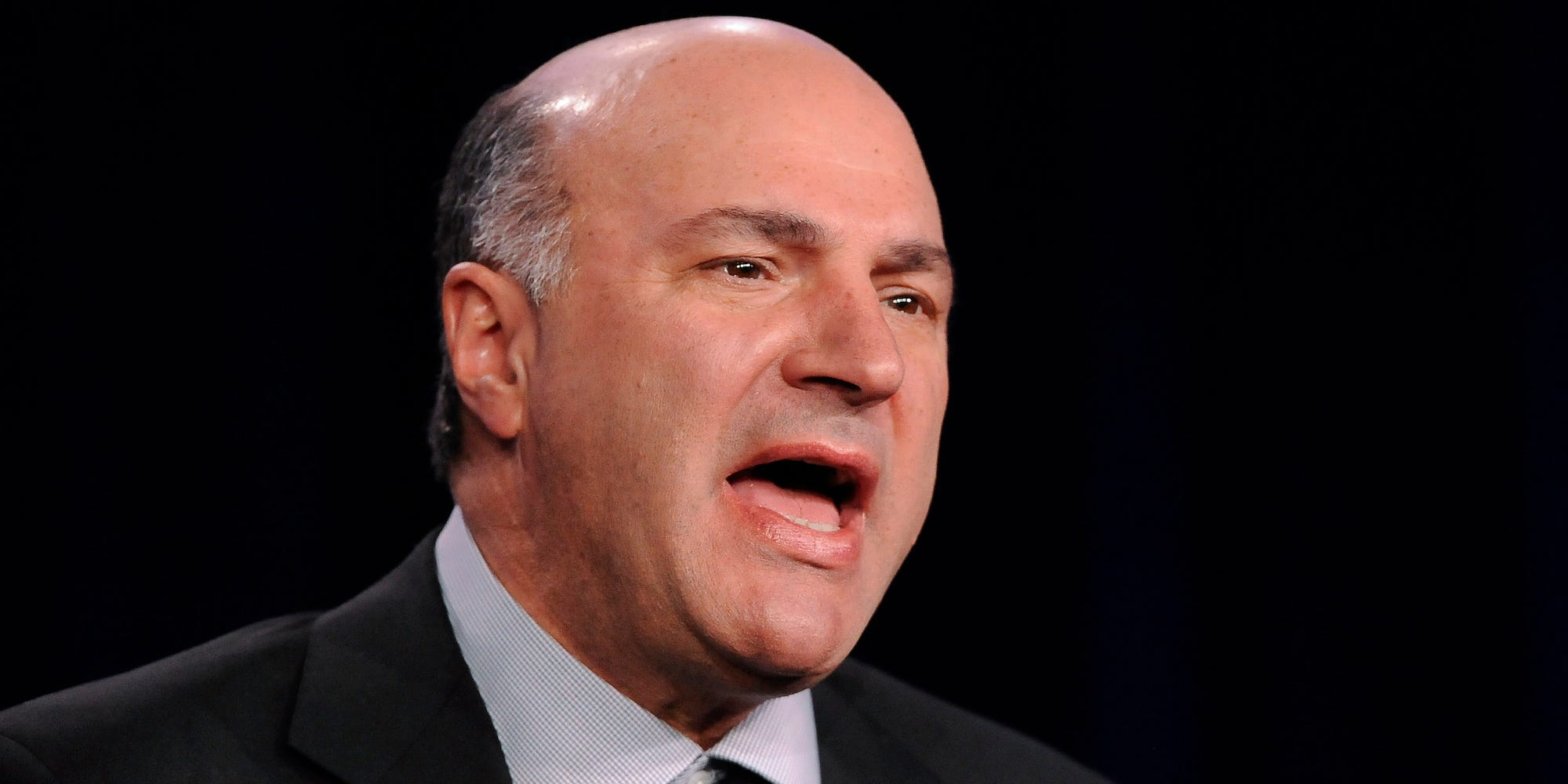

The Fed will likely spark more pain for the US economy, according to “Shark Tank” star Kevin O’Leary. He predicted the Fed will push interest rates to 6% in a bid to lower inflation. That could spark pain for small businesses, Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

The US economy is in for more trouble, thanks to the Federal Reserve’s ultra-aggressive monetary policy and the looming problem in the US’s oil supply, according to “Shark Tank” star Kevin O’Leary.

In a Thursday interview on Fox Business, the famed investor said he expected the Fed to raise interest rates another 50 basis-points, a move that would lift the Fed funds rate target to 5.75%-6%. Rates that high are bound to spark more pain for small firms, he said, which are already suffering from what O’Leary calls a “cash crisis” amid a higher cost of borrowing.

“That’s going to really hurt small businesses,” O’Leary said. He previously estimated that small businesses employ 60% of the US workforce.

Central bankers have raised interest rates aggressively over the past 18 months to control inflation, with rates now at their highest level since 2001. Prices are still well-above the Fed’s 2% target, with inflation accelerating to 3.7% year-over-year in August, per the latest Consumer Price Index report.

Part of that is due to higher energy prices, which were the biggest driver of inflation last month, the Bureau of Labor Statistics said. Oil prices have stuck close to a 10-month high, with Brent crude the international benchmark, trading around $94 a barrel on Friday while West Texas Intermediate crude traded around $91 a barrel..

O’Leary blamed high oil prices on a systemic shortage of crude production. The US is producing around 12 million barrels of crude a day, though demand will likely require that to rise to 18 million barrels a day, O’Leary estimated. That will need to be resolved by producing more barrels in addition to more oil refineries, which process crude into products like diesel and gasoline.

“This is not brain surgery,” he said. “We have to do this or we’re going to be in real trouble in three years on the whole oil issue.”

Forecasters have warned that oil prices could go even higher through the end of the year as supply cuts from producers in OPEC+ could deepen. More supply pressure could potentially push Brent crude up to $120 a barrel, JPMorgan strategists warned, a level that could push inflation higher and bring economic growth to a halt in coming quarters.