Russia and China are developing a new reserve currency with other BRICS countries, President Vladimir Putin said. The basket currency would rival a US-dominated IMF alternative and let Russia widen its influence, an analyst said. The dollar’s dominance is already eroding as central banks diversify into the Chinese yuan and smaller currencies. Loading Something is loading.

Russia is ready to develop a new global reserve currency alongside China and other BRICS nations, in a potential challenge to the dominance of the US dollar.

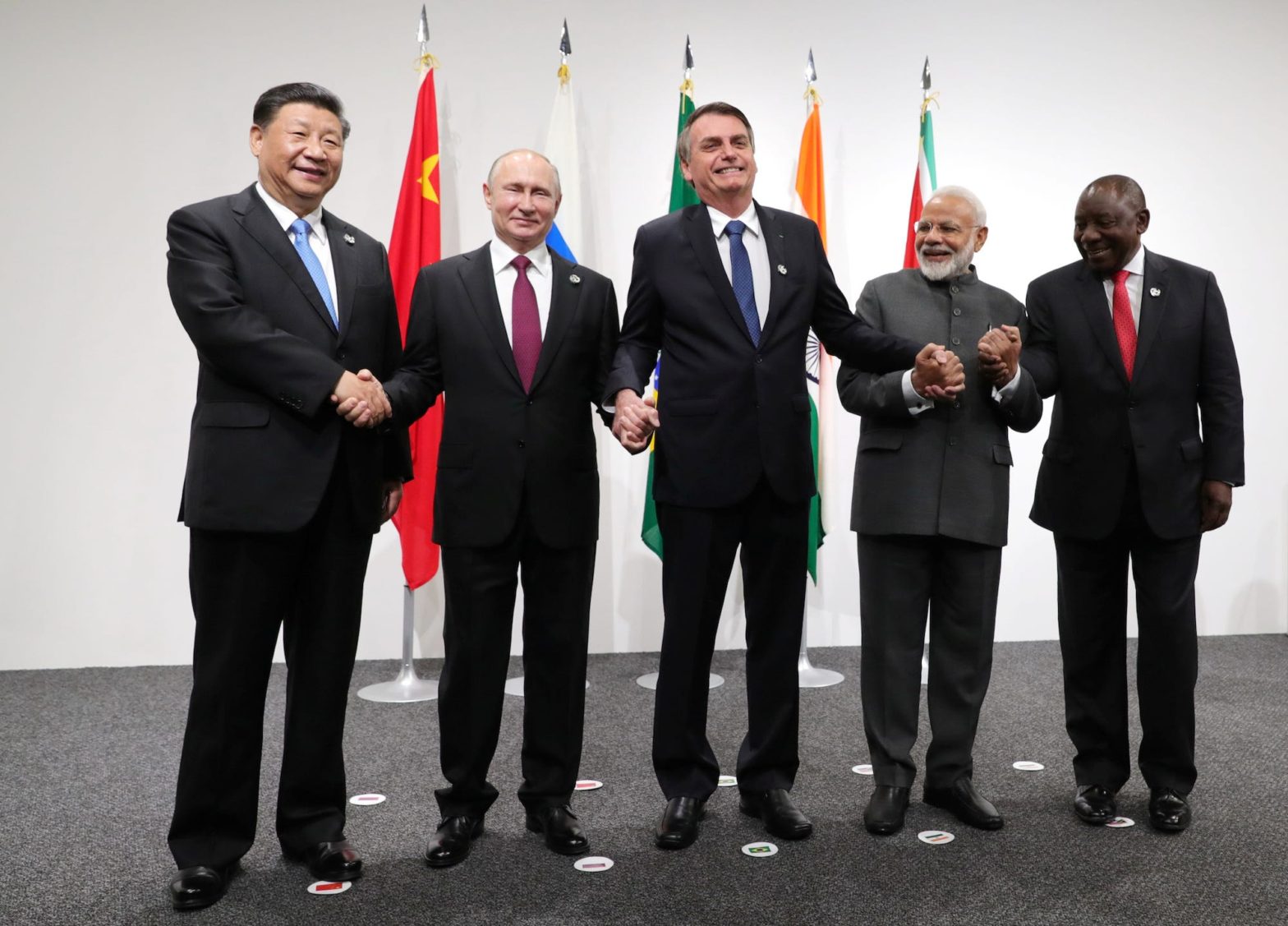

President Vladimir Putin signaled the new reserve currency would be based on a basket of currencies from the group’s members: Brazil, Russia, India, China, and South Africa.

“The matter of creating the international reserve currency based on the basket of currencies of our countries is under review,” Putin told the BRICS Business Forum on Wednesday, according to a TASS report. “We are ready to openly work with all fair partners.”

The dollar has long been seen as the world’s reserve currency, but its dominance in share of international currency reserves is waning. Central banks are looking to diversify their holdings into currencies like the yuan, as well as into non-traditional areas like the the Swedish krona and the South Korean won, according to the International Monetary Fund.

“This is a move to address the perceived US-hegemony of the IMF,” ING’s global head of markets Chris Turner said in a note. “It will allow BRICS to build their own sphere of influence and unit of currency within that sphere.”

Russia’s move comes after Western sanctions imposed over the Ukraine war all but cut the country out of the global financial system, curtailing access to its dollars and putting pressure on its economy.

“The speed with which western nations and its allies sanctioned Russian FX reserves (freezing around half) no doubt shocked Russian authorities,” ING’s Turner said.

“The Central Bank of Russia effectively admitted as much, and no doubt some BRICS nations — especially China — took notice of the speed and stealth at which the US Treasury moved,” he added.

Those sanctions have likely encouraged Moscow and Beijing to work on an alternative to the IMF’s international reserve asset, the special drawing rights, Turner suggested.

While it’s not a reserve currency, the SDR is based on a basket of currencies made up of the US dollar, the euro, the British pound and Japan’s yen — as well as China’s yuan.

One possibility is that the BRICS basket currency could attract the reserves not just of the group’s members, but also countries already in their range of influence, he suggested. These include nations in South Asia and the Middle East.

Russia has seen its currency the ruble rebound to above its pre-war level, thanks to central bank support, after it plunged 70% in less than two weeks after the Ukraine invasion. It has risen 15.2% in June to 1.87 cents. Meanwhile, the yuan has held steady at around $0.15 over the same period.

Read more: What does Russia invading Ukraine mean for markets? 13 investing experts share their outlook on the Fed’s likely response, short- and long-term trades, and whether bitcoin can ever become a ‘safe-haven’ asset