US stocks are flirting with a bear market, and it’s been even worse for tech stocks. Based on earnings reports and trends, Brad Erickson of RBC identifies his top picks in the space. Erickson also discussed which stocks are best-positioned for the second half of the year. Stocks are continuing to slide, and at some point, investors will decide that they’re cheap enough to be worth the risk. The question is when that will happen.

Brad Erickson, who covers tech and internet stocks for RBC Capital Markets, is the latest to try his hand at figuring out what’s worth the risk and which stocks have fallen to bargain levels — and conversely, which stocks are still vulnerable to steep selling.

Erickson says that both stock prices and multiples for the companies he covers have been cut by more than 40%, but there are clear distinctions between companies that sold off as part of the broad tech rout and those that are experiencing serious trouble in their businesses.

“The Q1 reporting outcomes were a tale of two tapes: shorted squeezes with little/no follow-through (FB, BMBL, DASH, BMBL, MTCH, PINS, ANGI, ZG, SNAP & SQSP) and then those that saw fundamental impact and got hit accordingly (GOOGL, CARG, AMZN, EXPE, LYFT, WIX, FVRR, RDFN, SKLZ & CVNA),” he said.

Erickson also says that after conversations with small-business consulting agencies that collectively have hundreds of clients, there are signs that small businesses are going to be cautious in the second half of the year — but so far, it doesn’t seem like many of them are actually changing their plans or cutting spending.

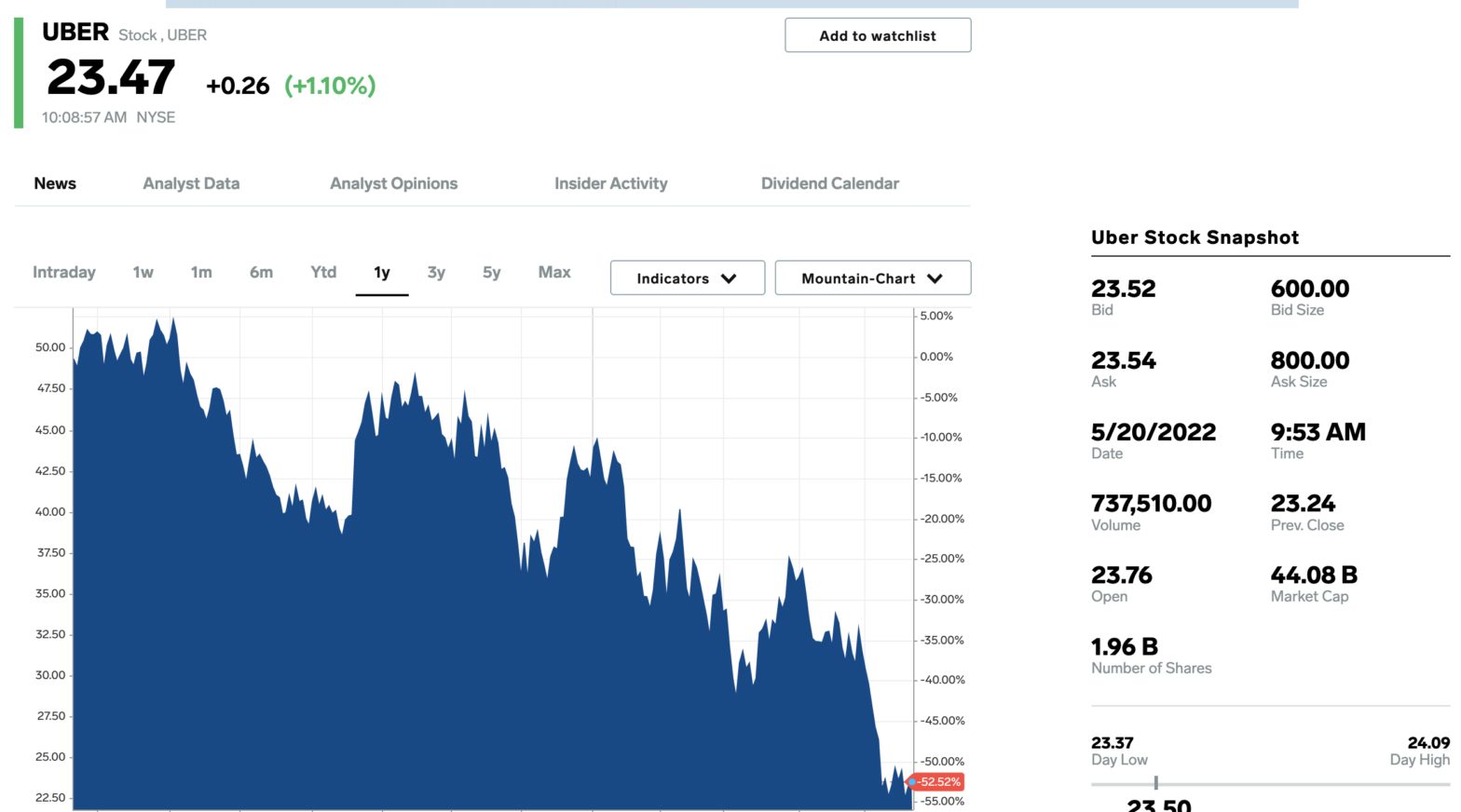

But if consumers do cut back on their spending in response to fears about inflation, high interest rates, or other factors, he says Amazon, Carvana, DoorDash, and AirBnB are especially vulnerable. Erickson has been calling Amazon one of his favorite stocks in the sector this year, but says Booking, CarGurus and Uber are still favorites.

He explains that travel website operator Booking is gaining market share in the US and its Asia-Pacific business is gaining strength; Uber has upside because travel is going to recover; and CarGurus’ core business is still meeting expectations.

Meanwhile he says Meta Platforms, Lyft, and Match.com are still top-rated names that look more appealing after all the selling.

Among stocks with a moderate “Sector Perform” rating, he says, Wix.com has 9% upside to its price target of $75 and Angie Homeservices has 17% upside to its price target of $6 a share.

He adds that CarGurus, Booking, Uber, Alphabet, and Pins have seen big stock declines but only small changes in profit projections, which might set the stocks up for success in the second half of the year. And he thinks CarGurus, Lyft, Match.com, and Wix are the most affected by “transitory” problems that should fade.

Erickson has “Outperform” ratings on the following 10 stocks, which are ranked from lowest to highest based on the amount of upside they have to his price targets. The rankings and calculations are based on Thursday’s closing prices.