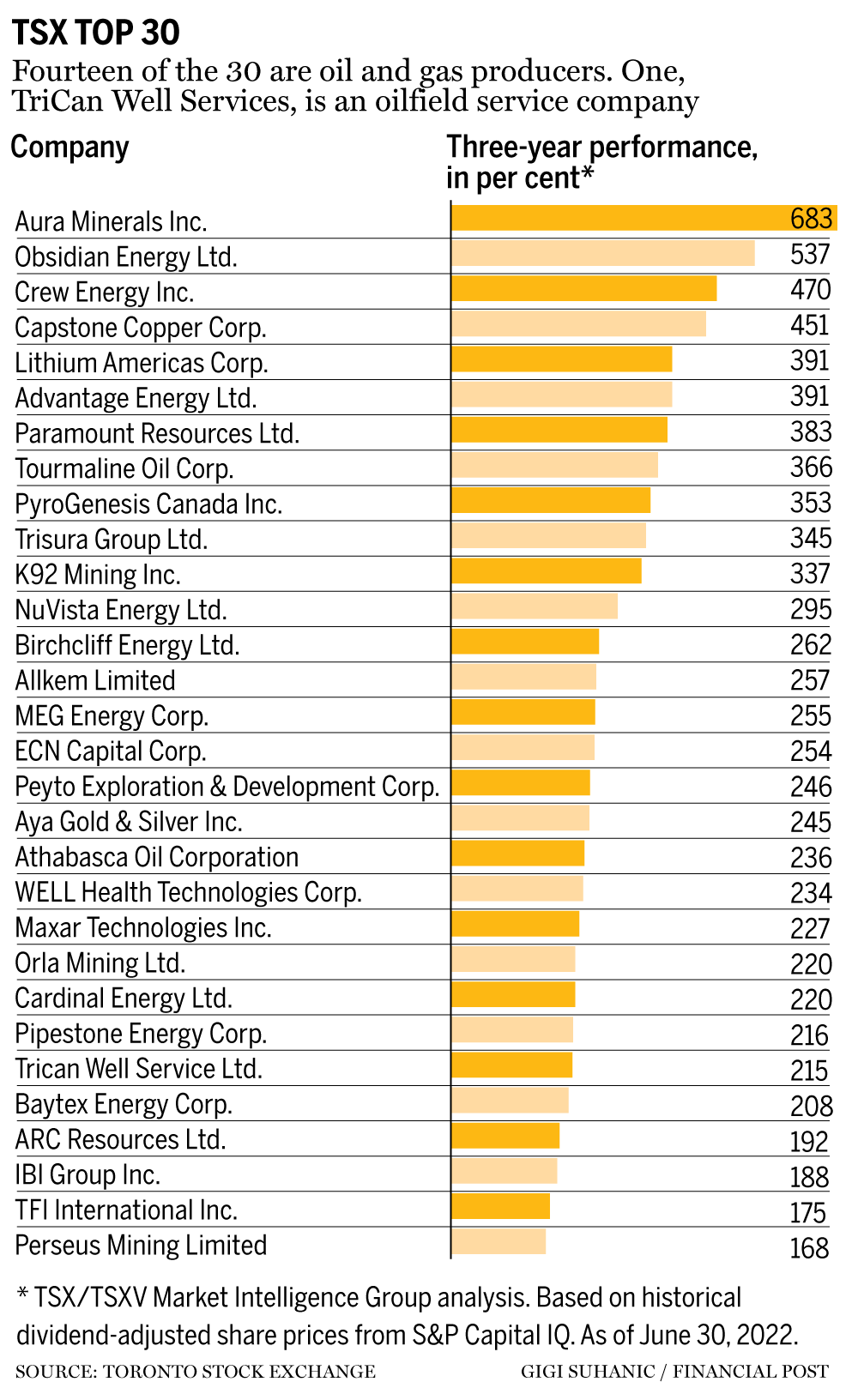

Fourteen energy producers made the 2022 list of the 30 best performing stocks on the S&P/TSX index over the past three years, posting an average share-price increase of 306 per cent over that period.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Obsidian Energy Ltd. (formerly Penn West Petroleum Ltd.), a mid-size oil and gas company focused on light oil in central Alberta, led the energy pack after its dividend-adjusted share price rocketed 537 per cent since 2019, according to TMX Group Ltd.’s fourth annual ranking. Only Aura Minerals Inc. did better.

Energy companies and one oilfield service company leapfrogged conventional growth stocks on this year’s list, as shares rallied alongside surging oil prices.

“We’re seeing an interest in the sector that we haven’t seen in years,” TSX chief executive Loui Anastasopoulos said. “We’re seeing companies use their cash flows to pay down debt, buy back shares, increase dividends etc. It’s a lot of positive stuff.”

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Anastasopoulos added: “You can’t ignore the geopolitical situation with the invasion of Ukraine by Russia and the destabilization of global oil that’s come as a result of that — that has refocused investors’ attention on energy security.”

Meanwhile, e-commerce giant Shopify Inc. dropped off the rankings entirely after three years in either first or second place. Other pandemic-era darlings, such as Mississauga, Ont.’s Cargojet Inc., which soared on the boom in online shopping during COVID-19 lockdowns, also sank back to earth.

Energy’s only rival was mining, which continues to perform well in 2022. Aura, a mid-tier gold and copper miner focused on Latin America, led the table for the second consecutive year, as its stock price is now up 638 per cent over three years.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

For the first time since TMX Group began the rankings, Alberta was home to half of the Top 10 companies on the list. A handful of Alberta executives from top-performing energy and natural resource companies were set to celebrate Thursday in a virtual market opening ceremony.

The chief operating officer for Birchcliff Energy Ltd. — 13th on the 2022 ranking — said oil and gas companies are finally reaping some rewards after a protracted period of depressed prices that forced companies into “survival mode” when crude futures were briefly negative in 2020.

Recommended from Editorial Tamarack Valley set to acquire Deltastream in $1.425-billion deal Canada’s crumbling roads are getting worse in climate change — but Alberta oil may be the answer Wisconsin judge rules against Enbridge in dispute over Line 5 pipeline This advertisement has not loaded yet, but your article continues below.

Article content Birchcliff, which was unhedged when prices plummeted during the pandemic, was forced to take on debt and cut costs wherever possible to continue operating. “We really looked at scale,” said Chris Carlsen. “Instead of previously drilling, say, four wells at a time, you would have two drilling rigs on one pad, drilling seven wells each for a 14-well pad — so you have all these services on one pad and you’re then getting the benefit of that scale, that repeatability of the operations.”

Carlsen added: “That drove a whole new ability of us to survive and thrive during the pandemic. I think that now has put the business in a way stronger position coming into a high commodity price environment.”

Birchcliff reported record adjusted cash flow in the second quarter of 2022 and the company said it’s on track to reach zero debt by the end of this year.

Anastasopoulos said this year’s list reflects a rotation from growth stocks to value stocks, and showcases companies demonstrating strong performance through recent macroeconomic and geopolitical uncertainty.

“Tech stocks have been in favour for a number of years,” he said. “But as the markets evolved and sectors have rotated, people are looking for value,” he continued. “As fundamentals continue to improve for sectors like the oil and gas sector, investors pay attention.”

• Email: mpotkins@postmedia.com | Twitter: mpotkins