Close to half of those aged 55 to 64 only have $5,000 or less put aside for retirement, HOOPP survey says

Published Jun 21, 2023 • Last updated 5 days ago • 5 minute read

One in five Canadians aged 55 to 64 haven’t saved for retirement, while close to half only have $5,000 or less put away. Photo by Getty Images/iStockphoto Canada may be inching closer toward a retirement crisis as a higher cost of living keeps people from saving, while many baby boomers on the cusp of leaving their working lives have little put away.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

More Canadians were unable to put money aside for retirement in the last 12 months amid elevated levels of inflation and rising interest rates, according to the 2023 retirement survey from Healthcare of Ontario Pension Plan and Abacus Data. In all, 44 per cent of people neglected to save, an increase of six per cent from the year before. Trying to cope with the high cost of living is the top concern of 70 per cent, followed closely by worries paycheques won’t be enough to keep pace with inflation.

But what may be more worrisome is that a large swath of baby boomers, aged 55 to 64 and not yet retired, don’t appear to have nearly enough savings put aside. Indeed, one in five haven’t tucked anything away, while close to half only have $5,000 or less in retirement savings. Another 75 per cent have $100,000 or less put aside, a concerning figure considering Canadians expect to need $1.7 million to retire comfortably, according to a report out this year from the Bank of Montreal. The result is people expect they will have to retire later than they hoped, with 54 per cent saying higher inflation will force them to kick their desired retirement date further and further down the road.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Older people are also finding their standard of living is starting to be affected as they try to keep up with rising costs. Thirty-eight per cent of those aged 55 to 64 say they’re falling behind, compared to 33 per cent in all age groups. “The picture is bleak for those older Canadians,” Ivana Zanardo, head of Plan Services at HOOPP told The Canadian Press last week.

The data suggests difficult times ahead for the baby boomer generation, which may also mean a retirement funding crisis will arrive at our doorstep sooner, rather than later.

“In the five years that HOOPP and Abacus Data have conducted this survey, about 70 per cent of Canadians have consistently agreed that Canada is heading for a retirement income crisis,” David Coletto, chief executive of Abacus Data, said in a press release. “These findings for older Canadians suggest a crisis might be looming ever closer if current economic trends continue.”

Article content This advertisement has not loaded yet, but your article continues below.

Article content Things don’t look much better for younger people, the research found. Of those aged 18 to 34, 51 per cent say they’re struggling with higher costs and have been forced to live beyond their paycheques. That’s also the case for 31 per cent of those above the age of 35. Younger Canadians are also very worried about what high interest rates will mean for their own retirement savings, along with their ability to pay down debt. They’re plagued by other worries, too: how to manage rising inflation and the high costs of housing and whether they’ll be able to secure a solid pension plan through their jobs.

“The kids are not all right when it comes to retirement saving — we’ve known this for a while — but neither, as it turns out, are their parents,” Zanardo said.

This advertisement has not loaded yet, but your article continues below.

Article content Many Canadians are hoping a work pension could be an option that might rescue their retirements. The survey found 69 per cent would be willing to take a pay cut if it meant access to a good pension, while 80 per cent think employers should be mandated to add money to employee pensions. Another 74 per cent believe workers without solid plans will end up as a problem for taxpayers.

But Zanardo said access to pensions through people’s jobs have been on the downslope for a while, creating a difficult situation for Canadians finding it hard to put money away for retirement. Recent economic challenges have only made that worse.

“Declining access to workplace pensions, as well as high housing costs, have been taking a toll for years,” she said. “But more recently, high inflation and interest rates have been added to what may be a perfect storm for those struggling to save.”

This advertisement has not loaded yet, but your article continues below.

Article content _____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

Statements from credible sources, including the International Monetary Fund, about Canada’s heightened housing market risks have alarmed consumers, investors, lenders and policymakers alike, but perhaps the pictures they are painting shouldn’t be taken at face value, argue real estate experts Murtaza Haider and Stephen Moranis.

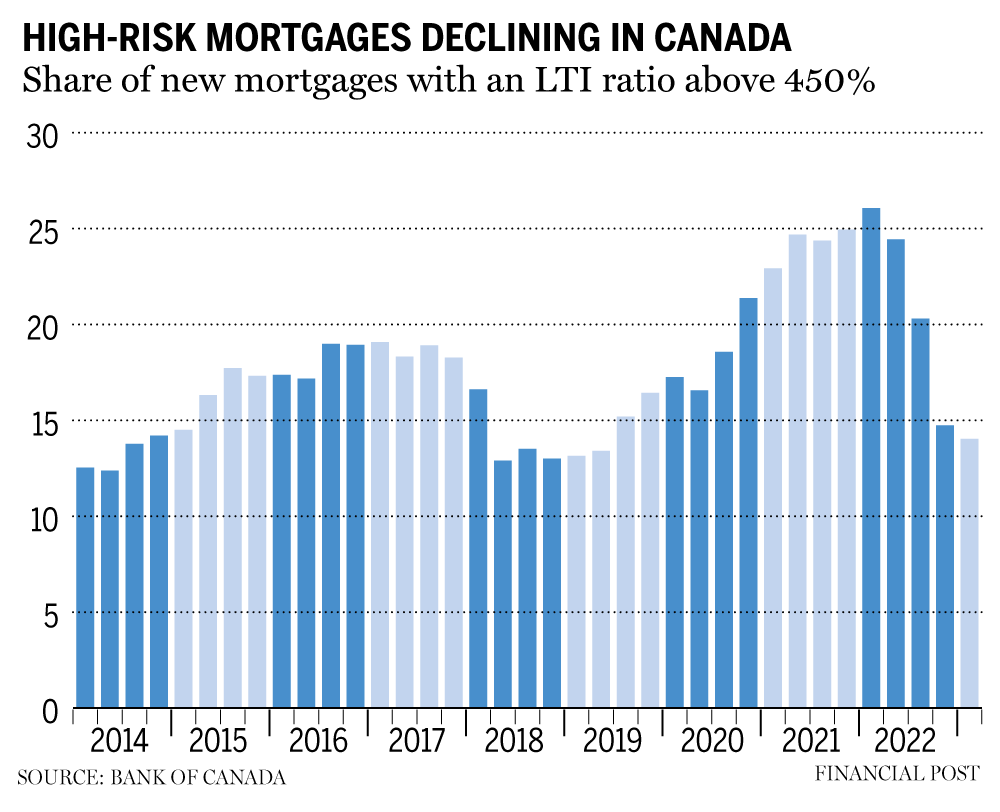

Housing markets and borrowers in Canada are more stable than the IMF suggests, and risk metrics are even improving. One indicator getting better is the share of new mortgages with a loan-to-income (LTI) ratio of more than 450 per cent, a proxy for high-risk mortgages. High LTI mortgages peaked in the first quarter of 2022, but have declined to pre-pandemic levels since then. Investors constitute the smallest segment of high LTI borrowers, much lower than first-time and repeat homebuyers.

This advertisement has not loaded yet, but your article continues below.

Article content The number and quality of new mortgages being issued are also improving. Variable-rate mortgages spiked during the pandemic to 54 per cent of new originations in the first quarter of 2022 from 9.15 per cent in the first quarter of 2020. Since the peak, variable-rate mortgages have declined to pre-pandemic levels, with a significant increase in fixed-rate mortgages, which represented 87 per cent of new originations in the first quarter of this year.

Read the full column to find out what else is moving in the right direction, and also what seems to be getting worse, but not so badly that there’s reason to panic.

___________________________________________________

The Bank of Canada will post its summary of deliberations from its last interest rate decision meeting at 1:30 p.m. Chris Smalls, a U.S. activist who led the successful drive to unionize a New York Amazon fulfilment centre, will join Unifor organizers to launch the first union drive at an Amazon facility in B.C. Today’s data: Canadian retail sales, new housing price index This advertisement has not loaded yet, but your article continues below.

Article content ___________________________________________________

_______________________________________________________

OSFI hikes domestic stability buffer for Canada’s big banks Canada among investors’ favourite bets for sooner-than-expected interest rate cut The pandemic didn’t kill the office, it was already dying The toxic workplace trait that’s costing employees money and burning them out Lumber prices surge amid record wildfires Can we retire at 55 even though we have a $525,000 mortgage? ____________________________________________________

The S&P 500 is officially in a bull market, given it’s risen 20 per cent since its October low. Veteran investor Peter Hodson has seen this play out many times in the past and has some advice for investors, starting off with the notion that technical definitions don’t mean that much in the real world.

____________________________________________________

Today’s Posthaste was written by Victoria Wells (@vwells80), with additional reporting from Financial Post staff, The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Article content