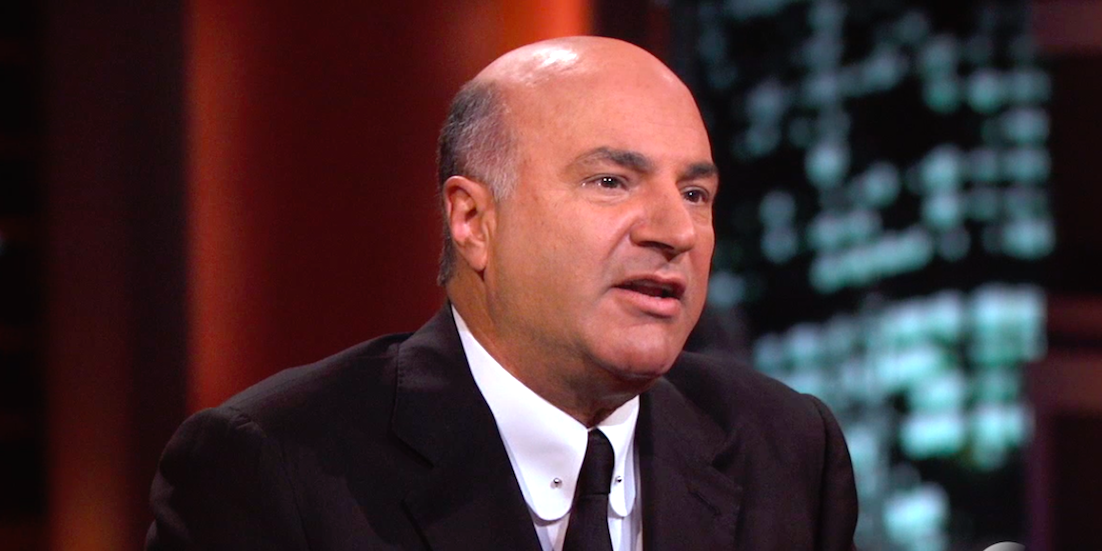

Kevin O’Leary dismissed talk of de-dollarization, pointing to the greenback’s dominance in commodities. The “Shark Tank” star also said he won’t accept the yuan due to lack of trust in the Chinese government. “So I don’t care what form of transaction you want to do with me in Asia, I will not take Chinese yuan.” Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

“Shark Tank” star Kevin O’Leary dismissed talk of de-dollarization and said he won’t accept the yuan in business dealings as he lacks trust in the Chinese government.

In a YouTube interview on Thursday, he said he’s been hearing warnings since 1977 that other currencies will replace the dollar.

“And I’ve always found that interesting because no other currency is actually used to denominate all the commodities of the Earth,” O’Leary said.

He added later: “When you quote a price in India, Shanghai, Zurich, Geneva, Paris, London, there’s only one currency, the US dollar.”

His remarks add to a growing chorus of de-dollarization commentary, as a number of countries are pursuing non-dollar trade agreements, especially using China’s yuan. And the yuan recently overtook the dollar in Chinese cross-border transactions.

But O’Leary is skeptical of the yuan and doubted that individual or institutional investors would put much faith in it.

“How much of an institution’s money or a sovereign wealth fund would you put into the Chinese yuan? Well, my answer is zero,” he said. “Because it’s not that I don’t trust the Chinese people, I don’t trust their government. So I don’t care what form of transaction you want to do with me in Asia, I will not take Chinese yuan.”

Despite his feelings about the yuan, he said last fall that investors shouldn’t avoid Chinese stocks, as the country is bound to become the largest economy.

Still, he noted on Thursday that China still must adapt to US accounting laws and protections of intellectual property rights.

“They’re a great nation. They’re great people, they make great products, and they’re very advanced in some sectors, but they are still not the American economy,” O’Leary said. “So I don’t treat them that way yet. And I would never invest in their currency. Nor would anybody else.”