Crypto billionaire Brock PierceAP

Brock Pierce, a self-made billionaire, is one of the world’s biggest cryptocurrency advocates. Pierce is an unabashed bitcoin bull, but he still says bitcoin “maxis” are making a mistake. He shared three of his favorite investments besides the world’s largest digital token. Unlike most self-made entrepreneurs, Brock Pierce was famous before he was wealthy.

The 41-year-old cryptocurrency billionaire became widely known before his 13th birthday thanks to his role in Disney’s “The Mighty Ducks,” but though that gig led to a handful of others in movies, acting wasn’t his calling. Pierce bid Hollywood adieu in the late 1990s and began to get involved in streaming video and digital currencies – over 10 years before they went mainstream.

In the two decades since, Pierce has become one of the biggest names in crypto. After co-founding Blockchain Capital, a crypto-focused venture capital firm, and Tether, the largest stablecoin on the market, Pierce is now one of the world’s most influential and vocal digital asset advocates.

Pierce has made educating world leaders about crypto one of his top priorities. Last fall, he led a delegation of 37 crypto industry veterans that helped guide El Salvador President Nayib Bukele as the country adopted bitcoin as legal tender. It was an unprecedented victory, but soon it may just be the first of many.

Leaders in “over 30 governments” have chatted with Pierce about following in El Salvador’s footsteps, he told Insider in a recent interview. And after working to convert politicians to crypto, Pierce is preparing for a transition of his own. He confirmed that he’s planning to take the fight for crypto-friendly regulation into his own hands by running for a US Senate seat in 2022.

“I’m clearly taking a very serious look at how does the US get involved, and it starts by having people that actually understand what’s happening having a seat at the table and those conversations occurring,” Pierce said. “I spend a lot of time in Washington, DC, talking to our elected officials, talking to legislature at a state and federal level, and trying to inform people to provide them with the necessary information so they can make wise, informed decisions regarding our collective future.”

To Pierce, crypto is more than just a promising technology or a way to store and build wealth. He sees it as a way to give “economic opportunity to everyone” by banking the unbanked, restoring accountability in a financial system marked by “shadow” and “opaqueness,” and “democratizing and decentralizing” the economy to work for everyone – not just the rich.

Idealistic? Perhaps. Imminent? Possibly, depending on how quickly governments figure out how to regulate it. Inevitable? Pierce has no doubt.

“This is a very basic technology at its core,” Pierce said. “The implications of this technology, like the internet, are substantial and broad, but at its core, it’s just a database. And with this distributed database, we can do all sorts of things that will likely affect everything.”

“Maxis” are mistaken: Three bitcoin alternatives to considerDespite Pierce’s unshakable conviction in bitcoin, he’s no bitcoin maximalist. Those so-called “maxis” believe that all blockchain-based cryptos besides the world’s largest token are inferior – a narrow line of thinking that, in Pierce’s view, hurts progress.

“I try to always maintain an open mind,” Pierce said. “I don’t want to become so rigid in my views that I closed the doors on things that could succeed. I know that I don’t have all the answers, and I don’t want to close myself off from potential innovation. And so I’ve always been agnostic in the sense that, if anyone succeeds in making the world a better place, we all win. So why would I want to close the door on a technology that might be successful?”

That begs the question: If the head of the Bitcoin Foundation has diversified away from only holding the so-called digital gold, how can investors do the same?

Pierce told Insider about three alternatives to bitcoin that he owns and likes, though these ideas are not investing recommendations. Below is commentary from Pierce about each, along with the token or stock’s symbol or ticker, as well as a chart of how each asset has performed in the past year.

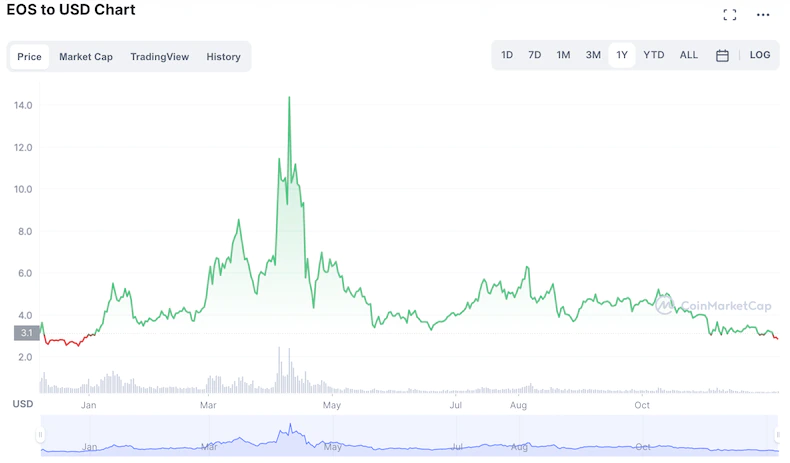

1. EOS

CoinMarketCap

Symbol: EOS

Commentary: “One of the projects that I was very active with and I’m reengaged with right now is a project called EOS. I was involved in its creation. It was the most successful altcoin of its time, having sold over $4 billion worth of tokens. And that project has been maturing and there’s some really interesting things coming out of it. And so I’m focusing a lot of my time and attention on that project again right now.”

2. Bit Digital

Markets Insider

Ticker: BTBT

Commentary: “I sit on the board of Bit Digital, which is a Nasdaq publicly listed, very large mining operation, similar to a Riot (RIOT) or a Marathon (MARA). So I wouldn’t sit on that board if I didn’t see potential in those thoughts. I think that, yes, that is a reasonable way to invest and get exposure to the sector.”

3. Coinbase

Markets Insider

Ticker: COIN

Commentary: “I’m a Coinbase shareholder. Through my firm, Blockchain Capital – or my prior firm – we were a reasonably large investor in Coinbase and were very, very public about that investment. I continue to hold stock in the public company, personally. I’m a fan. Obviously, Coinbase has been a hugely successful business in this space.

I would certainly encourage people though to, if you’re going to invest in this space, to have some direct exposure to the underlying assets – or asset, in the case of bitcoin, if that’s your focus. But public equities are also, in one sense or another, a way to get exposure to the sector. Certainly, if you’re new to the industry, and if you don’t understand how to buy and hold and secure crypto, that might be a safe way to get some exposure in a traditional sort of fashion.”