If your income exceeds the limits to contribute directly to a Roth IRA, you may have heard about the so-called ‘Backdoor Roth IRA,’ which allows traditional IRA conversions to Roth IRA regardless of income. This allows investors to continue funding a Roth IRA despite reporting a higher income.

This loophole was set to be closed when the original Build Back Better Act was passed by the House in November 2021. As such, many of my fellow tax and financial planning peers have cautioned clients not to plan on funding their Roth IRA through the backdoor anymore, assuming that the act would eventually pass and that income limits would be placed on conversions. There was also speculation that this limit would be retroactive to the beginning of 2022, making backdoor Roth IRA contributions a thing of tax-avoidance lore.

Political commentary aside, the time has passed and this provision seems unlikely to pass this tax year – at the time of this writing, the Inflation Reduction Act is the new bill in Washington, and it does not include any provisions affecting retirement savings for individual taxpayers. With that in mind, the backdoor Roth IRA strategy lives another tax year, while down markets also offer additional Roth conversion opportunities for anyone with a pre-tax IRA wishing to lock in a potentially lower tax rate on their savings with strategic tax bracket planning.

What Is the Backdoor Roth?A backdoor Roth is really just a regular Roth IRA – the backdoor part describes how the account is funded for people who have a higher income that exceeds the annual limit set by the IRS ($144,00+ for single filers and $214,000+ for married filing joint in 2022).

To fund it through the backdoor, you first have to make a qualifying contribution to a traditional IRA, which anyone with earned income can do up to the annual limit of $6,000 for 2022 ($7,000 if you’re age 50 or older). Then rather than deducting the contribution to the traditional IRA from that year’s taxes, you simply convert the contribution to your Roth IRA in the same tax year. And voila, you’ve added another $6,000 to your Roth IRA through the backdoor.

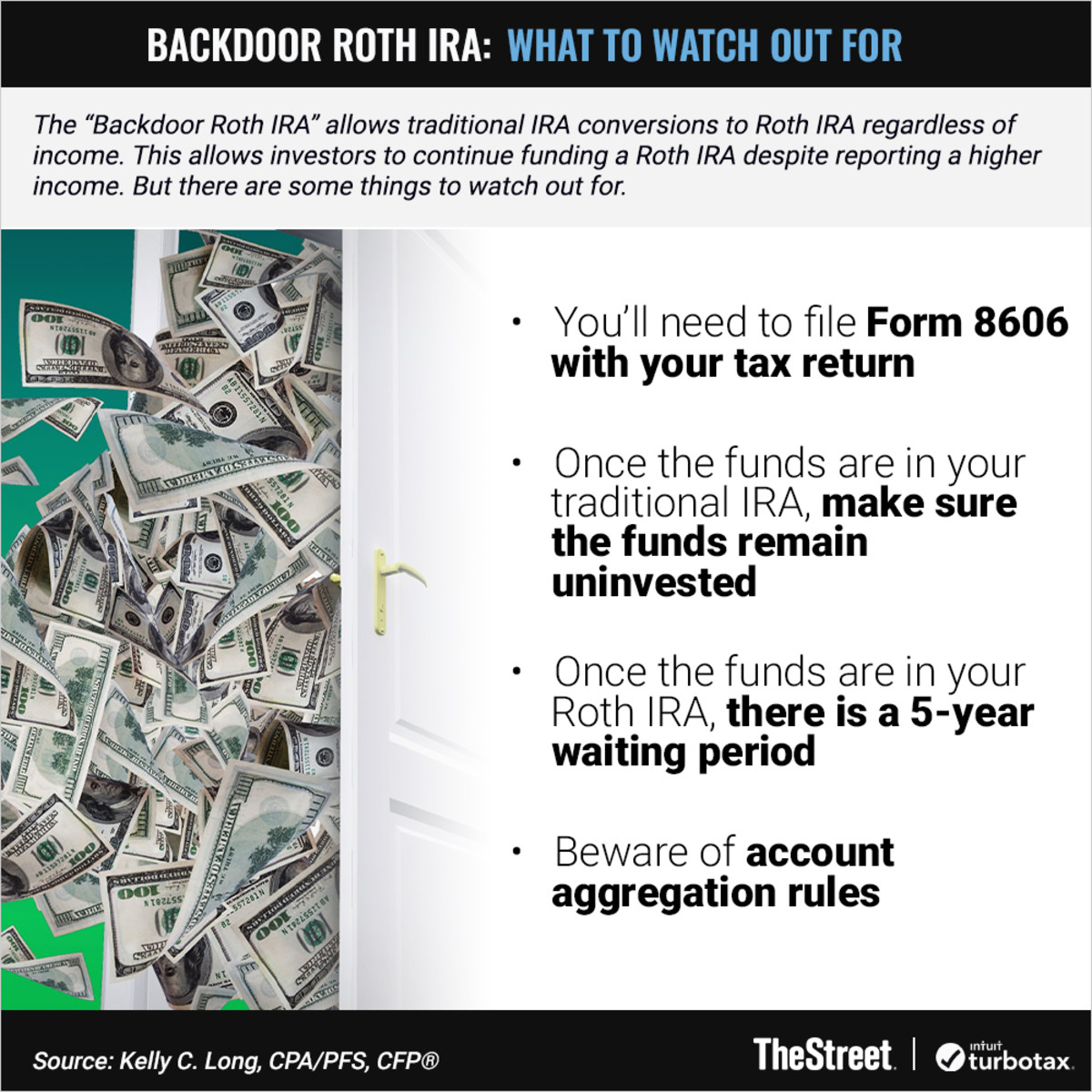

4 Things to WatchGraphic: ‘Backdoor Roth IRA’: 4 Things to Know

There’s not a catch, per se, but there are some things to watch out for.

First, in order to document that you did NOT take the deduction for your initial contribution to the traditional IRA, you’ll need to file a Form 8606 with your tax return. If you missed this at the time you filed your taxes, you can submit it later.

Scroll to Continue

Then, once the funds are in your traditional IRA, make sure they remain uninvested in the market, as any earnings recorded prior to the conversion to your Roth IRA WILL be taxable at the time you convert. Some tax professionals recommend waiting a certain amount of time before performing the conversion in order to avoid an appearance of deliberating skirting tax rules (which is disallowed), but back in 2018 an IRS tax law specialist went on the record and stated that the IRS was aware of this strategy and essentially said it was allowed under the current law.

Take that for what it’s worth – this commentary is not tax or investment advice, but I’ve yet to hear of a backdoor Roth IRA contribution being disallowed because there wasn’t enough time between the contribution to the traditional IRA and the conversion to the Roth IRA.

That said, once the funds are in your Roth IRA, there is a 5-year waiting period before you can consider those contributions to be part of your Roth IRA basis. In other words, if you withdraw funds that were converted to a Roth IRA within 5 years of the conversion, you’ll pay taxes on the withdrawal, even if you’re over age 59 ½. Direct Roth IRA contributions can be withdrawn at any time without tax consequences, but any converted funds have a 5-year wait to “lose” their taxable status.

Finally, you want to beware of account aggregation rules when performing backdoor Roth IRA contributions. If you already have funds in any traditional or pre-tax IRA accounts, including SEP-IRA or SIMPLE IRAs, your backdoor Roth IRA contribution will not be tax-free because you’ll have to aggregate the conversion as a percentage of all your pre-tax IRA money. One way to avoid this would be to roll any pre-tax IRA money into a 401k or 403b if you have access, as those accounts are NOT included in the account aggregation rules. Or just plan on a portion of your backdoor Roth contribution to be taxable.

It’s unlikely that Roth IRA conversions will be allowed without income limits forever, so higher income savers should keep an eye on tax law changes before performing this transaction each year. However, for the 2022 tax year, it appears the backdoor Roth IRA will survive another year.

Panelist Bio| More About Our Tax Expert, Kelley C. LongBio: Kelly C. Long, CPA/PFS, CFP®

Read more from our partners at TurboTax:

Deductions Allowed for Contributions to a Traditional IRAIRA Tax Benefits: Taxes on Retirement vs. Non-Retirement AccountsWhat Is IRS Form 5498: IRA Contributions Information?I Started Investing This Year, What Do I Need to Know Come Tax Time?Editor’s Note: The opinions expressed in this article are those of the authors. The content was reviewed for tax accuracy by a TurboTax CPA expert.