E-commerce company also planning a 10-for-one stock split

A new class of shares called the Founder share will provide CEO Tobias Lutke with 40 per cent of the total voting power. Photo by Peter J Thompson/National Post Ottawa-based e-commerce company Shopify Inc., whose stock soared early in the COVID-19 pandemic but later gave up much of those gains, is proposing a novel share structure that will guarantee chief executive Tobi Lütke retains 40 per cent voting power through a new “founder” share.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

“I cannot think of a precedent,” said Richard Leblanc, a professor of governance, law and ethics at York University.

The founder share would give Lütke a variable number of votes that, when combined with other shares beneficially owned by him, his immediate family and his affiliates, will represent 40 per cent of the total voting power attached to all of the company’s outstanding shares.

Shopify said it is intended to “strengthen the foundation for long-term stewardship by Mr. Lütke, a proven leader who has delivered significant shareholder value since the Company’s IPO.”

Shareholders are to vote June 7 on the new governance structure, which would add the new founder share to Class A stock, which carries one vote per share, and Class B shares that carry 10 votes each.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Separate classes of shares largely fell out of favour in the early 2000s when the shareholder democracy principle of one share, one vote took hold — but they have made a comeback at tech companies, where founders are considered integral to their success.

“Tobi is key to supporting and executing Shopify’s strategic vision and this proposal ensures his interests are aligned with long-term shareholder value creation,” Robert Ashe, Shopify’s lead independent director, said in a statement.

Another component of the arrangement, which the company said would keep Lütke essentially where he is in terms of control, is that longtime shareholder and Shopify director John Phillips will convert all Class B shares held by a company he co-owns, Klister Credit Corp., into Class A shares.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

If that conversion had already occurred, the voting power held by all Class A shareholders would increase to around 59 per cent from 49 per cent.

In a statement, Phillips, whose company invested in Shopify 15 years ago, noted that Class A shares rose to more than $675 from the $17 IPO price, “significantly outpacing the broader market.”

Shopify is separately planning a 10-for-one stock split, which the company’s statement said is intended to make the shares more accessible to investors.

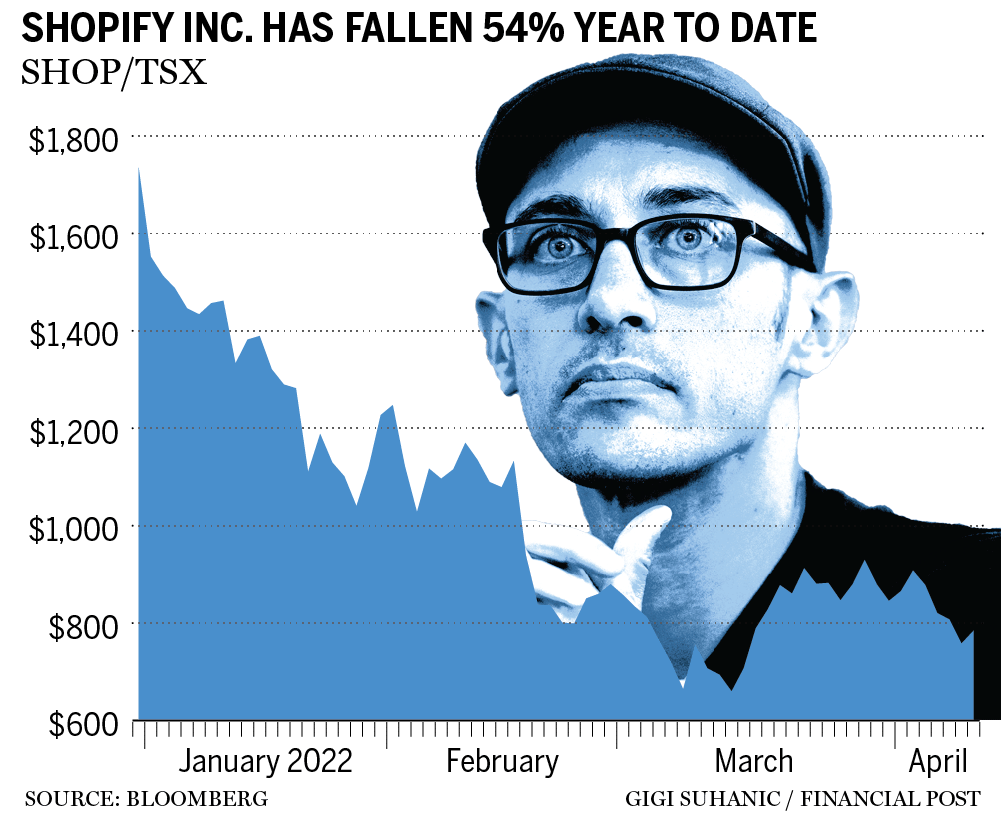

More On This Topic Shopify’s 48% stock slump proves that it’s no Amazon Despite Shopify’s stock-market wipeout, analysts see a path for long-term growth Shopify plunges in 2022 tech wreck, losing title as Canada’s biggest publicly traded company This advertisement has not loaded yet, but your article continues below.

Article content Leblanc said the new governance structure would be unique if approved by shareholders at the June meeting, but he noted that a special committee of directors on Shopify’s board took steps to ensure the new founder share doesn’t outlive its intended purpose.

“The reality with 40 per cent is that it may be de facto control, but there is sunset,” he said, noting a provision that kicks in if the Lütke leaves his position or his family and affiliates fall below owning 30 per cent of Class B shares.

“He cannot give control to anyone, and if/when he ceases to be CEO, he must convert to Class A (shares),” Leblanc said.

The restriction on “inter-generational transfer of voting power” is appropriate, he said, “because investors are investing in the CEO not the CEO’s children.”

This advertisement has not loaded yet, but your article continues below.

Article content Brett Seifred, a partner at Davies Ward Phillips & Vineberg LLP, also praised the sunset provision.

“In short, this looks like an elegant solution to the oft-repeated criticism of dual-class share structures that they should not outlive the founder,” he said.

Leblanc suggested that Shopify’s plan should lead other boards to consider whether their dual-class shares should be subject to similar sunset provisions.

In the United States, the Council of Institutional Investors has been pushing for time-based sunsets provisions to give founders time to establish companies and culture, while placing a time limit on the uneven distribution of voting power among shares.

Online thrift companies ThreadUp and Poshmark agreed, setting limits of seven and 10 years, respectively, on their dual-class share structures. And last year, meal kit company Blue Apron collapsed its dual-class share structure and recapitalized into a one-share, one-vote equity structure.

This advertisement has not loaded yet, but your article continues below.

Article content Canada has a long history of family-controlled companies using a dual-class share structure to maintain control, often, though not exclusively, in the media and telecommunications sector.

Governance at Rogers Communications Inc. came under scrutiny last year when the founder’s son Edward Rogers made sweeping changes to the board without consulting other shareholders. The B.C. Supreme Court ruled in November that he was within his rights as chair of the Rogers Control Trust, which controls 97.5 per cent of the company’s Class A voting shares. Rogers’ Class B shares are non-voting.

An earlier dual-class dust-up that made waves in Canada’s investment community involved Magna International Inc. In 2010, Magna’s board of directors approved an arrangement that would pay founder Frank Stronach and his family nearly $900 million to collapse the dual-share structure through which he controlled the auto-parts maker.

The arrangement was justified by the board because shares of the company had long traded at a discount to those of peer companies. That discount that was expected to shrink with the retirement of Stronach’s Class B voting stock. But some institutional investors complained to the Ontario Securities Commission that the rich compensation to make that happen was “abusive” to the holders of the subordinated voting Class A shares. They lost, and the transaction was allowed to proceed.

• Email: bshecter@postmedia.com | Twitter: BatPost

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300