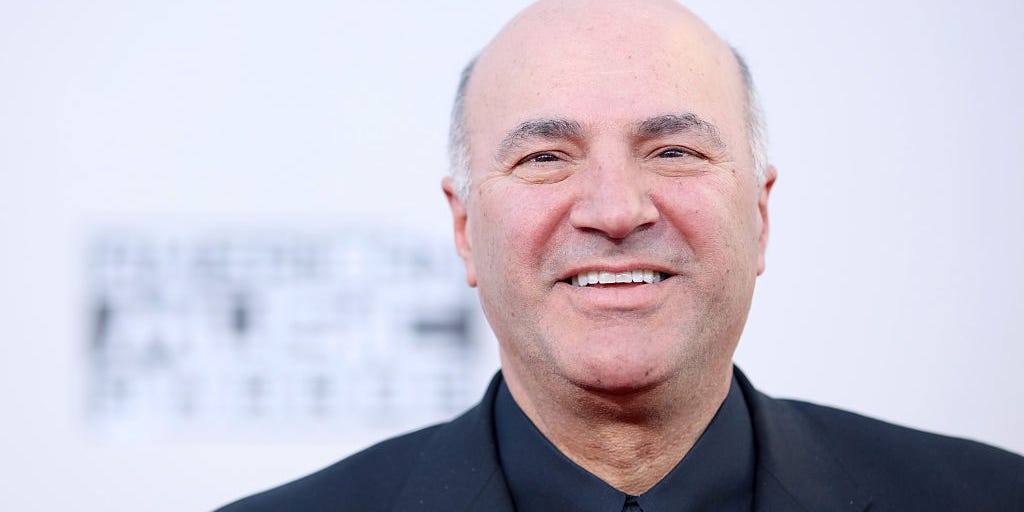

Institutions aren’t putting money into bitcoin, despite talk of rising interest, Kevin O’Leary said. A bitcoin spot ETF won’t happen as the main crypto exchanges are under SEC scrutiny, he told CoinDesk. Without compliant and transparent exchanges in the US, bitcoin won’t rise in value, he added. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Despite optimism that top institutions on Wall Street are going to step into bitcoin investing, that’s not actually happening, “Shark Tank” star Kevin O’Leary said.

In recent months, asset managers such as BlackRock and Fidelity have filed to form the first bitcoin spot ETFs. But according to O’Leary, this won’t happen as long as crypto remains under federal scrutiny.

“You know, people talk about, ‘there’s great institutional interest in bitcoin.’ No, there isn’t. They don’t own any of it, and they’re not going to own it while [SEC Chair Gary] Gensler’s suing everybody,” he told CoinDesk on Tuesday.

The SEC has launched a number of lawsuits against the industry’s biggest players, and argued that many of the traded tokens are unregulated securities.

Crypto exchanges Coinbase and Binance were among the largest targets of a crackdown this past summer, with the SEC suing both for regulatory violations.

O’Leary said that limits options for firms such as BlackRock.

“What exchange could you put it on? You’re going to use Coinbase? You can’t — you can’t put an ETF on an exchange being sued by the regulator. That’s never going to happen,” he said.

He added that Binance is rapidly shrinking, with its co-founder Changpeng Zhao also under intense pressure and scrutiny: “What institution wants to get involved in that?”

His comments came on the first day of the trial of Sam Bankman-Fried, whose mismanagement of the FTX exchange led to its collapse last year.

O’Leary said the days of “crypto cowboys” are quickly being left in the past, noting that as long as regulation discourages investing in the US, the industry won’t expand as hoped.

Meanwhile, more transparent crypto exchanges may emerge in other parts of the world, potentially sending institutional interest elsewhere.

“You want to see bitcoin appreciate in value, it has to be on a compliant exchange, regulated and approved by the regulator in his jurisdiction. Now is that going to be in the US ? Doesn’t look like it,” O’Leary said.