Think the Prairies and Atlantic Canada

Published Feb 09, 2023 • Last updated 2 days ago • 4 minute read

14 Comments

Crews working on shingling a multi-unit housing complex in Regina, Saskatchewan. Photo by TROY FLEECE/Regina Leader-Post files Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Good morning!

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account Share your thoughts and join the conversation in the comments Enjoy additional articles per month Get email updates from your favourite authors Housing affordability is still on the ropes across most of the country despite recent declines in prices, so it might seem there’s no path open for single Canadians to achieve their dream of owning a home. Not so, says a new report from Zoocasa released on Feb. 8.

“Home prices in many cities have come down from the peaks of early 2022, with some of the major cities across Canada flattening in the later months of last year.” the report said. “While homes are still expensive, single buyers may have more luck in their home search now than they would have this time last year.”

National home prices fell 12 per cent during 2022 to an average of $626,318, according to the Canadian Real Estate Association, potentially opening the door to more buyers, although higher interest rates and tougher qualifying rules still pose barriers for some. Individuals living alone accounted for three in 10 households, according to Statistics Canada.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

In an attempt to ferret out opportunities for solo buyers on a tighter budget, real estate brokerage Zoocasa crunched the numbers for 18 markets using average prices and median income data from Statistics Canada to identify five major Canadian cities where a singleton can make a go of homeownership.

Zoocasa said the Prairies and Atlantic Canada offer the best options for single homebuyers, assuming a 20-per-cent down payment and a mortgage amortized over 30 years at the current average interest rate of 5.14 per cent.

Of the five most affordable cities for single-income earners, Regina comes out on top. The average home price there is $311,500 and the income required to qualify for a mortgage is $48,450, but the actual median income is $58,000, leaving surplus income of $9,550.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

The next most affordable city is Saint John, N.B. The average home price is $261,300 and the income required is $40,613, but the actual median income is $48,000, leaving surplus income of $7,387.

Edmonton, at No. 3, has an average home price of $366,600 and the income required is $57,000, leaving a surplus of $2,600 since the actual median income is $59,600.

Fourth is St. John’s, Nfld., where the average home price is $316,800, the income required is $49,275 and the actual median income is $50,400, for a surplus of $1,125.

Winnipeg comes in at No. 5, with an average home price of $323,400, required income of $50,288 and actual median income of $50,400, leaving a small surplus of $112.

Vancouver and Toronto — Canada’s hot housing capitals — remain out of reach for the average single homebuyer.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

Average prices there are $1,114,300 and $1,081,400, respectively, requiring average incomes of $173,250 and $168,150, both well above the cities’ median incomes of $56,400 and $62,000.

Detached homes are mostly off limits to single buyers as well, although Zoocasa said they were affordable for an individual purchaser in Saint John where the average price is $261,900.

Overall, apartments are the most affordable for single individuals with prices in seven cities within reach, including Calgary and Edmonton, where average prices are $286,200 and $176,400, respectively, “well within the affordability range of the average income,” Zoocasa said, Edmonton also has the most affordable townhouses with an average price of $229,300.

Advertisement 6 This advertisement has not loaded yet, but your article continues below.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

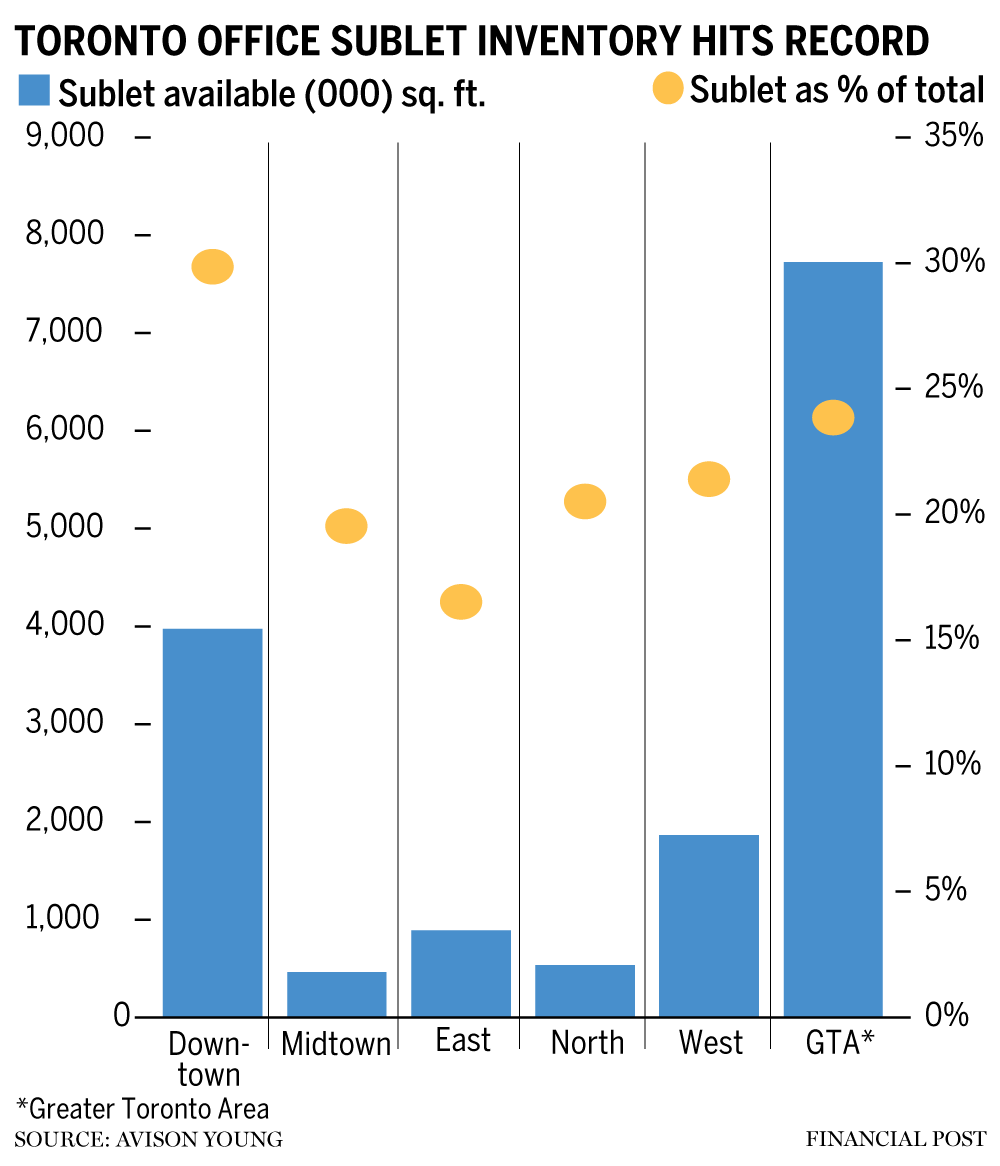

As office tower owners continue to grapple with the uncertainty brought on by the COVID-19 pandemic, their tenants are facing some stark choices of their own.

For many, the shift to work-from-home and various hybrid arrangements have changed the calculus on how much space they need, leading to a surge in square footage hitting the sublet market.

A report conducted by Avison Young on the Greater Toronto Area’s office market showed sublet activity was up 26 per cent in the fourth quarter of 2022 from the same period a year ago, with inventory now at record levels.

Advertisement 7 This advertisement has not loaded yet, but your article continues below.

— Shantaé Campbell

Read the full story here.

___________________________________________________

Eric Martel, chief executive at Bombardier, will make a presentation at a Canadian Club event entitled “Driving Canadian Ingenuity and Defending our Borders” Vancouver Mayor Ken Sim and Deloitte leadership launch Deloitte Summit. Designed to transform the way people work, it is equipped with state-of-the-art technologies and spaces to increase collaboration, and create solutions to maximize social impact Today’s data: U.S. initial jobless claims Earnings: PepsiCo Inc., L’Oreal S.A. Toyota Motor Corp., Unilever Plc, Astra Zeneca Plc, PayPal Inc., Thomson Reuters Corp., Telus Corp., Kellogg Co., Cameco Corp., Saputo Inc., Bombardier Inc., Canopy Growth Corp., Precision Drilling Corp., Silvercorp Metals Inc., Aurora Cannabis Inc. Advertisement 8 This advertisement has not loaded yet, but your article continues below.

___________________________________________________

_______________________________________________________

____________________________________________________

If your mortgage is weighing heavily on your mind, you aren’t alone. Last year, Canadians faced seven interest rate hikes and one more so far in 2023, bringing the overnight rate up another 25 basis points to 4.5 per cent. For those with variable-rate mortgages, mortgage payments have increased significantly in a relatively short time. If you are worried about more interest rate hikes, or are finding it hard to keep up with your mortgage payments, our content partner MoneyWise explores some options to help you avoid defaulting on your mortgage.

____________________________________________________

Today’s Posthaste was written by Gigi Suhanic, (@gsuhanic), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.