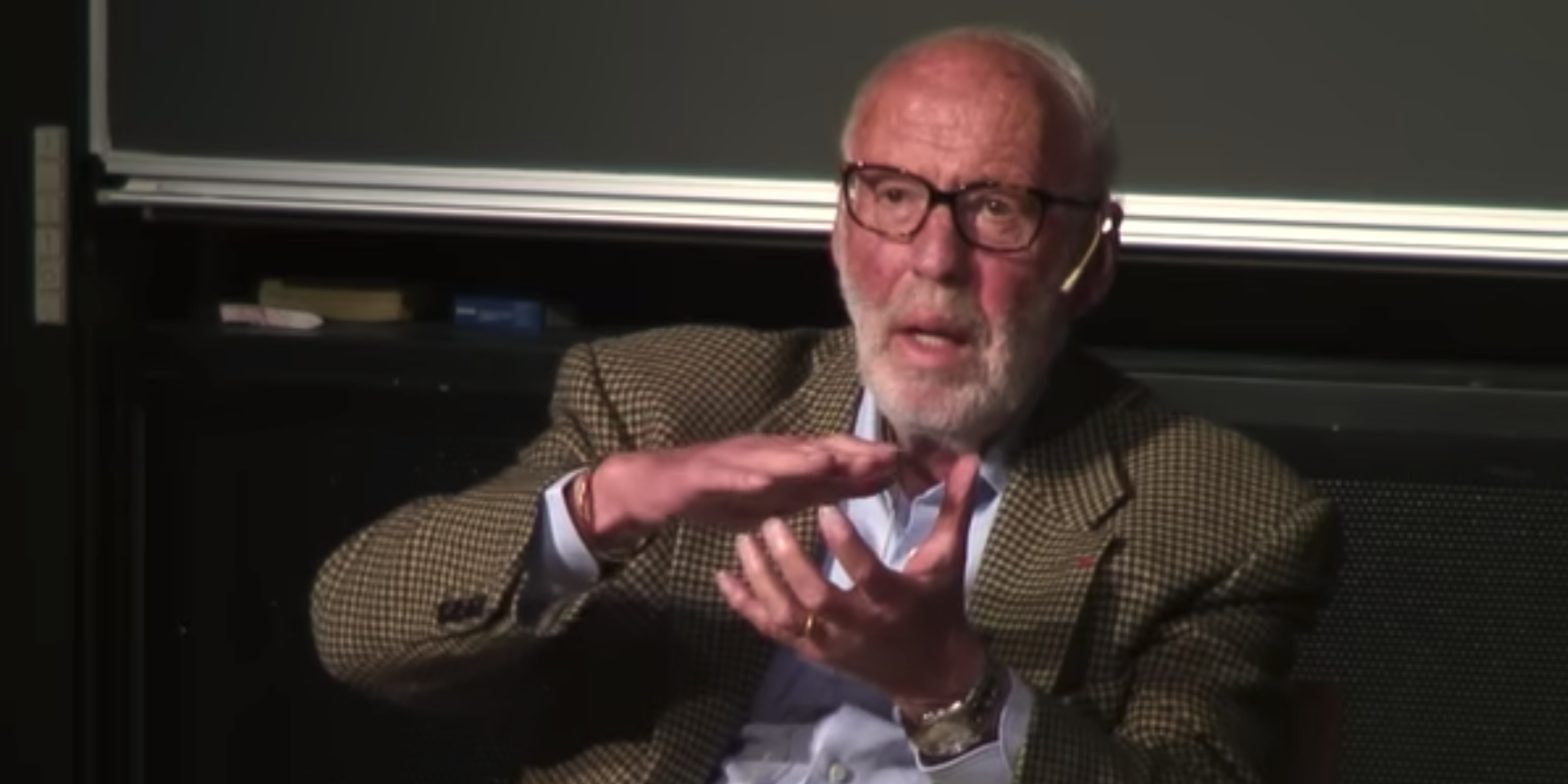

Jim Simons discussed why his hedge fund employs scientists instead of bankers, defended Warren Buffett’s relevance in an age of supercomputers and algorithmic trading, and shared the five principles he lives by in a recent, rare interview during the 2022 Abel Prize Week.

“We hired statisticians, physicists, astronomers, mathematicians — the important thing was that they were very smart,” the Renaissance Technologies founder said about his early recruitment strategy.

“I like to say that you can teach a physicist finance, but you can’t teach a finance person physics,” the former NSA codebreaker and MIT math professor added.

RenTech, one of the biggest and best-performing hedge funds in history, is a quantitative fund that relies on algorithms to decide the bulk of its trades. Yet Simons asserted that Buffett’s traditional approach of seeking out wonderful businesses run by honest and brilliant executives wouldn’t become obsolete.

“It’s perfectly reasonable to study a company deeply, analyze their management, and say, ‘This is a good company, I’m going to invest in it,'” Simons said. “We don’t do that at all.”

“Warren Buffett’s kind of investing will always have a place,” he added.

Simons retired as RenTech’s CEO in 2009, stepped down as its non-executive chairman last year, and now invests his time and effort in philanthropy. During the interview, he outlined the five principles that he tries to follow in daily life:

1. “Be guided by beauty. Just as a great theorem can be very beautiful, a company that’s really working on all things very efficiently can be beautiful.”

2. “Surround yourself with the smartest and best people you possibly can. Let them do their thing, don’t sit on top of them. And if they’re smarter than you, all the better.”

3. “If everyone is trying to solve the same problem, if that’s the latest and greatest thing to do, don’t do that. Do something original, don’t follow the pack.”

4. “Don’t give up easily, stick with it. Not forever, but really give it a chance to get where you’re going.”

5. “The final principle is ‘hope for good luck.’ That’s the most important one.”

Read more: Value investors have missed out on massive gains by dismissing the likes of Amazon and Alphabet as overpriced. Fund manager and writer Adam Seessel explains how to fairly value tech champions, and avoid losing out again.

Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Markets Stocks Jim Simons Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.